Flexible Manufacturer Budget Sheet

It is not simple to run any business. Many points need to be kept in mind and handled daily so that all operations occur smoothly. A manufacturer needs to track costs properly so that it can be known whether they are working within their budget or not.

Costs can alter during a project and these need to be recorded carefully. A manufacturing business has different operations and costs such as shipping materials, replacing workforce, costs of running machines, etc. It is necessary that these be recorded and any changes to these be stated as well if a manufacturer wants to calculate his/her budget properly. A flexible manufacturer budget sheet can be useful here.

What is a flexible manufacturer budget sheet?

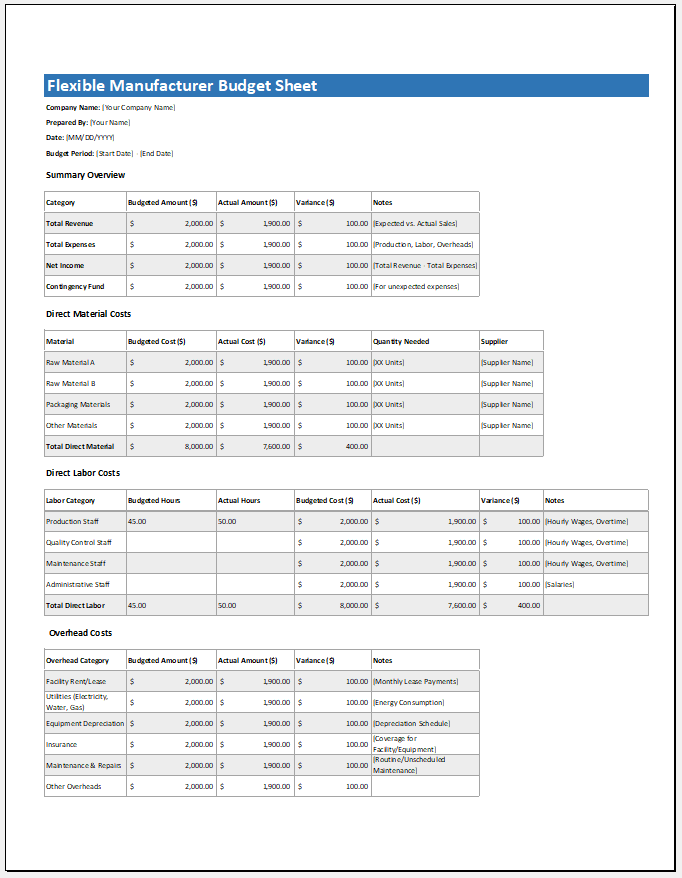

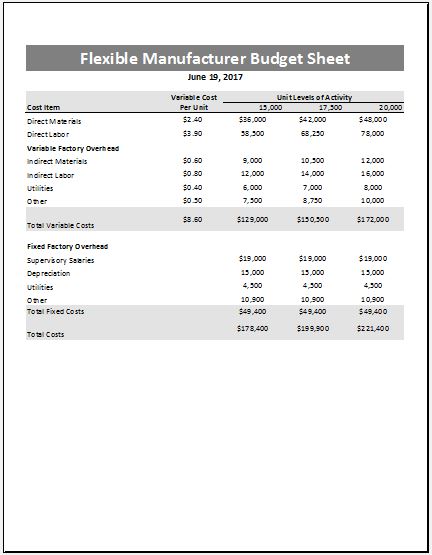

This is a budget sheet that helps a manufacturer record various expenses in a flexible way whilst keeping how much cash they have to use in mind. The budget sheet includes details of expenses such as materials, labor, utility costs, proper taxes, employee benefits, etc.

What does a flexible manufacturer budget sheet do?

The budget sheet lets a certain manufacturer know how much money they are spending on different expenses within a certain time frame. It flexibly does this keeping in mind the cost of expenses that may change and also whether the manufacturer has encountered new expenses. The sheet even notes whether a certain expense has been discontinued.

File Size: 49 KB | MS Excel

How to create a flexible manufacturer budget sheet?

To create a usable flexible manufacturer budget sheet, you can keep in mind the following points:

Platform to use:

You need to consider where to make the sheet so that it can be made without any errors. For instance, you can make it in Microsoft Excel where it is simple to pursue different calculations and make relevant tables as well.

Details to add:

The heading of the sheet can include the name of the particular project that the budget sheet is being made for. The heading should let the reader know what the budget sheet deals with. State the period that the budget sheet is being made for. For instance, it can be for a year. If this is the case, state the date and year it is for.

Make a table:

You will need to create a table that can add the manufacturer’s expenses. These will be added in rows and can include points such as indirect materials plus supplies, labor, employee costs, utility costs, property taxes, insurance, machinery fixing costs, buying new machinery, factory rent, repairs plus maintenance, others, etc. It is helpful to note down the expenses that you face so that these can be included. At the bottom of the table, there can be a row for totals.

You can have columns for the first quarter, second quarter, third quarter, and fourth quarter. A column for totals and another for a percentage of the total can be included as well. If there are any changes make sure there is space to include these in easily.

Estimate the budget

The expenses that a manufacturer may face can change therefore when a manufacturer wants to calculate his/her budget, this must be done flexibly. This budget sheet helps a manufacturer calculate his budget in this way. The sheet will let the manufacturer know the expenses he/she is facing. He can see whether he is spending more than what he has and how this can be handled.

A manufacturer must spend carefully so that he/she can get profits and not go into loss. This budget sheet can help here. The budget sheet lets a manufacturer keep track of his/her expenses in one place therefore limiting confusion. It is helpful to plan costs if a manufacturer wants his/her business to prosper.

You will be able to know where unnecessary spending is occurring so that the costs can be cut down here. Because the budget sheet is flexible, you will be able to change details where needed such as whether the cost of a certain expense has increased or decreased or even if you have a new expense.

Preview

File Size: 49 KB | MS Excel

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Holiday Shopping Budget TemplateNext Article →

Expense Budget Templates

Leave a Reply