Vehicle Mileage Log Template

We all use various modes of transport in our everyday life, being cars or motorbikes the most common form of commute. Keeping a vehicle mileage log is helpful for individuals as well as businesses. You might be using your car to earn income. If that is the case, keeping a mileage logbook will help you claim back taxes as well. You can even deduct your tax but as a document, you will require a vehicle mileage logbook.

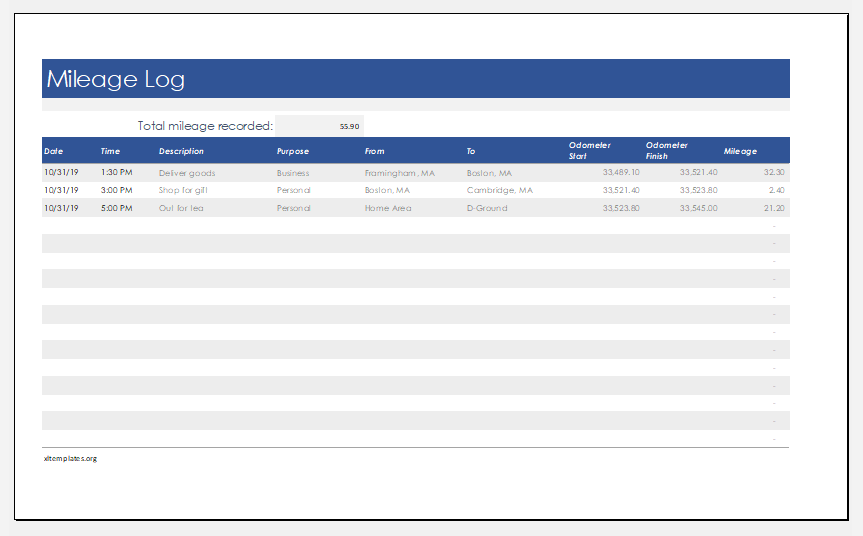

If you want to claim back your mileage expense, most of the authorities will need you to present the mileage for at least one year. If you are using your vehicle for business purposes, you need to maintain a certain set of information, which includes:

- Date

- Destination

- Purpose of trip

- Vehicle starting mileage

- Vehicle ending mileage

- Total miles or kilometers driven

Mileage logbooks can be bought from stationery stores. Or you can even use the Excel templates. Maintaining the data as mentioned above will help you track your business and personal travels as well. When you claim your mileage from the tax authorities, they might want to look into any documentation available to make sure that an individual is not claiming excessively. Logbooks can come in handy during such times.

If you are using your vehicle for business reasons, you will also need to present your mileage logbook in the event of the annual audit. Just by looking at the logbook, you can tell the expenses you have incurred for personal travel.

If your company provides you with benefits such as travel mileage, it is again a good practice to maintain a logbook. This will make it easy for you to determine your business and personal travels and at the same time, you can present your log sheet to the company for claiming back the mileage expense.

Companies that offer vehicles to their employees also need to account for the vehicles provided. But frauds also happen in such situations. An employee maintaining a mileage logbook can save herself in a situation of the allegation. Your logbook can easily distinguish between any travels for work reasons and otherwise. Keeping the receipts of petrol or any maintenance expense can help you back your claim and will save you from any allegations too.

While filing your taxes, the tax authorities will also want to look at any evidence that you have against your mileage. Your logbook can be your evidence along with the travel receipts. Keeping a detailed record of your travel will save you from any unnecessary questions. If you are not sure as to what constitutes business travel, you can take assistance from your company.

Keeping logs might sound daunting when it isn’t. But always try to choose a method that is easy for you to use and to explain it further as well. If you ever forget to mark your mileage, you can even look into the history of your mileage log and make an estimate.

Preview

Format: Excel (.xlsx) 2007-10 | File Size: 78 KB

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Run Chart TemplateNext Article →

Inventory Control Template for Excel