One-year Financial Planning Worksheet

Financial planning is best for those people who want to be in charge of their money and keep control of it. As a matter of fact, it is very easy to meet your short-term goals as you can keep an eye on them and focus on them in a better way. However, meeting long-term goals is a bit challenging. You will need to have a deeper insight into various things for planning things for next year especially when you have done this type of planning before.

What is a one-year financial planner worksheet?

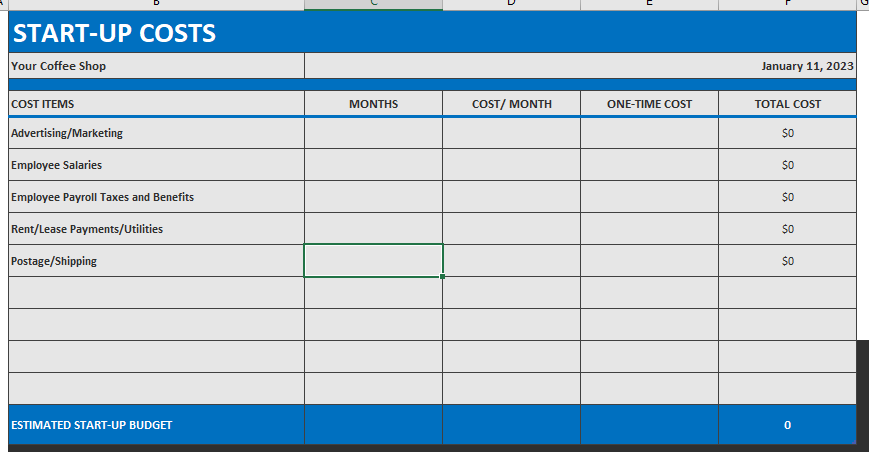

It is a tool that helps the user in long-term planning. This budget planning template has lots of benefits. You can easily meet your financial goals if you plan everything. Financial planning is a process going through which the user becomes more aware of his financial needs in the next few years.

It also allows the user to become a thinker who has the potential to think some years ahead of the present time. If you are not capable of long-term financial planning, you should use this worksheet.

What does a one-year financial planner worksheet do for you?

This tool helps you keep track of the financial goals that you have set for the next year. It has a separate space where it asks you to write the financial goals that you want to reach in the next years. This prompts you to think about your future goals. After that, you become more conscious of meeting your goals and you start strategizing how you are going to do it. This way, this planning worksheet makes you more aware of your planning and budgeting and if you follow it correctly, you will never find yourself in a financial crisis.

Using a one-year financial planner:

It is very important to follow the right procedure to use the worksheet so that you can reap the benefits for which it has been designed. Here are some tips:

Set realistic goals:

This worksheet helps a person in planning because it asks the person to share his financial goals as well as the total budget he has. Therefore, it depends on you how you are going to set your goals and then devise an action plan to follow. It is very important to set realistic goals that you can meet easily.

Know your budget:

You should know how much money you will be able to make in the next few years because this will impact the planning that you are going to do now. Keep track of your earnings in the last years. This will tell you a lot about the next years.

Know your debts:

Debts are very important, and you should never ignore them. It should be your goal to pay off the debt and deduct it from the total amount you will earn for meeting your other goals.

Excel Worksheet File 90 KB

Format (.xlsx)

Excel Templates

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

← Previous Article

Building Maintenance Worksheet TemplateNext Article →

College Party Budget Worksheet