Monthly Mileage Logs

The distance travelled in miles is known as mileage, and for a vehicle, mileage is the number of miles travelled per gallon or litre of fuel. This mileage information is helpful for different reasons, such as tax deductions or reimbursement purposes. A mileage log, mileage logbook, or mileage tracker is used to track and record mileage.

These mileage logs can help you save through mileage deduction. This can be done by deducting the mileage of business trips from the total mileage on your vehicles. The Internal Revenue Service (IRS) has listed the trips considered business drives, including mileage for meeting with clients, picking up supplies/inventories, travelling to and from an office, etc.

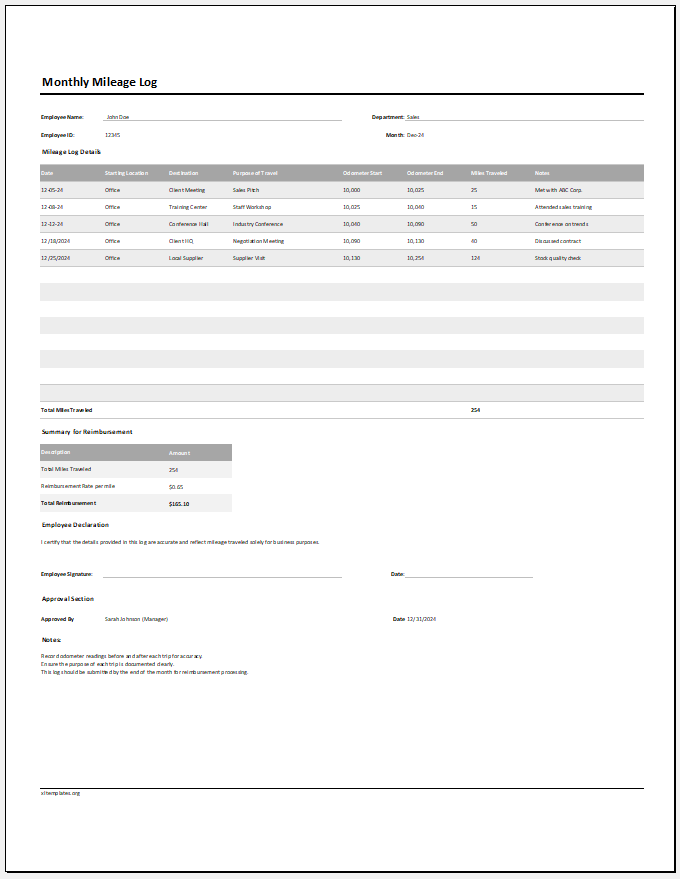

(Template)

File Format: MS Excel [.xlsx]

IRS also has requirements for the information that needs to be included in the mileage logs. Those requirements are:

- Total mileage through odometer reading

- Dates of business trips

- Places drove for business

- Business purposes of trips

Many mileage tracking applications, such as MileIQ, are available to fulfil IRS requirements and make record-keeping easy. Such applications or templates track, log, and calculate the mileage for each drive. Information in these templates can be recorded quickly and without hassle. In addition, these mileage logs can be helpful when the IRS wants to scrutinize the business mileage.

Usually, for tax deduction or reimbursement purposes, the mileage log is maintained every month and is referred to as a monthly mileage log. It records the miles a vehicle has been driven in a month. This monthly mileage log has various benefits for drivers, such as:

- To keep track of mileage for own records

- To keep track of mileage for IRS purposes

- To claim deductions on tax returns

- It could be used as a fitness guide of the vehicle or to know when are different mechanical tasks required for the vehicle, such as oil change, etc

A monthly mileage log could prove to be a beneficial tool for a tax deduction. However, this can only happen if it is up to the requirements of the IRS. People overlook many common mistakes when managing monthly mileage logs, which results in them not attaining any tax returns. Some of those mistakes are:

- Not stating the business purpose of the trip started as a business trip

- Using estimations rather than exact calculations

- Errors or negligence in stating or calculating miles or other information in the log

- Not stating sufficient information

Therefore, avoiding mistakes and providing sufficient information to obtain tax-related benefits is essential. There is another concept of a contemporary mileage log, which is what the IRS wants the drivers to maintain. In this type of log, the records must be kept daily or at least weekly. This is because the IRS needs enough information to grant tax deductions.

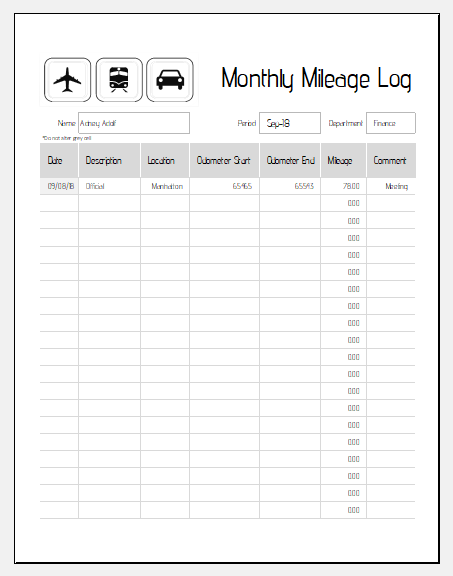

Preview

File Format: MS Excel [.xlsx]

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Wedding Invitation Tracker TemplateNext Article →

House Renovation Budget Template