Monthly College Expense Calculator

College life is both enjoyable and a time that requires you to act responsibly. The fun side of college can truly be experienced only when you are able to fund your education comfortably. That’s why it’s essential to manage your spending wisely to avoid the need for student loans.

Staying within your budget during college helps you avoid unnecessary financial stress. When you plan and organize your expenses carefully, you can enjoy your time, stay focused on your studies, and reduce the risk of falling into debt.

To help with this, using a monthly expense calculator can be a practical tool for keeping your finances on track.

What is a monthly college expense calculator?

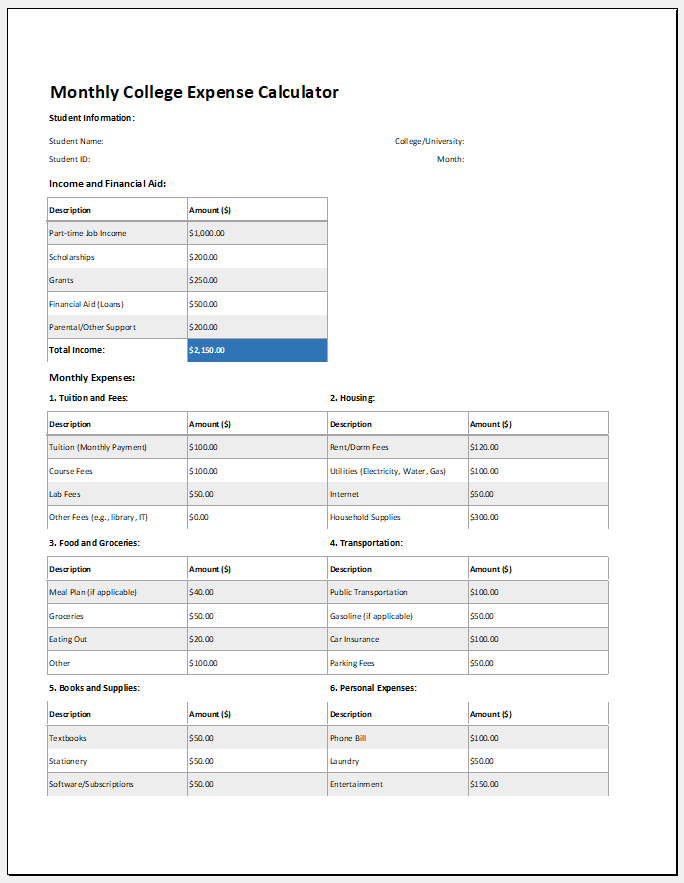

The worksheet is designed to help you estimate your expected monthly college expenses. It allows you to record your income, anticipated costs, and other related financial details to better plan your budget.

College budget calculator overview

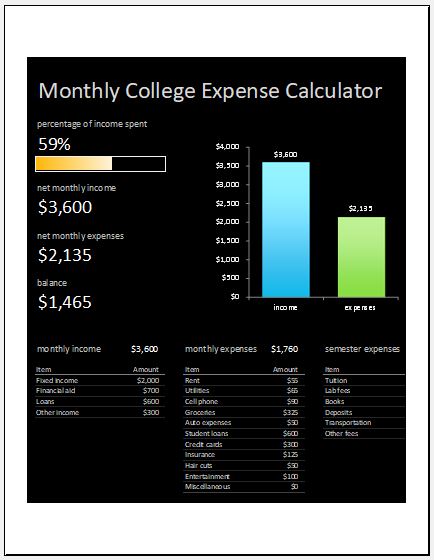

This calculator provides a breakdown of your expected college and monthly expenses. It also records your income or any regular financial support you receive each month. By comparing your income with your expenses, you can easily determine whether you are staying within your budget.

(Template #1)

Excel Spreadsheet

Creating Accurate Monthly College Expense Calculator

To effectively manage your college budget, it’s important to create a document that can accurately calculate your monthly college expenses. Here are a few tips to keep in mind while designing this document:

Using Microsoft Excel

Microsoft Excel allows you to create a detailed and efficient monthly college expense calculator. With all the necessary information organized in one place, you can accurately track and calculate your monthly college-related costs.

Format of document:

This worksheet is designed to help track and manage monthly college expenses for the student. It includes a section to specify the student’s name, the name of the college, and the month for which the expenses are being recorded. All relevant expense details can be organized clearly in a table format for easy reference and calculation.

Organize income and expenses for a clear financial overview

To effectively manage your finances, it is helpful to group similar expenses so they can be easily added to a table. Begin by creating a section for income, listing all sources such as scholarships, fellowships, financial aid, part-time work, or any other earnings.

Next, include a detailed expenses section. This should cover essential items such as tuition fees, where you can note the total amount due for the month. Record all regular monthly costs, including textbooks, supplies, library fees, photocopying, laptops, and other academic equipment.

You should also track your food expenses, including groceries, snacks, and dining out. If applicable, include accommodation costs and utilities like electricity and water. Other important expenses to record are cell phone bills, internet charges, health insurance, car insurance, and loan repayments.

Don’t forget to add personal and miscellaneous expenses such as entertainment, clothing, or any other lifestyle-related costs. At the bottom of your table, include a row to calculate the total expenses. By also including a row for your total income, you can easily compare it with your total expenses. This comparison will help you determine whether your spending is within your budget and identify areas where you may need to cut back.

Manage your college budget with a monthly expense calculator

Tracking your college expenses is essential to avoid falling into debt. A monthly college expense calculator helps you understand where your money is going, so you can stay within your budget and avoid overspending.

This tool allows you to identify your monthly spending patterns, showing you where you might be spending too much and where you can cut back. By having a clear picture of your finances, you can make smarter financial decisions, reduce unnecessary expenses, and avoid financial stress.

Using a calculator like this not only helps you manage your cash more effectively but also encourages saving for emergencies. Ultimately, it empowers you to enjoy your college life and complete your degree without the burden of financial worries

Template Preview

Format: Microsoft Excel

- Winter Clothing & Gear Budget Sheet

- Winter Utility Expense Template

- Fuel & Equipment Sheets

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

← Previous Article

Home Remodel Expense Calculator WorksheetNext Article →

Breakeven Analysis Calculator Template

Leave a Reply