Vehicle Kilometer Log Template

Usually, one needs to log how many kilometres they have travelled. This may be for business or even personal use. An employee may have to travel somewhere for business-related purposes and will be using their vehicle to do this. When this occurs, they must record how much they have travelled so that they can be compensated for it. For personal use, one may want to know how much they have travelled and the cost of this to manage their budget.

To record kilometres travelled, one can consider a vehicle kilometre log. The document can be employed to track mileage. It may be for tax reporting purposes or to let the employer know how much has been travelled for work-related purposes.

This log is important as it lets the employer know how much has been travelled for work activities in case the employee needs to be reimbursed. When one keeps track of how many kilometres their vehicle has travelled, they can better determine when the car’s maintenance is required. One can also get an idea of vehicle-connected expenses, like the fuel that is being used.

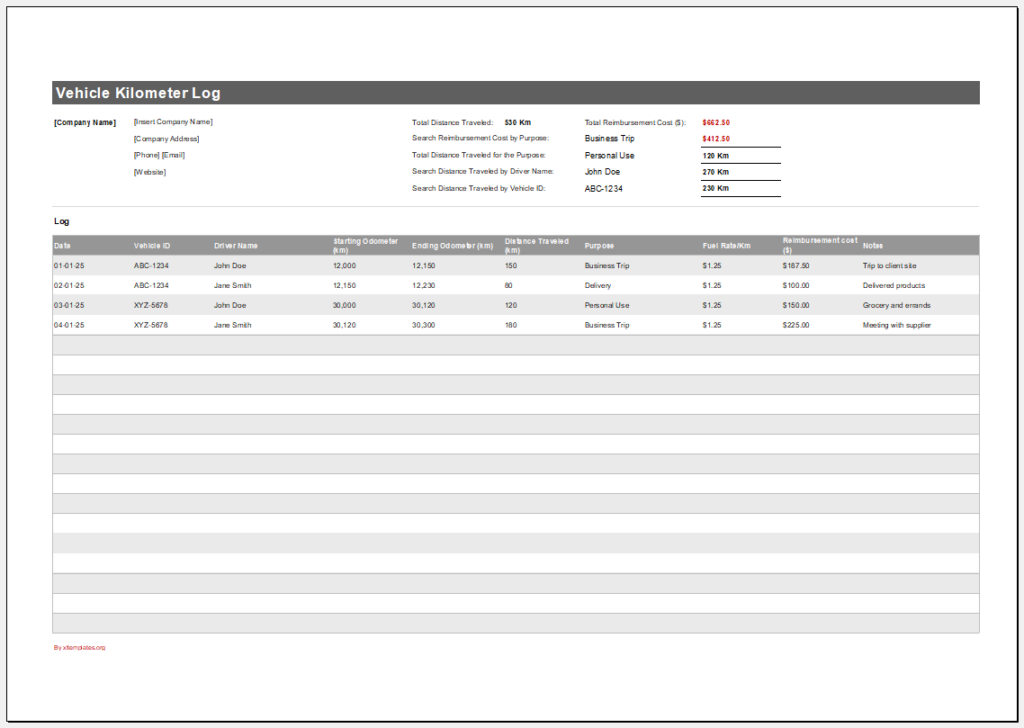

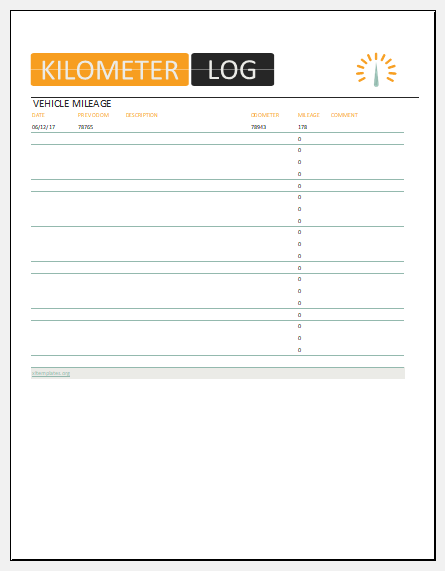

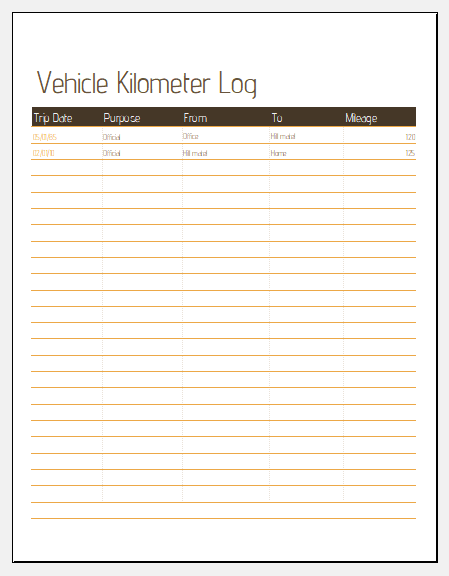

The log includes details about how much the vehicle has travelled. The date for travel will be noted, and the purpose can be briefly stated. The odometer start and stop readings will be mentioned to calculate the total miles travelled.

MS Excel (.xlsx) File

Benefits of a Vehicle Kilometer Log:

The following are some advantages that a vehicle kilometre log may have:

- It allows one to record details about vehicle travel in one place.

- Let an employee accurately inform the employer how much was travelled for work-related activities.

- It helps one set their budget by noting how much they spent on fuel.

- Let one know when it is time to maintain their vehicle.

The following are some limitations that a vehicle kilometre log may have:

- The date and day noted may not match.

- There may be a repetition of dates in the log.

- Some may find it time-consuming to fill in the log immediately.

How to make a vehicle kilometre log?

The following points can be useful when making a vehicle kilometre log:

Structure of log:

The log should have a formal structure that is simple to use. It should include a heading such as “Vehicle Kilometer Log.” The name of the person the log concerns can be included, as can the period the log is handling. The details related to mileage can be recorded in a table format.

Create table:

The table can have a column for a date that mentions the travel date. A column explaining the reason for travel needs to be present so that this can be noted briefly. A column for destination can be included. A column for the odometer start and one for the odometer end should be included to record these readings. A column for total miles will mention this. At the bottom of the table, you can have a row for the total mileage covered so that this can be calculated for the period.

You can make this log effectively in an application such as Microsoft Excel so that the mileage travelled can be recorded and the calculations can be done easily.

The log should not be complicated to fill in and even remove important details; otherwise, many people may not use it. It should, therefore, have a simple and easy-to-use format.

Businesses often require employees to keep track of distance travelled for work-related purposes. The employee may need to be compensated for this, and the company needs to know the miles travelled to reduce operational costs.

For personal purposes, one may need to record mileage travelled to create a proper budget and remain in it. For tax purposes, one may need to know how many kilometres they have travelled in a certain period. A simple vehicle kilometre log can help here.

MS Excel (.xlsx) File

MS Excel (.xlsx) File

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Employee Absenteeism TrackerNext Article →

Vehicle Mileage Journal Template