Petty Cash Reconciliation Sheet

Petty cash is important as it helps one effectively pursue small payments. It tends to be a limited cash amount that includes bills and coins. Employees can use this to carry out small purchases.

This is when the company or office’s credit card and check cannot be used or if one is not permitted to use them.

A business needs to monitor where petty cash is going so that it gets used for work-related purposes. A business needs to handle all company cash properly so that everything is transparent. A petty cash reconciliation sheet is a document that is important in this case.

What is a petty cash reconciliation sheet?

This sheet records where petty cash is being spent so that a company can ensure that it is spending it carefully and following company policies. Businesses must reconcile payments so that they occur for work-related purposes.

What does a petty cash reconciliation sheet do?

The sheet analyzes where petty cash has been spent and records this information in one place. This includes why the petty cash was spent, when it was spent, etc. When details such as these are recorded, it is more possible to figure out and fix discrepancies. These can then be investigated and fixed.

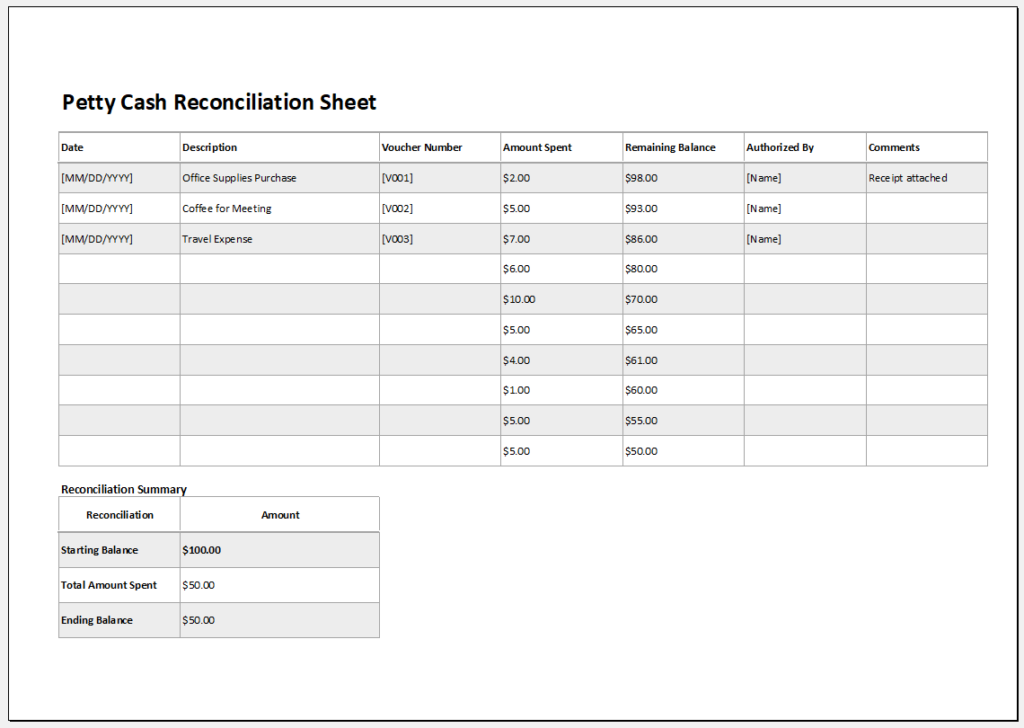

Excel Spreadsheet Template

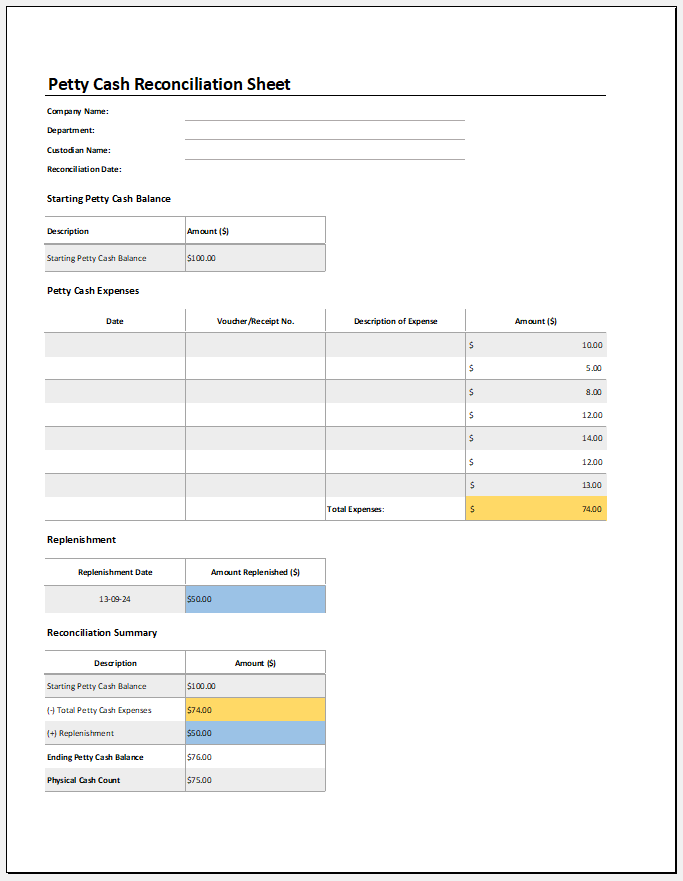

Excel Spreadsheet Template

How to create a petty cash reconciliation sheet?

A company that uses petty cash needs to monitor where this money is being used. A detailed petty cash reconciliation sheet needs to be made. The following are tips that can help you make this sheet:

Professional document:

The sheet is for a professional setting and should, therefore, be made carefully in an application like Microsoft Excel. You can add the name of your company and its contact information. Include the name of the department on the sheet and the month that it is dealing with.

Simple table:

The information can be added to a table, which is made simply so that employees add in the details regularly and so that all petty cash transactions are recorded.

Make table:

