Spending and Savings Worksheet

Those who want to save money know they must keep track of their spending and savings. This helps them determine whether they are keeping a balance between the two. People also keep track of their expenses and the money they save when they have a goal for which they require a specific amount. Keeping track and controlling spending is a good thing that most wise people do.

What is a spending and savings worksheet?

It is a financial tool used by people who want to manage their finances efficiently. It records information such as income, expenses, and savings, eventually letting the person get a deeper insight into his financial situation. This way, lots of things can be managed expertly. People who use the worksheet can also make informed and right decisions.

Excel (.xlsx) Worksheet File

Why is it important to use the spending and savings worksheet?

In this age, everyone is concerned about saving more money because of the hike in competition among people to have a better standard of life. In addition, people want a safe and better future, which cannot be possible without having ample money in their accounts.

This need arises, and then people become more concerned about balancing the money they receive every month and the money they spend. Overspending eventually takes you closest to bankruptcy, which can lead to many problems in the time to come.

This worksheet allows people to determine if they are spending more than they should. Based on this information, people can make better decisions about managing their finances.

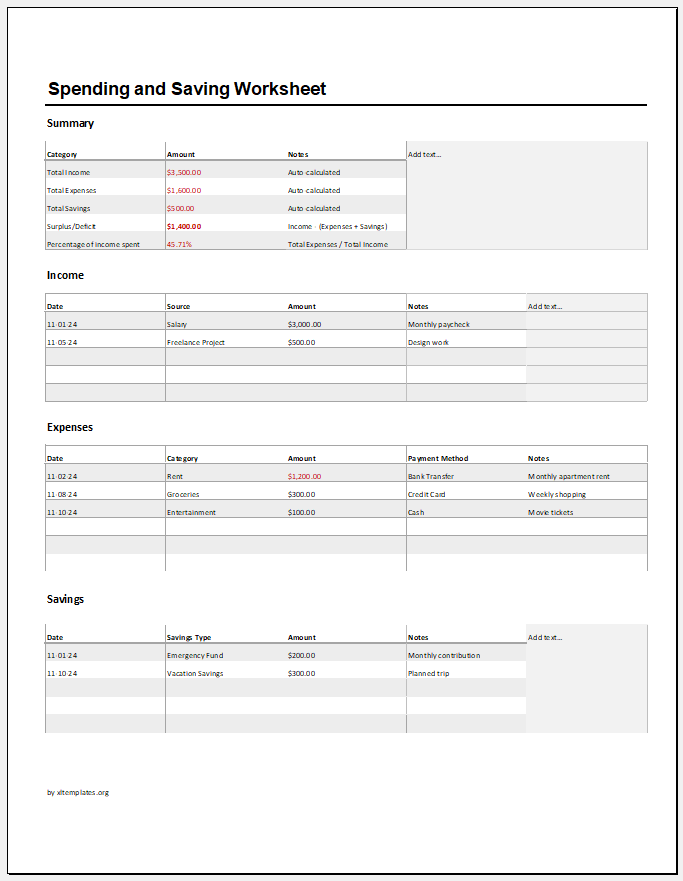

What does a spending and saving worksheet look like?

This worksheet is usually created in MS Excel file format, and it includes sections with various empty fields that enable people to get useful information about their finances. A complete breakdown of this worksheet is given below:

Details of income:

This part of the worksheet collects information about a person’s source or sources of income. Here, you will be required to input your salary, any other type of allowance you receive, such as a pension, other side income sources such as freelance work, rental amount, and much more. This is the inflow of money.

Expenses that are fixed:

You can never avoid many such expenses, no matter what. These expenses include your utility bills, rent payments, and much more. If you are trying to save money, you should remember that you can never achieve your goal by cutting out these unavoidable cash outflows from your pocket.

Avoidable expenses:

Another type of expense is avoidable expenses. These include money spent on food, entertainment, clothes, etc. You can easily avoid those expenses by deciding between your wants and needs and then compromising a little bit on your wants.

You don’t need to be a miser to avoid expenses. A fine balance needs to be achieved, and the worksheet will help you determine that balance at some point.

Total expenses:

Here, you will add the values of fixed and variable expenses to see the total amount you spend each month from your income. This will give you a brief overview of your spending and a clear picture of your financial situation.

Total amount kept aside:

Another section of the worksheet includes the space to mention the amount you have allocated for saving. This is the amount you have decided not to spend and keep aside for the future. The savings amount can be determined by subtracting the total expenses from the total income.

Remember that amount of savings and expenses will let you see whether you are spending more than required or you are being a miser. If your expenses exceed your income, you will face difficulties. Similarly, if there is a significant difference in income and expenses, there is something you need to be concerned about if this is unusual.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Small Family Kitchen Design PlanningNext Article →

Vehicle Mortgage Payment Calculator