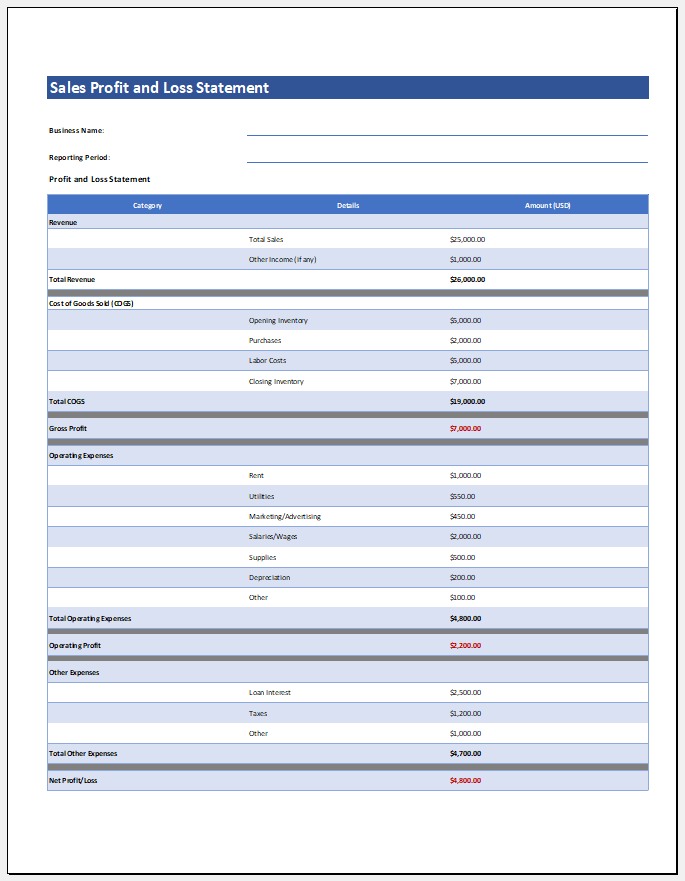

Sales Profit and Loss Statement

What is a profit and loss statement?

A profit and loss statement, also known as an income statement, is a document that documents all the expenses your business has incurred and the revenue it has generated. Every profit and loss statement has a specific time period to cover. Some statements are created for a month, and some are created for six months.

Why is the profit and loss statement used?

This statement is used when a business wants to know certain things about its business. At times, a businessman needs to understand how his company is doing.

This statement helps him to determine the losses the business is facing and the profit it is making. Based on this information, certain essential decisions are taken. For example, with this income statement, the business person can better determine which area the business needs improvement. He can also figure out whether the company’s performance is satisfactory.

provided by templates.office.com

What is the objective of using a profit and loss statement?

Every company has its net profit and loss, usually created at the end of the year. People, particularly investors, like to see this information to decide whether the company is worth their investment.

If the company makes a good profit, reinvesting in that company is the best idea. However, if the company is going at a loss, then the investment should not be made in that company.

Put another way, the profit and loss statement indicates to investors what they should and should not do. Additionally, certain business decisions are entirely based on the information provided by the profit and loss statement. Some of the everyday decisions that are taken with the help of this income statement include:

- How is a business performing, and whether the company is in a position to buy new shares?

- Should a business hire new employees?

- Show a business to start a new project or work on previous projects.

- Does a business need improvements? If yes, what kind of improvements?

- What changes should be brought to the business to make it attractive to investors?

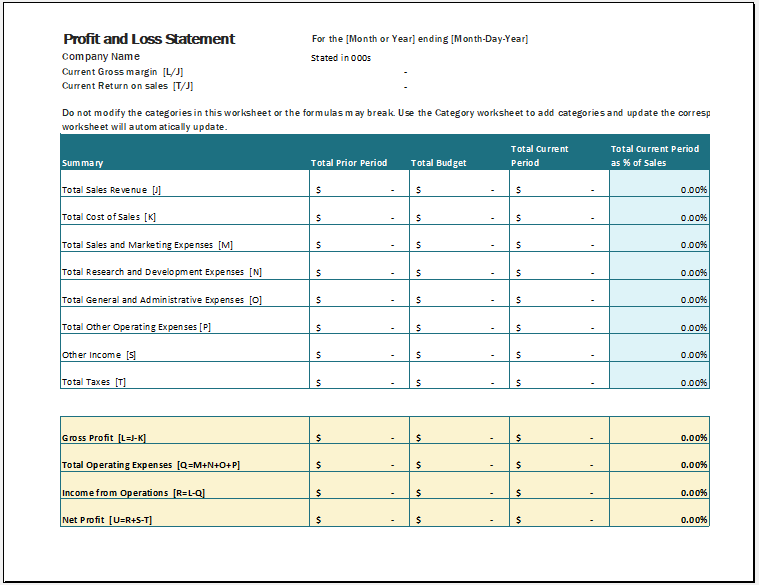

Short format

Excel (.xlsx) Worksheet File

When should the profit and loss statement be used?

Every business must use a profit and loss statement after every specific period. Usually, businessmen want to review the overall performance of the business after every quarter.

Another situation in which this statement must be prepared is when a business tax return document must be created. Since the amount of tax a business is liable to pay depends on the income it generates in a particular period, this document is a must-have in certain situations.

When someone is trying to start a new business, they should be able to show the projected profit and loss statement. According to this statement, it can be seen that the person getting ready to start the business is expecting a particular amount of loss of profit in his company. This lets everyone know whether the prospective businessman has a realistic approach or not

What information is required to prepare this type of income statement?

The profit and loss of business depend on lots of factors. The calculation of profit and loss also entails some details to be considered. Typically, a profit and loss statement includes the following information:

- A complete list of transactions a business has carried out in a given period. This list tells the cash flowing in the company and the cash flowing out.

- This statement also mentions petty cash transactions, which tell much about a business’s profit and loss.

- Total income of the business in a reported period. In this section, all the sources of income are mentioned, along with the total amount received.

- Any discounts, returns, and other reductions should be documented in the same document.

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

← Previous Article

Office Expense Budget WorksheetNext Article →

Rental Building Inventory Worksheet