Expense Report Templates

Often employees need to carry out a work-related expense so that they can fulfill the tasks that they have been assigned. This may include buying office supplies or travelling for business reasons and having to buy an air ticket, get accommodation, etc. Employees need to be reimbursed for these expenses that are for business-related purposes. A proper procedure should be present for this that is transparent.

An expense report is a document that can be considered here. It lists the various business expenses that an employee has incurred allowing the employee to record as well as report expenses related to this.

Expense reports are important as they allow a company to track employee spending that is related to business activities. This can aid in preventing overspending. The employer will know where the employee has spent money and if they should be compensated for this. An expense report allows the employee to professionally request payment for expenses they have incurred for the business.

The document includes the details about the employee such as their name and address and post in the company. The different business-related expenses will be listed along with the cost of these so that the total cost can be known. This allows the employer to analyze where money is being spent.

Various types of MS Excel expense report templates are given below. Get help from these.

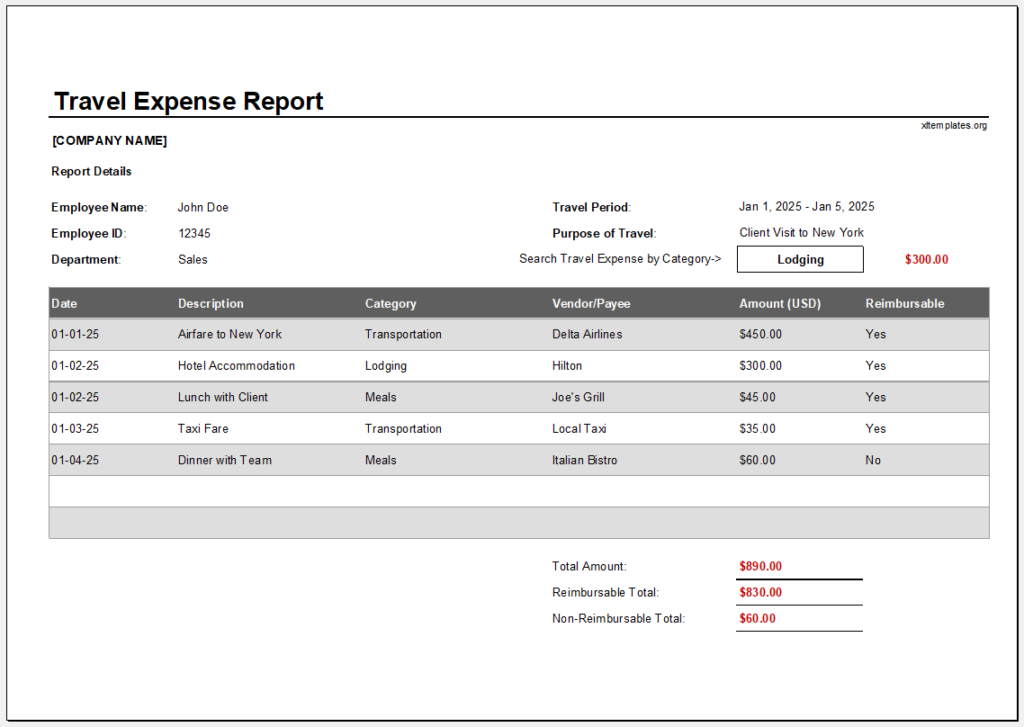

#1 Travel Expense Report

Size: 37 KB

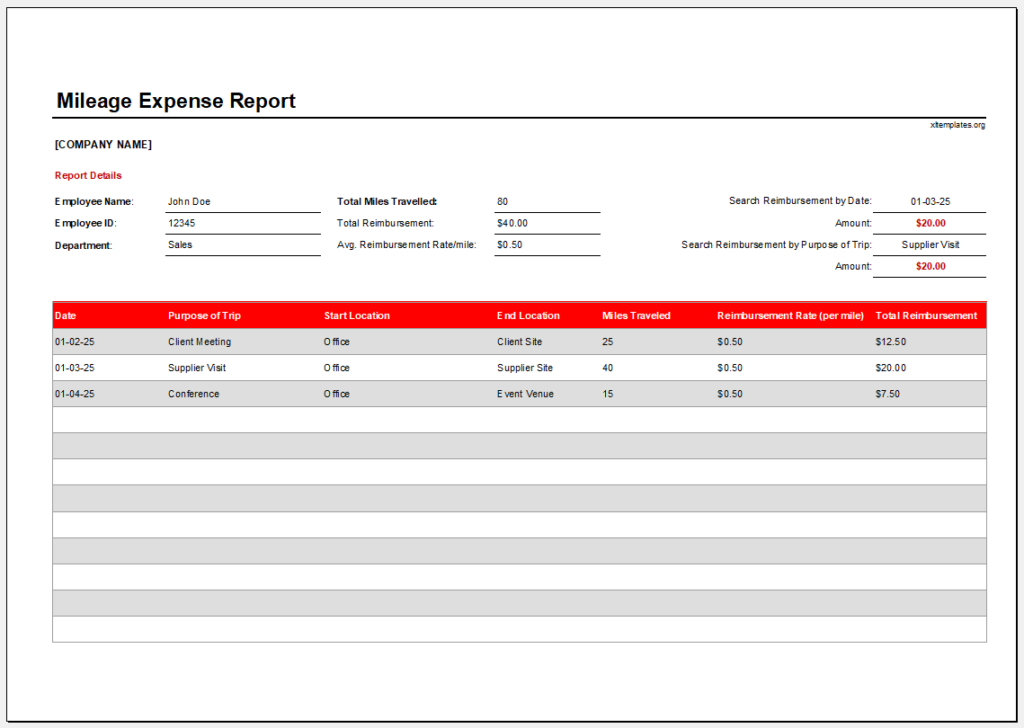

#2 Mileage Expense Report

Size: 102 KB

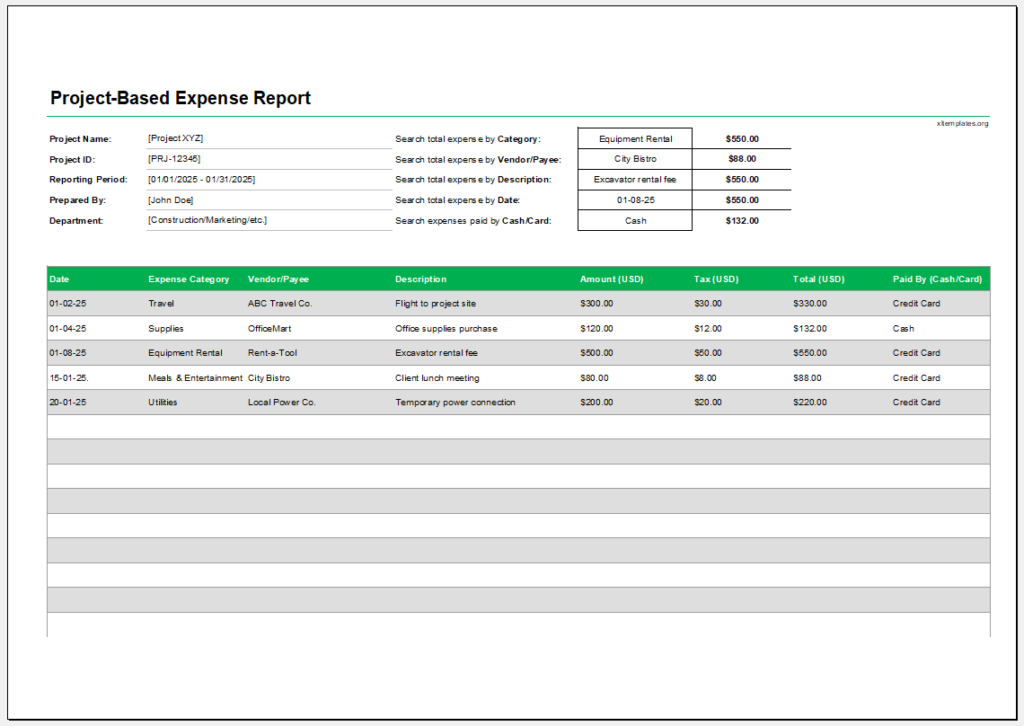

#3 Project-Based Expense Report

Size: 112 KB

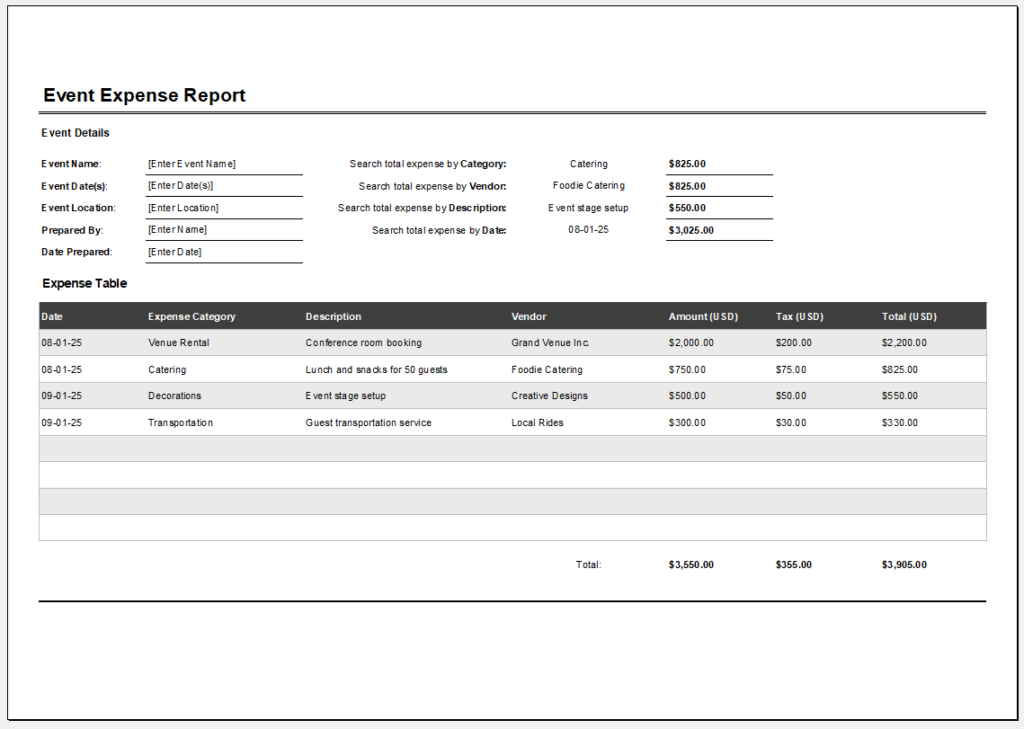

#4 Event Expense Report

Size: 134 KB

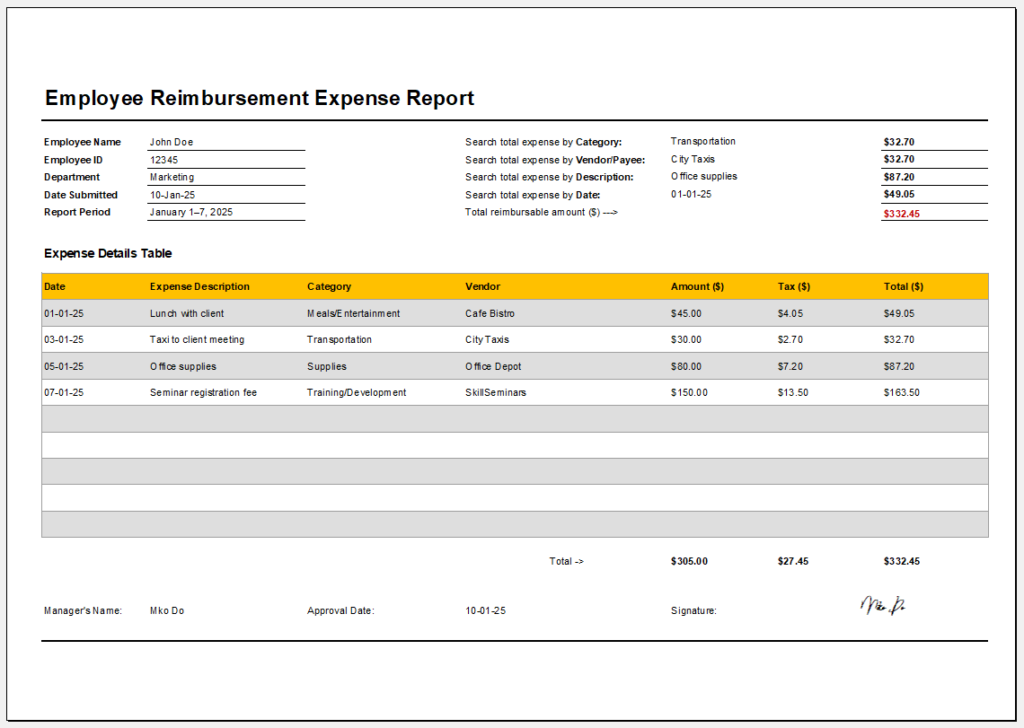

#5 Employee Reimbursement Expense Report

Size: 121 KB

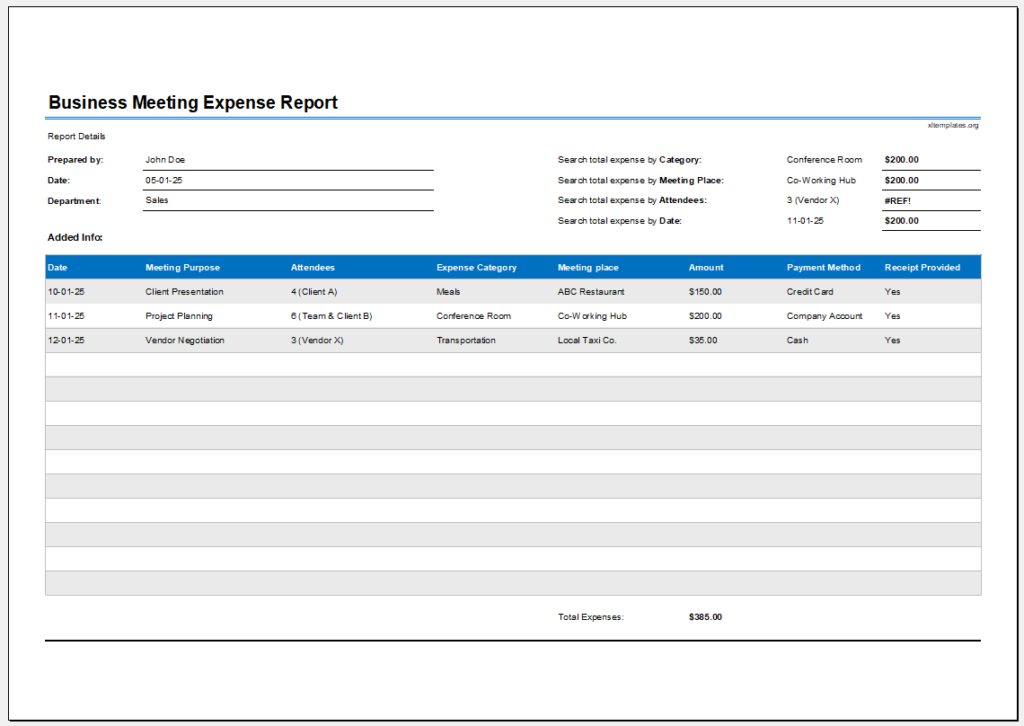

#6 Business Meeting Expense Report

Size: 130 KB

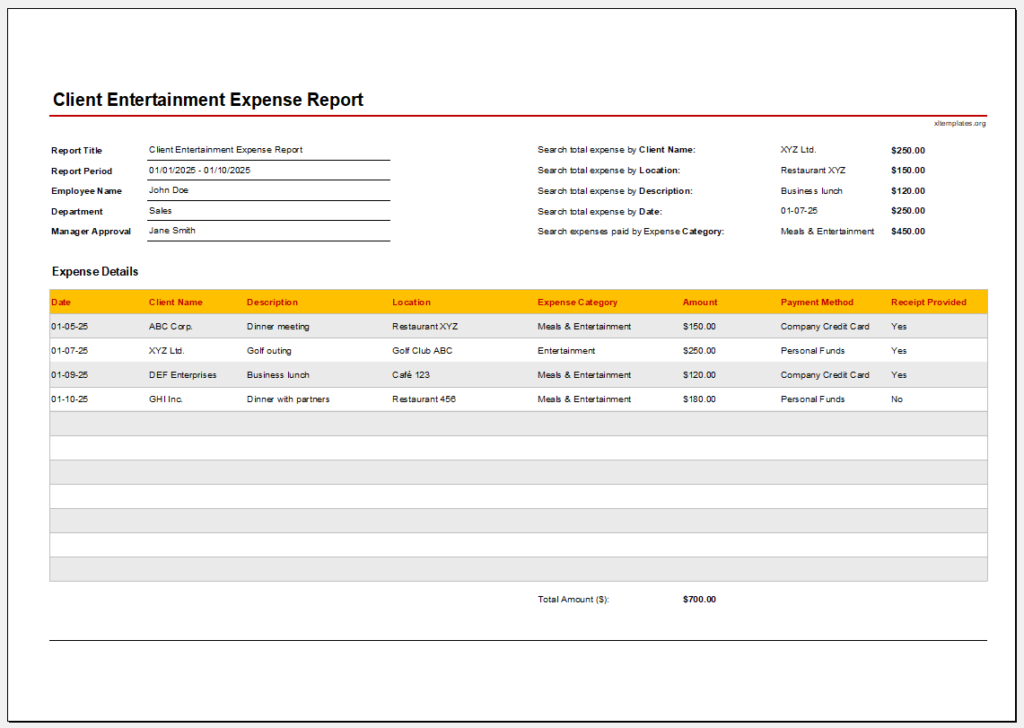

#7 Client Entertainment Expense Report

Size: 124 KB

Benefits of Expense Reports:

Below are some advantages that expense reports may have:

- Allows businesses to effectively and transparently track spending so that the budget can be managed in a better way.

- When employees know that their expenses are being tracked, they are less likely to overspend.

- Companies can figure out spending patterns when they consult these reports.

- The document ensures that an employee is fairly compensated for costs they have incurred whilst carrying out business activities.

- The document lets one professionally and formally document business expenses.

The following are some limitations that expense reports may have:

- It may be costly and time-consuming to make and process the document.

- Human error may occur when the expense report is being made.

