Itemized Bill/Invoice Templates

Clients or customers need to know what they are paying for if a business wants to show it is transparent and one that can be trusted. Invoices and bills tend to be important here. They can conclude a sales agreement amongst all parties to sell products or services. When a company sends an invoice, it formally requests that the buyer pay for what they have gotten. Different invoices can be found, and a company needs to choose one related to its needs.

An itemized bill or invoice can be considered. This invoice lists the costs of every item or service purchased and notes the total amount due. The buyer is often given the invoice before they pay.

The invoice is important as it helps a company formally communicate the cost of goods or services to clients or customers. Customers will know how much they need to pay and will know what they are paying for, as this will be noted on the bill. This way, all concerned parties will know there is transparency in payments, and customers can trust the business more.

The invoice includes details about the company and the customer. The goods or services purchased will be noted clearly on the document. The cost of these will be mentioned so that the total cost can be figured out. Any terms and conditions attached can be included on the invoice so that customers know when to pay and how they can pay.

Samples

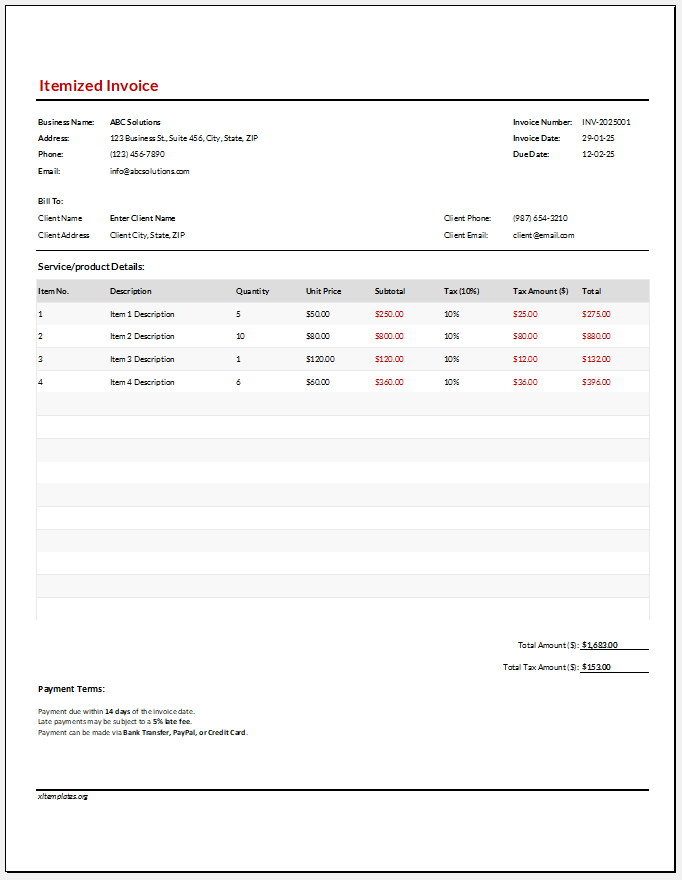

#1

Format: MS Excel [.xlsx] –Ink Saver

Benefits of an Itemized Bill/Invoice:

The following are some advantages of an itemized bill or invoice:

- The invoice will ensure customers know exactly what they need to pay for. They will see how the total amount due has been reached.

- The company can charge customers honestly by noting what they are paying for.

- Customers can trust a company more when payment procedures are transparent, as this invoice demonstrates.

- Companies can track sales, handle inventory, and record accounts receivable with the help of invoices.

- The invoice or bill can be employed as proof of transactions to meet legal requirements.

- Errors are likely to occur if the invoice is not made immediately. This can happen when one forgets exactly what the customer has brought. Excel worksheet takes care of that.

- An invoice that has a confusing format may be challenging to fill in. A suitable format can be a business marketing tool. Use it.

