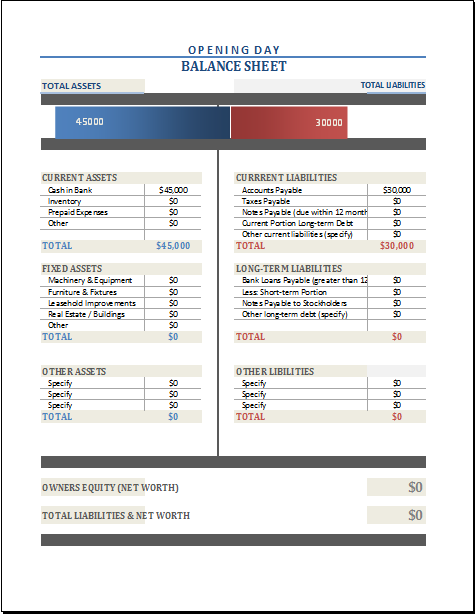

Opening Day Balance Sheet

The balance sheet is used by most companies to keep track of assets and liabilities a business owes. The total amount invested by the owner in a business is known as owner’s equity. It is important for a business to keep a balance between liabilities and equity.

It should be kept in mind that there should always be a balance between liabilities and equity. If both these values don’t balance each other, there is a problem with the values you have entered.

At the end of a month, a person is required to have a look at his business. The balance sheet is a snapshot of the business. You can get all the information about your assets, liabilities, capital, and net profit with the help of the opening day balance sheet.

Download the file:

What is an opening day balance?

The balance at the start of the financial or accounting period is known as the opening day balance. This balance calculation is started from the end of the previous accounting period. The amount of money a company possesses at the start of the new financial period is regarded as the opening balance. The balance at the end of the previous month becomes the starting balance of the next month.

If you do not have an opening balance sheet with you, you will not be able to estimate your profit or loss at the end of the month. You may want to get a template for your opening day balance sheet so that you can keep track of what you have earned throughout the month. The Excel balance sheet template is an Excel sheet that any businessman can use to estimate his business position.

Importance of opening day balance:

The balance at the start of the month is of great importance especially when one financial year is ended. This balance becomes used as a first entry at the start of the next accounting period. Moreover, when a user transfers his accounts to another accounting system, the opening balance of the account in the new system uses the previous month’s balance as an opening balance.

When a financial plan is started, the opening balance sheet is considered. The details shown by the opening balance sheet are used by the company to know the length of time the company has been operating.

What is the purpose of the opening balance sheet?

The opening balance is used to determine the total profit that the company has earned. The purpose of using the opening balance sheet is to keep a record of the opening balance in an organized manner.

The performance of the company can also be seen with the help of opening balance. The sheet also enables the company to keep track of its financial health and overall performance.

The template

You can download this template free of cost from the internet. The opening day balance sheet in Excel has been customized and designed in such a way that it can meet the demands of every business organization. This template can fit into any business. It can be a precious asset for people running a business. You can keep the record of your business in your hands always and in this way, you can make your finances go smoothly.

The template has made the lives of businessmen slightly easier. Now they don’t need to get into any complications. They are just required to download the template and use it.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Home Mortgage CalculatorNext Article →

Home Construction Budget Worksheet

Leave a Reply