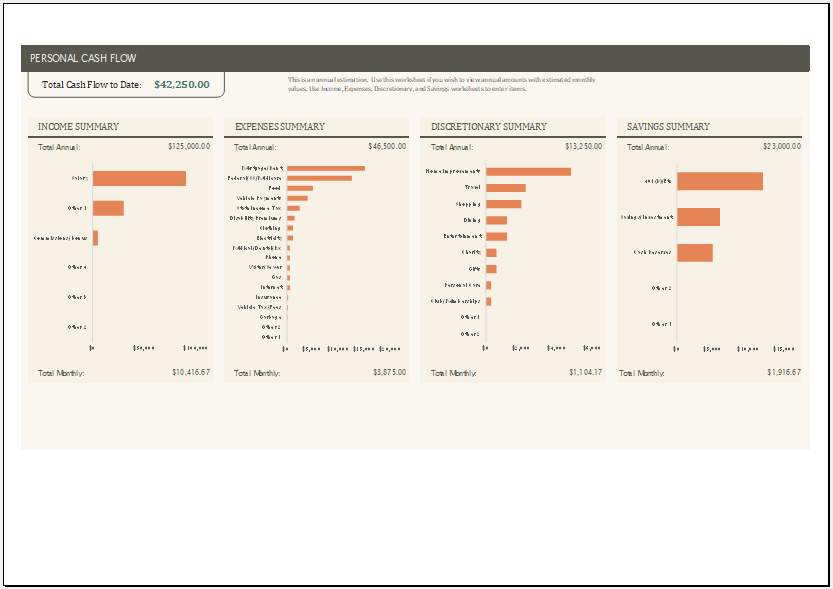

Personal Cash Flow Statement Template

It is necessary to know how much cash you are getting and how much is getting used. This helps you stay out of debt. It helps one organize where to spend money and where not to.

What is a Personal Cash Flow Statement?

A personal cash flow statement measures cash inflows and outflows so that you can see your net cash flow. This is for a certain period. When looking at cash inflows, these usually are salaries, any interest from savings accounts, any dividends from investments, if you have capital gains, etc. Cash outflows are all expenses involved.

What should be included in a Cash Flow Statement Template?

If you need to make a cash flow statement template, you can consider the following points:

- Microsoft Excel– Make the template in Microsoft Excel. Over here, you can do calculations.

- Heading– You need to have a heading so that it is known what the template is for. For this, it can be a “Personal Cash Flow Statement.”

- Income Summary– This can be in the form of a chart. Start with this heading. Under this, you will see the total annual income. Give this in numbers. The chart will show where your income came from. This will be from salary, commissions, bonuses, etc. The chart will then have the amount from these. If it is a chart, it is simple to understand only by viewing it. Simply looking at it will help you know where most of your income is coming from.

- Expenses Summary– You will have this heading next. Under this will be the total annual stated in figures. You can also have a Chart to understand it by simply viewing it. This will have those things where you spend your money. It will be things like mortgage/rent, federal or medical, food, car payments, state income tax, disability premiums, clothing, electricity, medical or dental, phone, water, gas, internet, insurance, vehicle tax, garbage, etc. You need to include all the places where you spent money. This chart will then be developed, with the highest at the top and going in that order till the lowest. A pictorial representation is more straightforward to understand by only looking at it. You will not be confused by it.

Advantages of the Template:

The advantages of a personal cash flow statement template include the following:

- Let’s one know how much income they get

- Let one know clearly where their income is being spent and how much on which things

- Allows one to cut costs where not needed and save for more important things

- Will let one remain out of debt

The personal cash flow statement template should be made carefully without any mistakes. It is an important document that will help you determine whether you are staying within your budget and whether you are overspending. It can also help you balance your income.

Preview

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

New Business Startup Analysis WorksheetNext Article →

Customer Information Sheet Template for Excel