Important Details to Add

The main details that are added to this type of bill are:

- The date of issuing the bill

- The names and descriptions of each item purchased

- The price of each item

- Shipping charges

- Total amount to be paid

- Terms related to payment

The primary purpose of the sales bill is to collect the payment from the client. It is a formal way to request the clients to pay for services rendered. When the client pays the bill, it is stamped. The stamped sales bill proves that the client has made the payment, and now nothing is payable.

How do you create an itemized sales bill?

This sales bill is usually prepared in MS Excel format. Creating the bill in Excel is helpful as it has built-in formulas that make the calculation fast and accurate.

There is a restriction to follow a specific type of format to create an itemized sales bill. Here are a few tips that you can follow to make the sales bill for your business.

- Add the name of your company and contact details at the top.

- Add the address of the payable person.

- Mention the description of all the items that have been sold.

- Add the unit price of each item and the number of items purchased in the description section.

- If applicable, add the total amount the client must pay and the sales tax details.

Preview

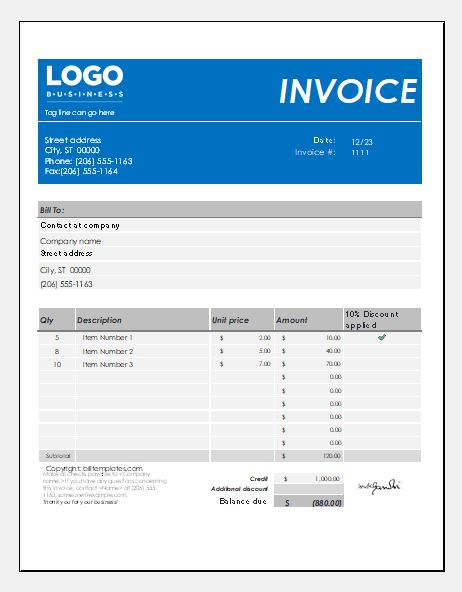

#2

A grocery shop can use this billing invoice to demand client payments. The invoice calculates the number of items ordered, quantity, and rate. The total is summed up, and the invoice is given along with the order. The invoice is handy in creating customers’ trust for future home delivery orders.

Format: MS Excel [.xlsx]

Give it a final look before you are done

The following points must be remembered to ensure everything necessary has been included.

Structure of bill or invoice:

The heading can be “Itemized Bill.” Details can be added in sections, and information related to what the customer has brought can be included in a table.

Company and customer information:

Include the name of the company or business, along with its address and contact number. Also, include details about the receiver, such as their name and address.

Invoice details:

Under this section, you will include the invoice number, invoice date, and due date.

Create table:

The table can have a column for items brought or services given. Under this, all purchases will be mentioned in separate rows. A column for quantity needs to be present, and another is for unit price. There will be a column for the amount. At the bottom of this table, you can have a row mentioning the subtotal and another for the total. If applicable, you can include a row for VAT before the total is calculated.

Other details:

A section for terms and conditions can be included so that customers are aware of them. You can also include the company’s bank details and how the customer can pay.

Simple to fill in and understand:

If you want the invoice to be simple to fill in and even understood by the people who need to consult it, ensure no extra information is included.

Ultimately, a business that wants to provide customers with a detailed breakdown of their expenses can make an itemized bill or invoice. Customers will have a transparent record of the costs linked with what they brought.

- Construction Quotation Template

- Commission Invoice Format for Excel

- Bill of Material Template

- Cash Memo Formats and Template

- Doctor Bill Template

- Cash Bill Template

- Daycare Service Bill Template

- Dental Service Bill Template

- House Cleaning Service Bill Template

- Catering Service Bill/Invoice Templates

- Hourly Service Bill/Invoice Templates

- Consulting Service Bill/Invoice Templates

- Cleaning Service Bill/Invoice Templates

- Tow Service Bill/Invoice Templates

- Work Order Bill/Invoice Templates

← Previous Article

Shipping Bill/Invoice TemplatesNext Article →

Handyman Service Bill/Invoice Templates