Quarterly Budget Analysis Sheet

A company needs to have a proper budget so that it can function effectively. A quarterly budget is important here. It behaves like a written financial plan related to the operation of the business. When a manager is making a quarterly budget, he/she needs to do some activities.

This can include carrying out projections of sales volume, the selling costs, cash receipts, collections plus inventory stock of the business, etc. The details need to be assembled carefully so that they can be understood. A quarterly budget analysis sheet can be considered here.

What is a quarterly budget analysis sheet?

The sheet analyzes the cash flowing within and even out of the business and then compares this cash flow to the budget the company has so that you can know whether the company is on track or not. This is done quarter by quarter allowing the company to track and even adjust performance within three-month increments.

What does a quarterly budget analysis sheet do?

The sheet will examine the different parts of budget expenditure plus revenue every quarter. It reviews the company’s financial performance. The sheet lets one know of the company’s quarterly budget, revenue, profit plus losses.

To make a quarterly budget analysis sheet professionally and without errors, you can look at the following tips:

Microsoft Excel:

You can create this sheet in Microsoft Excel. The heading can be “Quarterly Budget Analysis Sheet”. Include the name of your company. State the na-me of the department. You can include the name of the person making the sheet. You can make a table where you add the information.

Research and get data:

You need to look at past performance and get data. This will let you know what the financial situation of the company is so that better decisions can be made. When you look at historical financial details, you will be able to figure out patterns as well as trends in income plus expenses.

This can aid you in figuring out future cash flows. Looking at past performance will let you figure out places where you have overspent and underspent allowing you to adjust the budget. Collect financial records from the previous year such as bank statements, receipts, invoices, etc. You can organize the details into categories like income, expenses, savings, etc.

A spreadsheet can be used to make a clear overview of the financial situation. You can then see main trends as well as patterns in spending along with income. If you want to make a quarterly budget, begin with the annual budget and figure out items that consist of the same cost month-to-month, such as payroll. Divide these annual totals by four then place one-fourth within each quarter.

You can see the activities which are more seasonal and think about which time of year these will happen. Put them in the right quarter accordingly.

Details to add to the table:

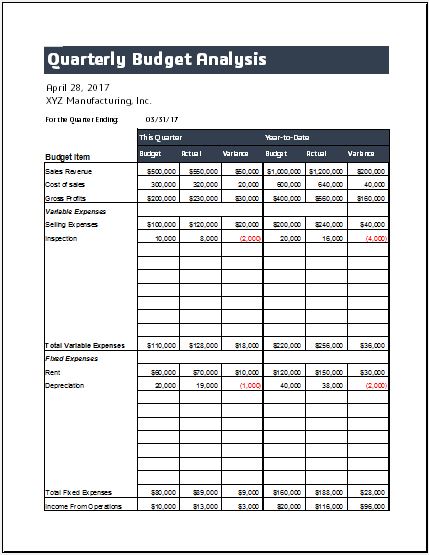

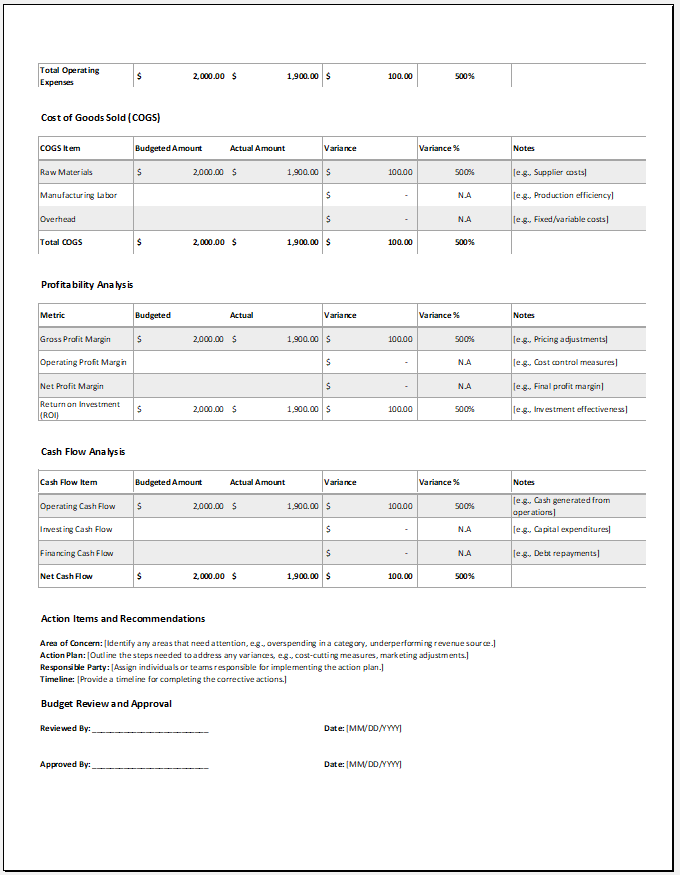

The table will arrange the items into different categories. You can have a column for budget items where you precisely state the item. An area for the quarter will be included. It will have columns such as budget, actual, and variance.

At the end of each section, you can have a row for total expenses. Have an area where you state the total expense of everything. A part for year-to-date can be present as well where you have columns for budget, actual, and variance.

Do the analysis

This sheet is important for mid-year analysis. It aids organizations in building net assets as well as making long-term financial sustainability across time. The sheet will let company staff, management, financial analysts, etc. figure out the financial standing of a particular company. The sheet does this by reviewing the financial performance of the company on a quarterly basis.

You will be able to analyze the procedure of cash flowing within and even out of the company. It will be possible to compare this cash flow to the budget you have so that you can know if the company is functioning within its budget or exceeding it. You will therefore be able to carry out any adjustments that will allow you to remain on track and let the company prosper.

Use the template that is made by our team of professionals.

Preview

Excel Template File: 82 KB

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Family Budget PlannerNext Article →

Small Business Budget Planning Sheet

Leave a Reply