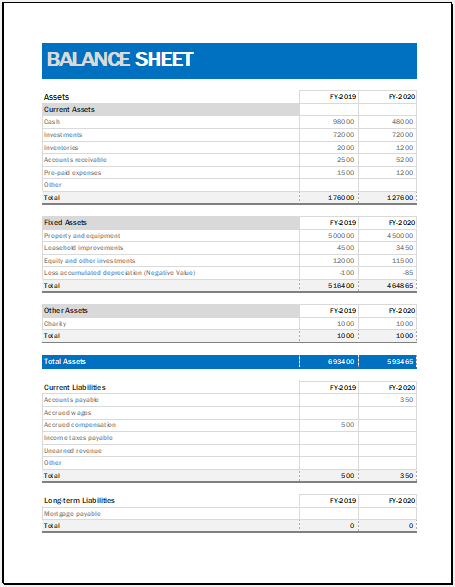

Yearly Comparison Balance Sheet

The balance sheet is the most commonly used document by a business to create different types of financial statements. For example, to create a statement of cash flow in two years, a business consults the balance sheet of the previous two years.

The balance sheet contains details of income generated by a business and much more information, which is then used to create the cash flow financial statement.

What is a yearly comparison balance sheet?

It is a professionally used document that is very helpful in comparing two years to obtain the necessary information. This sheet can help determine whether assets have increased or decreased.

The comparison balance sheet tells a businessman whether a business is progressing or not. Based on the information provided by this sheet, a businessman can make several decisions.

Knowing a business’s financial status is important for it to make a profit and flourish.

A yearly comparison balance sheet is the best way to Judge the company’s status and make further improvements. It is a very systematic and arranged way to show its status. The right balance sheet will make a sparky bounce and help the company get a higher rank in the business market.

Comparative balance sheets are basically an analysis of assets, liabilities, and equity related to a business. If they are prepared on an annual basis, they are called yearly comparison balance sheets.

It basically provides the reader with all the information regarding his finances. It will help the business owner to know his exact assets and liabilities.

The typical format includes details of current assets, fixed assets, current liabilities, and shareholder equity. Current assets must include cash, accounts receivable, and inventory.

Current liabilities include accounts payable, accrued expenses, short-term debt, and long-term liabilities. They consist of two columns: one column details the business assets and the second column details costs.

How to use the comparison balance sheet?

The user must be organized to use the comparison sheet effectively. For a better comparison, the details of all the years to be compared should be written side by side. Comparing the data becomes easier when it is written side by side.

In fact, when the balance sheets of more than two years are compared, the business gets more information. However, the process of comparing the balance sheets of all the years becomes too complex.

Template

The yearly comparison balance sheet template can be used to deal with the complexity associated with comparing multiple years’ balance sheets. This template is a very useful tool for all those people who need to get the progress report of the business of previous years but don’t have enough knowledge to do so.

In some organizations, experts are hired to do the comparison. The use of a template saves the company money by preventing the hiring of experts. The balance sheet also makes the comparison process faster and easier. The use of a template is recommended to save money and time.

It can save one’s time and energy, prevent long and detailed calculations, and always give exact results. This balance sheet can be either manually created or created using software, usually MS Excel. Nowadays, it is available in the market as a ready-made document. The available template will help one maintain a record of his business assets.

Excel File

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Comparative Balance SheetNext Article →

Funds Tracking Balance Sheet

Leave a Reply