Financial Logbook or Checkbook Register

A business engages in numerous financial transactions every day. Keeping their record and track is essential to the smooth functioning of the organization. Some transactions are small while others involve huge amounts. Irrespective of the size of the transaction, recording them holds equal importance.

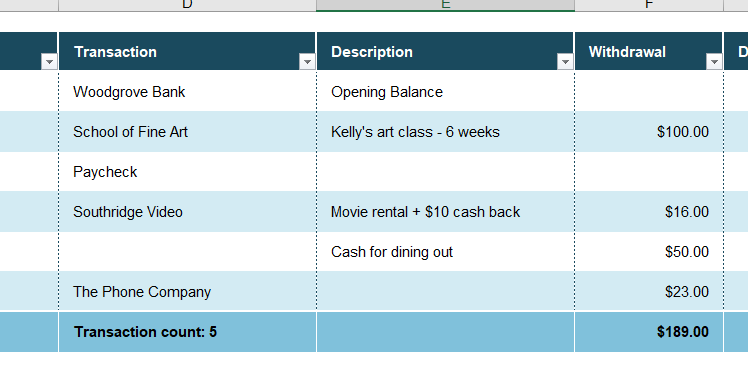

A business needs to maintain a cashbook register for this purpose. A checkbook register can also be referred to as a financial logbook or a financial transaction log.

What is a financial logbook or checkbook register?

A checkbook register is a record of debit and credit transactions of a business. It can be used to track account balance, transaction amounts, prepayments, received payments, remaining payments, daily or regular expenses, etc. The checkbook register gives an exact account balance, as it records the transaction immediately on its occurrence.

Before the technical advancements and adaptations, the checkbook register was completely maintained manually, which now has been replaced to a great extent by computers and automatic banking systems. However, the complete replacement cannot occur in this case, as the recording needs to be done manually for all the checks and payments.

What are the advantages of a checkbook register?

This register has many benefits, which include:

Tracks and records all the transactions.

As it keeps a record of all the transactions, it can be used for overviewing transactions. In addition, it can prove to be beneficial for reconciliation purposes, auditing purposes, and financial analysis purposes.

Provides easy accessibility.

As these registers are maintained by the organization, they can view their transactions, check the account balance, or update their records easily, without needing to contact the bank and wait for their records.

Indicates the accurate balance and aids in managing the finances well.

Whenever a transaction occurs it is recorded in the checkbook register immediately and the account balance is updated as well. It helps in indicating the exact amount of money, which is available for business use.

This will lead to the effective management of finances, and overspending can be evaded as well. In addition, better budgeting can be achieved as well as extra money can be invested to generate additional income. Further, if the incoming funds are not sufficient, the borrowing options can be assessed for the best choice.

Highlights mistakes.

When the accounts are reconciled, the errors, missed checks, or any other sort of mistakes can be surfaced by tallying it with this register.

What are the main components of a checkbook register?

The components of this register can vary as per the requirements of the organization and auditors. However, generally, the following elements are present:

- Company information.

- Account type

- Current account balance.

- Date of the transaction.

- Transaction or serial number.

- Description or details of the transaction.

- Check number.

- Debit or credit amount of the transaction.

- Deposits and withdrawals.

- Balance after each transaction.

- Reconciliation, if any.

- Closing balance.

- Notes or remarks, if any.

- Stamp and signature of the authority.

← Previous Article

Construction Cost Tracking WorksheetNext Article →

Employee Shift Change Record Sheet