Personal Monthly Budget Sheet

We are all aware of the benefits of creating a budget. A personal budget is a list of all expenses in accordance with income that helps to make a plan for how and where the money will be spent and saved. A budget is an essential tool that helps us keep a balance between our income and expenses.

The personal monthly budget sheet varies from individual to individual, as people’s financial situations are different. The budget sheet also depends on a person’s spending habits. Not every category applies to one person’s income or spending, and you may also find that some months are different than others if we talk about spending or expenses.

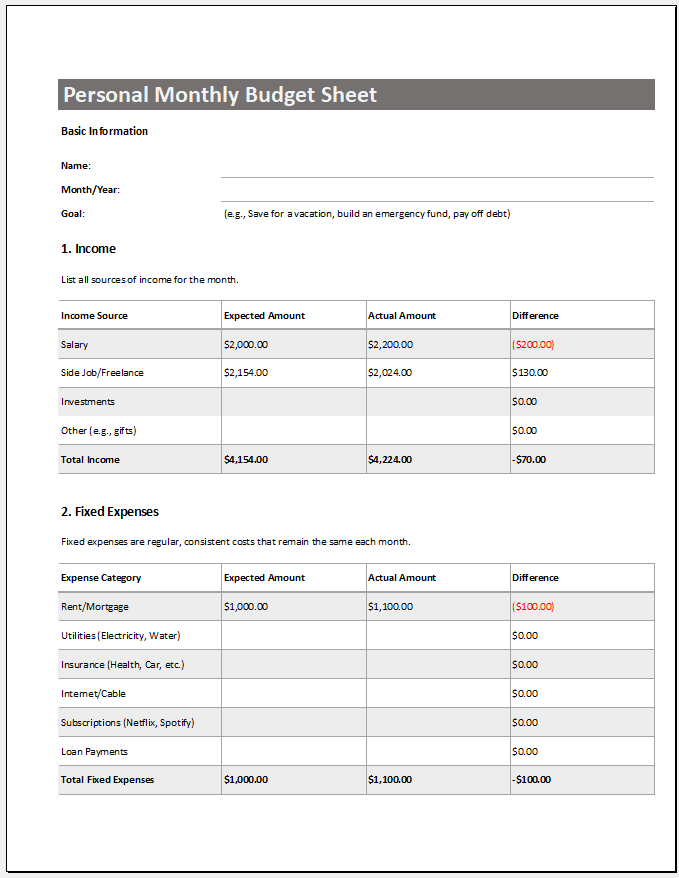

Making a monthly budget sheet is a common challenge. A typical structure of a personal monthly budget sheet consists of:

- Actual income earned includes salary, wages, and bonuses.

- List of each expense along with costs. Expenses might include bills, investment expenses, income taxes, and other personal expenses.

- Total costs of expenses.

- Savings, if any.

A personal monthly budget sheet acts like a financial map that helps with achievements. To attain future needs and overcome financial hardships, it is important to know how to make a good budget for the whole month, which is not that difficult. There are many different ways one can make a personal budget sheet depending on income, family size, and expenses.

Excel File

How to make a budget?

You can make a personal budget in the following two ways:

- Book or pen (handwritten)

- Computerized personal budget templates.

In today’s era, when money is considered the most important factor in life, budgeting helps us control our expenses and gives us financial security. Following a proper budget teaches family members the worth of money. The personal budget gives a sense of responsibility and accountability.

The benefits of managing a personal monthly budget sheet are the following:

- The budget sheets help in tracking down all the costs associated with each personal expense for a whole month.

- It tracks down when and where to use money and what expenses shall be cut off.

- The tool helps save money each month for future expenditures.

- Managing a personal monthly budget sheet saves time.

Personal budgets

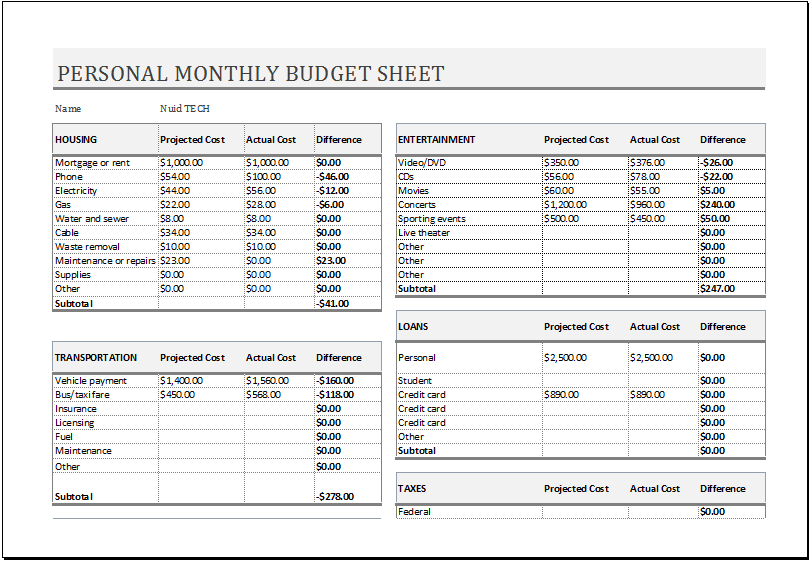

In order to allocate the budget for the month to various kinds of expenses at the start of the month and keep a check on the difference against the actual cost at the end of the month, you are required to use the personal monthly budget. With the help of this template, you can easily allocate the budget to the monthly expenses. It can also be very helpful in estimating the actual cost that a category has faced in the whole month.

This template can store all kinds of income details, such as wages, interests, savings, and refunds. It can record several categories and also the heads of expenses to cover all the expenses a business can bear in the whole month.

Monthly budget templates

Using this template is a very easy task. You are just required to fill in the number, and the calculations will be done very quickly. You can record your desired budget in the budget column. This column represents your goal. You can know how much you should spend each month. This budget column is prepared at the start of the month. Another column is for an actual budget. Here you can put the amount which you have spent the whole month.

Another column is the difference column, which stores the difference between the desired budget and the actual budget. If you get a negative number, it shows that you have consumed more than you desired. You should be very careful when adding and removing data, as it can mess up the formula.

Download your file below.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Electric Energy Cost CalculatorNext Article →

Vehicle Repair Log

Leave a Reply