Payslip Template for Excel

Companies or businesses grow through the collective efforts of their employees. These employees collaborate in teams, forming departments that handle specific tasks based on defined job descriptions. All teams work in coordination to accomplish their goals and contribute to the overall success of the company or business.

Employees are officially on their employers’ payrolls and are hired to perform the duties expected of them. Along with their monthly salary, they also receive bonuses, allowances, and medical benefits according to the company’s policies.

What is a payslip document/worksheet?

A payslip, also known as a wage slip, is an official document issued by an employer that outlines an employee’s earnings, including salary, taxes, medical contributions, and other deductions. It is provided to every employee, regardless of their rank in the company, and serves as a hard copy record of their income.

Previously, hard copies of payslips were distributed to employees, but in today’s paperless environment, soft copies are now emailed to the designated recipients.

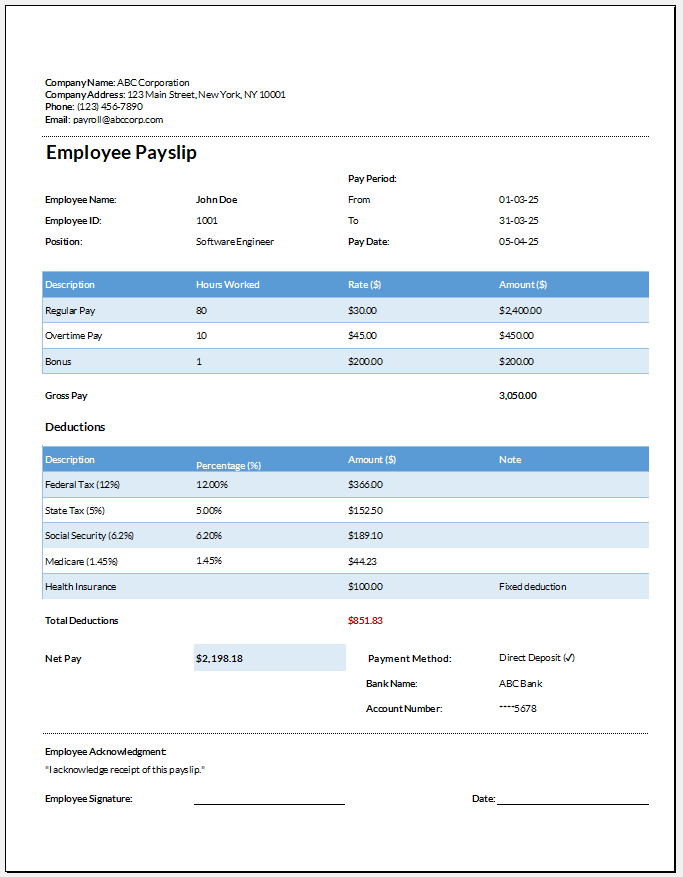

#1

This payslip template details employee compensation, including regular pay, overtime, bonuses, taxes, and deductions, with Excel formulas to calculate totals and net pay.

Excel File (.xlsx) -Size 132 KB

Standard text to add to the document/worksheet

Although payslips are official documents that can be presented as evidence in a court of law, the language used in them is simple and easy to understand. A typical payslip includes the following information:

- Name of the employee

- Employee Number

- Department

- Job description

- Work location

- Address of the company’s head office

- Contact information

- Gross salary

- Details of deduction

- Net salary

- Bank address

- The month in which the payslip is issued

- Date of payment

- Date of issuance

The information provided ultimately determines the status of employees within the company and their respective salaries. A distinction exists between gross and net salaries, as certain deductions are made before the employee receives their payment. These deductions may include taxes, medical benefits, reimbursable funds, endowment contributions, and other applicable charges.

All deductions are made according to the company’s policies, and every employee is fully informed about them. Additionally, some companies follow specific rules to deduct a fixed percentage of salary in case of absence from work. Any bonuses will also be reflected on the payslip.

Check for any discrepancies…

It is important to always check your payslip carefully to avoid any discrepancies. Since the company’s finance department prepares payslips for hundreds of employees, errors can sometimes occur. If employees spot these mistakes, they can have them corrected by presenting their payslip as proof.

Designing or downloading a good one…

Payslip designs are generally simple, as their main purpose is to inform employees about their salaries. They typically lack colors and artistic elements to maintain a straightforward and informative format. Templates for payslips are widely available online and can be easily used by downloading and filling in the relevant information.

Some specific payslips are available for download after purchase. To prevent unauthorized use, the programmer protects these templates by locking them or adding watermarks.

Many multinational companies hire designers to create customized payslips and take great pride in these efforts. They also hire freelancers from various websites to handle such tasks and compensate them accordingly.

Moreover, any employee can be assigned the task of creating them, as they can be easily made using MS Excel without requiring formal assistance.

If you’re looking to design a payslip using MS Excel, you can download professionally created templates from this webpage. Feel free to customize them as needed before printing and using them.

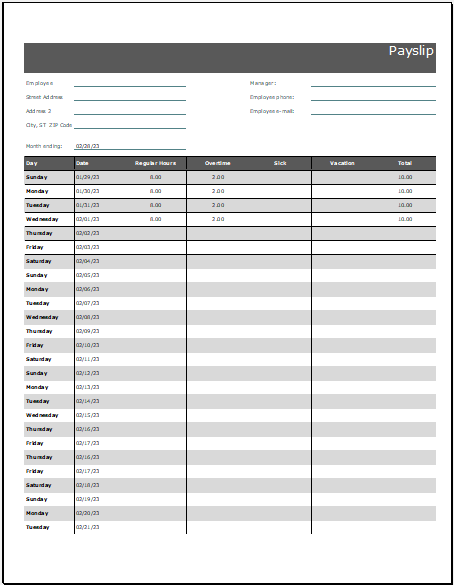

This payslip template summarizes employee earnings, including regular and overtime pay and applicable deductions like taxes and insurance.

Excel File (.xlsx) -Size 109 KB

Excel Templates

- Children’s Daily Activity Reward Sheet

- Winter Clothing & Gear Budget Sheet

- Winter Utility Expense Template

- Fuel & Equipment Sheets

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

← Previous Article

Welcome Party Budget WorksheetNext Article →

Customer Account and Balance Form