Payroll Calculator Template for Excel

A payroll calculator is used to calculate and record the payroll of each employee of an organization. A Payroll Calculator enables one to calculate the payroll precisely for their organization. It can do this in line with the Federal Tax Rules.

Payroll is a financial term and is used to record salaries and wages. Payroll can be defined as the list of the amount a company has to pay to each employee for his services during each pay period.

A Payroll Calculator will aid one in calculating as well as maintaining pay plus deduction reports for every employee. By this, you will be able to have a very confidential employee register that you can record some information in. The information can include the employee’s name, address, the date that they joined your company, annual salary, federal allowances, post-tax deductions, plus pre-tax holdings, as well as much more.

To be able to calculate the accurate payroll concerning an employee more information has to be included, for example:

- The gross pay of the particular employee succeeding deductions

- Taxable amount

- Every statutory payment that occurred

- Taxable benefits plus expenses

Along with wages a payroll calculator, also highlights the tax information, extra working hours spent by the employee (overtime), bonuses, leaves, and vacations. Considering all these factors the tool is used to calculate the payroll of the staff.

Payroll calculation of any business or organization is a time-consuming and complex process that varies from company to company. Employees of an organization work throughout the period to get their salaries for work on time, and the employer is obligated to transfer money to the staff as soon as possible at the end of each pay period.

A company can track and record the payroll of its staff in the following ways:

- develop an in-house software system.

- Outsourcing a financial company that calculates wages/payrolls.

Payroll calculations can be done daily, weekly, or monthly depending upon the nature of work of the hired employee and the structure of the company.

Benefits of payroll calculator template:

The payroll calculator is a useful tool and can benefit the management in the following ways:

- It is a time-saving tool for companies and employers to get their salaries without any delay. Thus motivates the workers.

- It gives the exact amount of wages to be paid to the workers after the tax has been deducted.

- It includes the overtime of each employee and reduces the chances of errors. Paid overtimes motivate the employees to work hard and give their input in the company’s growth and success.

- The tool helps in tracking down the wages to be paid to an employee according to the leaves and vacations.

- This tool automatically updates the wages of the staff.

The employees of an organization can also get additional benefits from the payroll calculation tool in addition to their regular wages.

- In today’s organizations, employees get some extra benefits like medical reimbursements and travel allowances which are automatic updates to the template.

- Perquisites are other privileges given to employees along with basic salaries. These include transport allowance, food allowance, house rent, and many more.

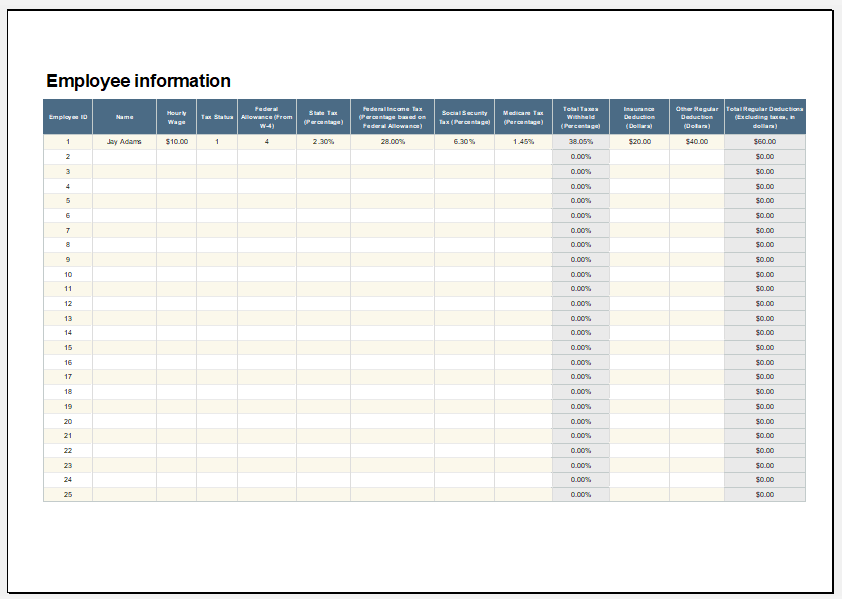

The template

An Excel Payroll Calculator will let you calculate this. The template contains three worksheets that carry out some functions. The first worksheet will be the employee register which contains detailed information concerning every employee. One can calculate the payroll that will have its basis on the vacation as well as sick hours including the regular work hours as well as overtime hours. The payroll calculator will aid one in fulfilling this task.

The third worksheet will aid one in informing the pay stubs. In the fourth worksheet, you will find the YTD payroll information. This will be a summary of payrolls given to every employee starting from the start of the year precisely to date. The fifth worksheet will depict the Federal Tax Tables. You can find a Payroll Calculator template online.

Preview

Provided by: templates.office.com/

File Size: 60 KB

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Checkbook Register Template for ExcelNext Article →

Employee Expense Report Template