Money Management Template

Money management is important. This is the procedure to track as well as plan how a person or group handles and uses capital. Money management can encompass budgeting, spending, saving, plus investing when considering personal finance. When looking at corporate finance, this includes raising and using capital.

If an individual or company does not want to end up in debt money must be managed carefully. It is necessary to know how much you are spending and whether this is not leading you to problems in the future. A money management sheet can be useful here.

What is a money management sheet?

This is a sheet that allows one to record their income, expenses, savings, etc. The sheet can therefore help one improve his/her finances.

What does a money management sheet do?

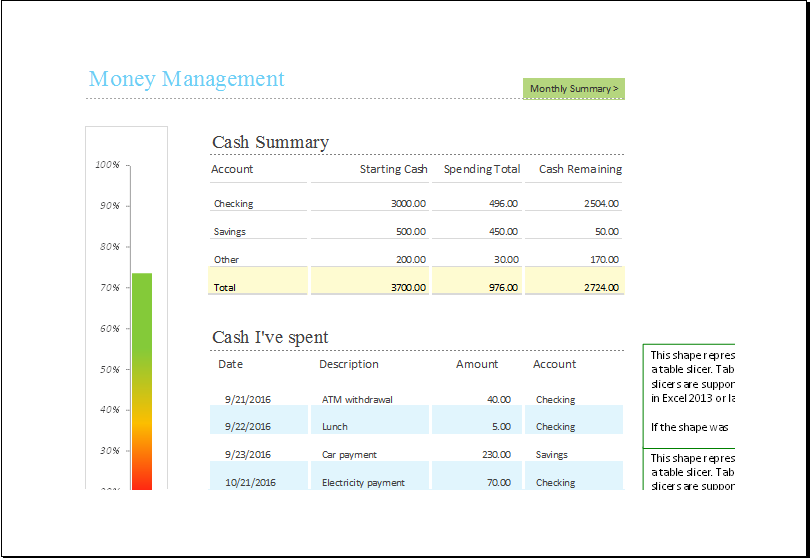

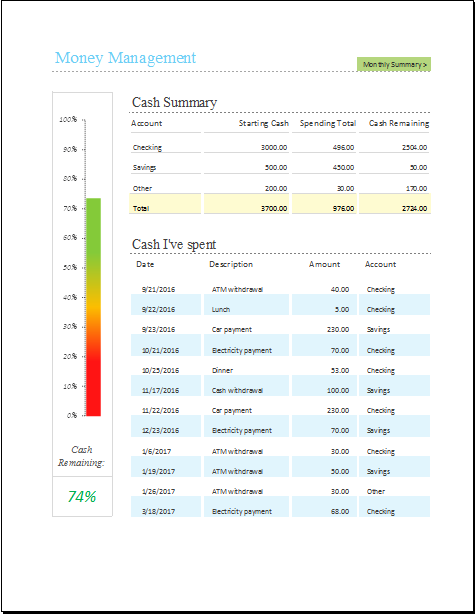

The sheet helps one make and maintain their budget as it will include details related to income, expenses, savings, and more. The sheet will let one get a glance at how they are managing their cash so that they do not overspend and end up in debt. This is because it records stuff related to cash and how it is being spent.

Excel File Size: 87 KB

The sheet should be made so that there is no difficulty filling it in and consulting it when required. The following tips can be considered when making a money management sheet:

Choose the right application:

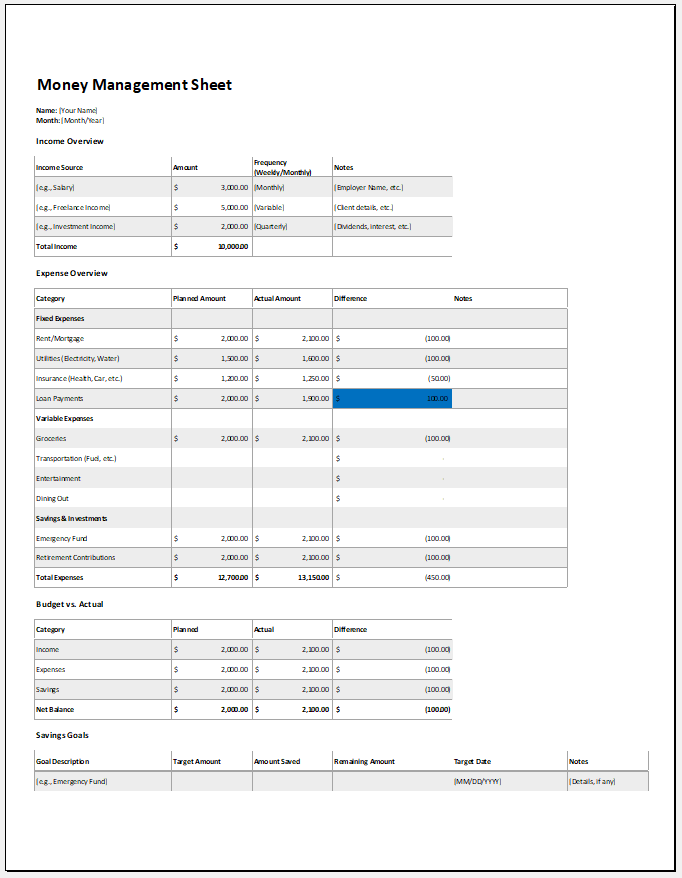

You can create this money management sheet in Microsoft Excel so that calculations can even be done easily. The heading can be “Money Management Sheet”. If it is a yearly or monthly management sheet, include this. If it is for a certain month, state the month and year after the heading.

Relevant details:

You can make tables that group similar categories and help you record money management features. For instance, you can have a column and table for income. If the money management sheet is for a year, you can have columns that include the months. You can have columns for budget, actual, and difference.

Under the income column, you can have rows for points like wages and tips, gifts gotten, interest income, refunds, others, etc. At the bottom of this table, you can include a row for total income. You can then have another category for home expenses. Under this, the rows will include mortgage, home insurance, electricity, gas, water, phone, internet, appliances, etc. You will have a row for total home expenses.

A category for daily living expenses will have rows for items like groceries, personal items, clothing, education, dining, other, etc. A row for total daily living expenses will be included. You can include a category for entertainment which will include points like music, games, etc. You will need to add total entertainment at the bottom.

A column for savings can even be included. You can include categories of the areas where cash gets used. You can have a category that states the budget summary. This will have rows for total income and total expenses. The net can be calculated accordingly. One for the projected end balance can even be included.

Points to consider:

It depends on what the sheet is being made for; according to this, you will add the relevant categories. Only include important information on the sheet if you want to limit confusion and make the sheet a professional document.

Bring your income and expenses to one place

The sheet is important because it tracks one’s income as well as expenses all in one place. This lets you know if you are within your budget or if you have to limit expenses and increase your income. The sheet will enable you to spend as much as you can and not exceed your budget.

When making the sheet and adding the different sections, you will get an idea of whether your income can sufficiently pay for the expenses along with the savings that you have planned. The sheet will let you know where you are spending too much and whether you need to cut down on some expenses. You will be able to see if you have any extra money that you can save and how much cash you can save. The sheet lets you see spending patterns.

Preview

Source: https://templates.office.com/en-gb/Trackers

Money Management Template

Download your file below. File Size: 76 KB.

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

← Previous Article

Family Budget TemplatesNext Article →

Transportation Cost Analysis Worksheet

Leave a Reply