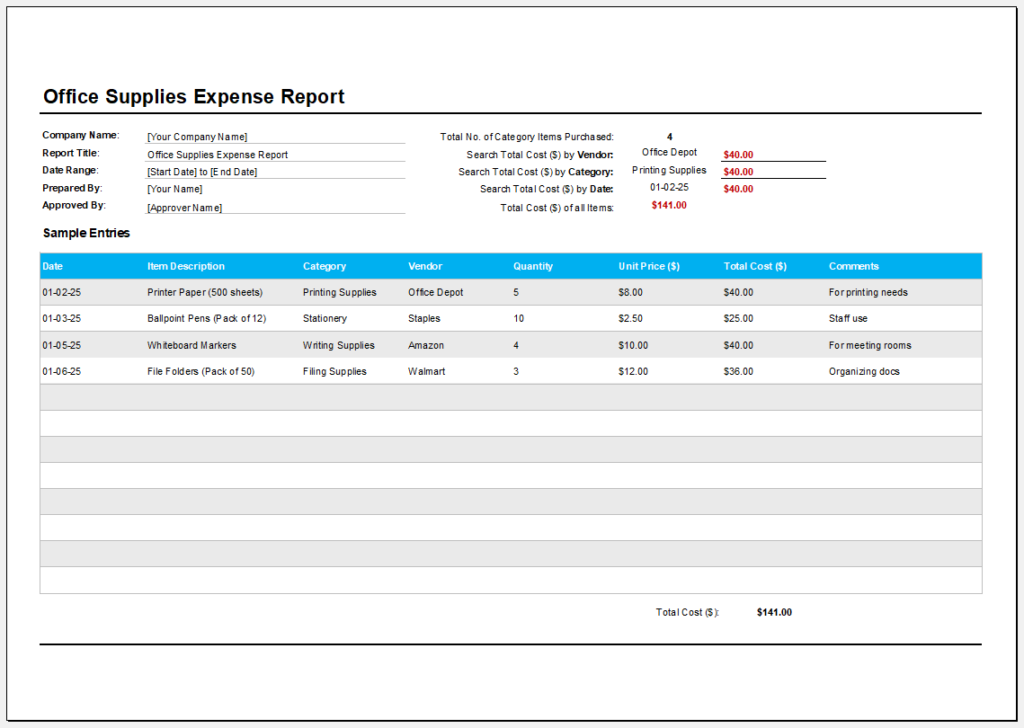

#8 Office Supplies Expense Report

Size: 132 KB

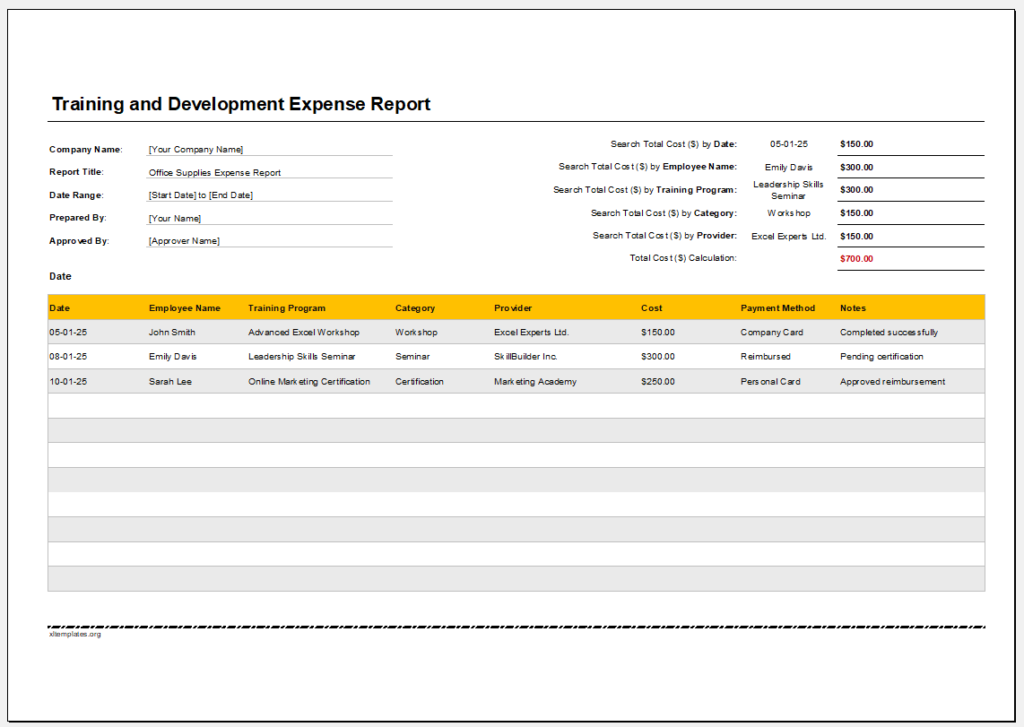

