T-Ledger Account Sheet

Business transactions must be carried out effectively so that no error occurs. There are different ways to do this including using T accounts. With the help of these, it is possible to carry out double-entry accounting.

The accounts are named like this because they have a shape similar to a T. This double-entry system allows a business to handle bookkeeping, accounting, as well as financial management. This is why it is important to know about a T-ledger account sheet.

What is a T-ledger account sheet?

This account sheet visually records business transactions. It is like a “T”. There will be one area for debits and another for credits.

What does a T-ledger account sheet do?

T accounts tend to be a simple way to show a single account. The double-entry accounting system is used with them to limit the likelihood of mistakes occurring. The account sheet visually records every transaction that a company pursues. When T accounts are logically ordered, it will be simpler to look for certain transactions fast.

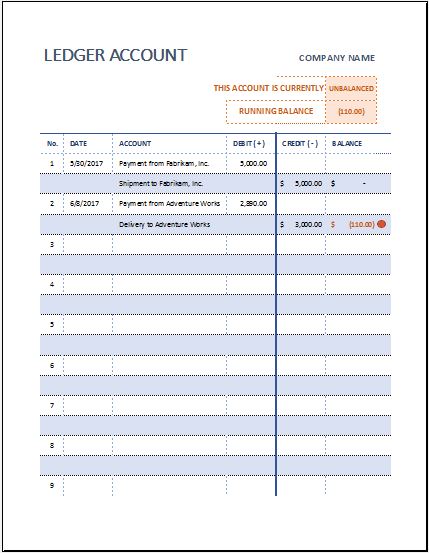

Preview

Excel Template File: 765 KB

How to create a T-ledger account sheet?

This account sheet will be used for an important purpose which can impact a business therefore it is important to make it carefully. The below tips can be looked at when making a T-ledger account sheet:

Professional format:

The account sheet needs to look professional and those who need to read it must be able to do this easily. You can make it in Microsoft Excel so that calculations can be pursued easily. You should give the document a heading according to what you are making the account sheet for. The reader should immediately know what the document is dealing with when they look at it.

Draw a “T”:

You need to draw two lines that appear as a T. This should be clear and the right size so that the details can be added easily.

Account title:

You will write the account title. This needs to be included above the horizontal line. This can be “cash”, “accounts payable”, “assets”, “rent expense”, etc.

Debit and credit side:

The debit side will be on the left. You can include the heading “Debit (Dr). On the right side, you include the credit part. The heading will be “Credit (Cr)”. It depends on what you are calculating; according to this, you will include the details.

The main areas of the balance sheet, i.e. assets, liabilities as well as shareholders’ equity or SE may be shown in the T-account. This is when some financial transactions happen. For instance, if you are calculating rent payment, under the debit and credit headings you will add the heading for date and amount.

At the bottom, you will have a space for balance. For example, if a company gets a $5,000 invoice from the landlord for the August rent, the account can show that a debit of $5,000 will be present to your rent expense account.

There will even be a $5,000 credit that goes to your accounts payable account. The transactions will show that your company has gotten an expense and even a liability to pay this expense. When the company has paid the invoice, the accounts payable liability will be removed. A debt will occur to that account and a credit will happen to the cash account. This limits the balance within that account.

Importance of a T-ledger account sheet:

T-accounts help in preparing and adjusting entries. The account sheets help accountants know what details to enter within a ledger so that an adjusting balance can be obtained. The account sheet is simple and can be read easily.

If an accountant wishes to find errors, recheck what bookkeepers have done during some audit, and generally want to be certain that no mistakes are present, this account sheet can be made. Double-entry accounting helps record all transactions two times to make sure nothing remains.

All transactions will have two equal areas, i.e. the debit and credit areas. When an accountant records both these parts of a transaction and then pursues a trial balance, they can be certain that everything has been done properly. In case the books are not balancing, the account will know that there is an error that needs to be fixed. They can then simply look for this mistake.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Business Expense ReportsNext Article →

Holiday Shopping Budget Template

Leave a Reply