Family Budget Planner Template

Family is important, and we all want our family to be happy. Running a household involves many expenses. If this spending is not managed, one can likely end up in debt and face much stress. It is better to have a procedure that helps you plan what is spent on family.

A family budget needs to be present as this will help everyone in the family know where money needs to be spent. A proper budget will allow you to spend strategically so there is no cash shortage, and you can probably save some money. A family budget planner template is a document that can help you here.

What is a family budget planner template?

This is a template employed to track and handle household income and expenses. It helps you have financial stability, as you will not spend recklessly and will know how much you can spend on household items.

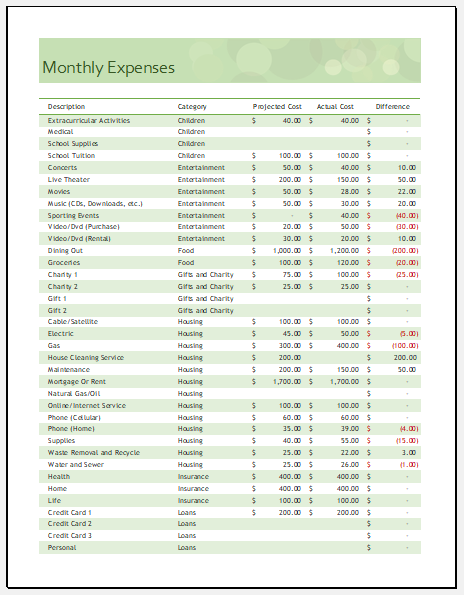

The planner lets one track one’s monthly household budget by considering income and expenses. It lists household costs and income so that the difference can be known. The planner helps one plan how to spend on household and family expenses.

(Preview)

A family needs to keep track of many things. This includes trips, emergencies, budget, etc. Keeping track of one’s income and expenses is helpful as well. This does not lead to an unexpected shortage of cash occurring. A planner made carefully can help a family stay organized.

Format: MS Excel 2010/+

File Size: 89 KB

It can seem stressful to make a budgeting plan related to household expenses. The following tips aim to help you remain organized and make an effective planner template:

Track expenses:

It is helpful to track your monthly household expenses so that these can be known. You need to know what you spend and how much it costs. When you have an idea of your monthly expenses, you can categorize them so that the planner is easy to use. You can include fixed expenses, which are the same amount every month.

This can include health insurance, house taxes, rent, school fees, etc. Variable expenses can change monthly. These can include groceries, electricity, stationery for kids, etc. Discretionary expenses can also vary monthly. These can include points like dining out, clothing, etc.

Make template:

You can create the planner in Microsoft Excel or table format. The heading for the planner can be “Family Budget Planner.” You can also decide how long you want the template to last.

Income details:

There can be an area where you state your income. There will be a row for total income and another for total spending. You can have columns for estimated, actual, and difference. In the income table, you will state all sources of income. At the bottom of the table, you can have a row for the total.

You can then create sections with similar items related to family expenses. For example, there could be a section for housing, transportation, insurance, etc. Separate tables can be made for these, with rows for estimated, actual, and difference. Under housing, there could be points such as internet, gas, electricity, garden supplies, home repairs, etc.

Under transportation, there can be points like insurance, parking, tax, maintenance, etc. All these tables will have a row for the total. You can then calculate the total of all these expenses and compare this with your income.

Template aids one in tracking their family’s monthly costs and income

This is an important template that families should have if they want to avoid going into debt. This is because the template aids one in tracking their family’s monthly costs and income so that their household balance remains in check. You can visualize spending habits to know where you spend more than necessary.

The planner helps you plan how to spend on family expenses to maintain financial stability. It tracks costs, allowing you to make a budget to pay all your bills promptly. When you plan your income, it is more possible for you to save money, which can be used for major expenses.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Birthday Calendar TemplateNext Article →

Sales Lead Tracker