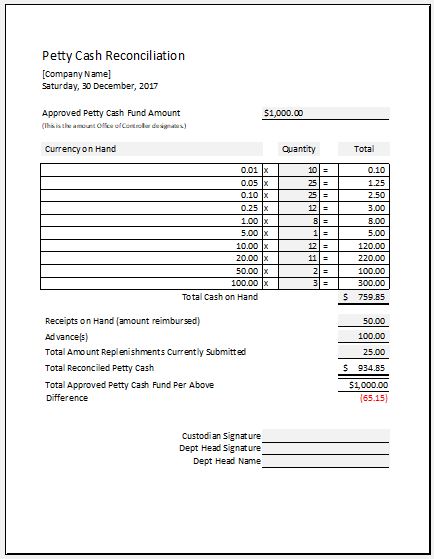

Include the relevant columns that will help record vital petty cash payment details. There can be a column for a date that records the date that the transaction occurred. A column for description will briefly state where the petty cash was used. It may be to pay some bills. This information will let the reader know whether the petty cash was used for the rightful purposes.

A column for quantity and another for amount can be included so that the total amount for the particular transaction can be known. At the bottom of the table, an area can record the total amount of petty cash.

A row for paid vouchers can be included. You can have an area for total petty cash plus paid vouchers and another row for total authorized petty cash float. A row for the difference must be added. On the sheet, there can be an area for comments where any extra comments can be noted.

Draft petty cash reconciliation to determine the expenses

A company needs to carry out petty cash reconciliation to determine the expenses that require reimbursement. The sheet will help you determine when you need to replenish petty cash so that it is available to use when needed.

It is important to have petty cash available at all times, and only when this cash is tracked and monitored can one know when they have a shortage. A company must reconcile its payments if it wants to make certain all recorded payments occurred. It is also important to know if all records present are transparent and accurate.

When petty cash reconciliation occurs with this sheet, a company will know that all petty cash used did get used. It is important to manage petty cash so that this money can be tracked. Employees who handle petty cash will not face problems when all transactions are recorded. The employer will not be able to wrongfully accuse any employee of using petty cash wrongly when a record such as this is present.

Preview

Format: Microsoft Excel

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

← Previous Article

Cash Flow Statement TemplateNext Article →

Daily Revenue Spreadsheet

Leave a Reply