#9 Training & Development Expense Report

Size: 131 KB

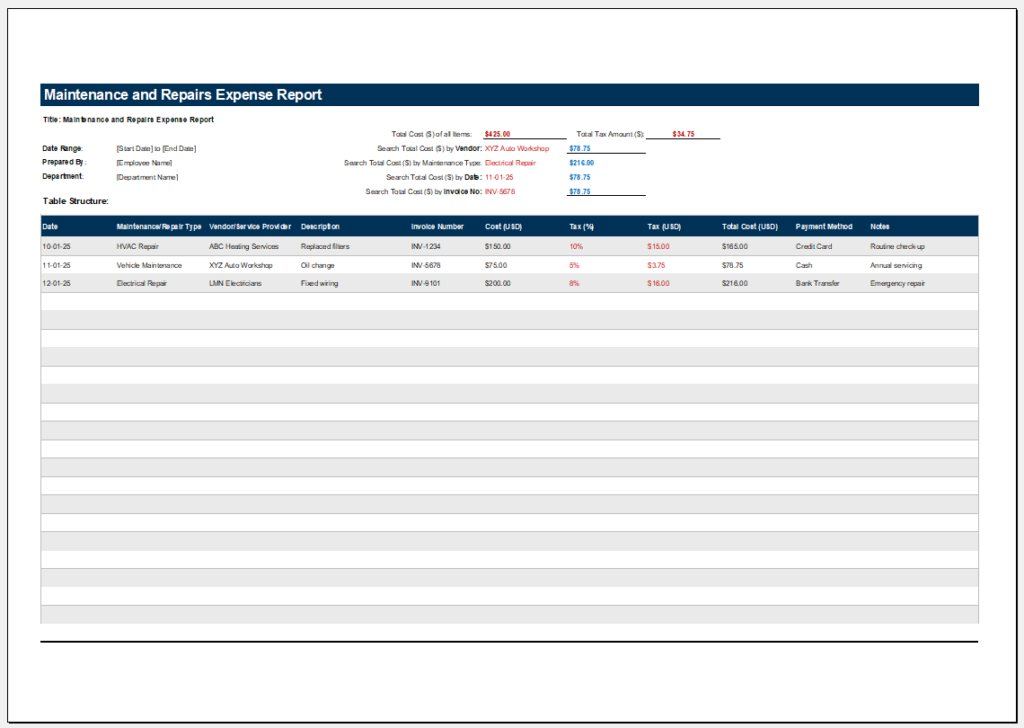

#10 Maintenance & Repair Expense Report

Size: 112 KB

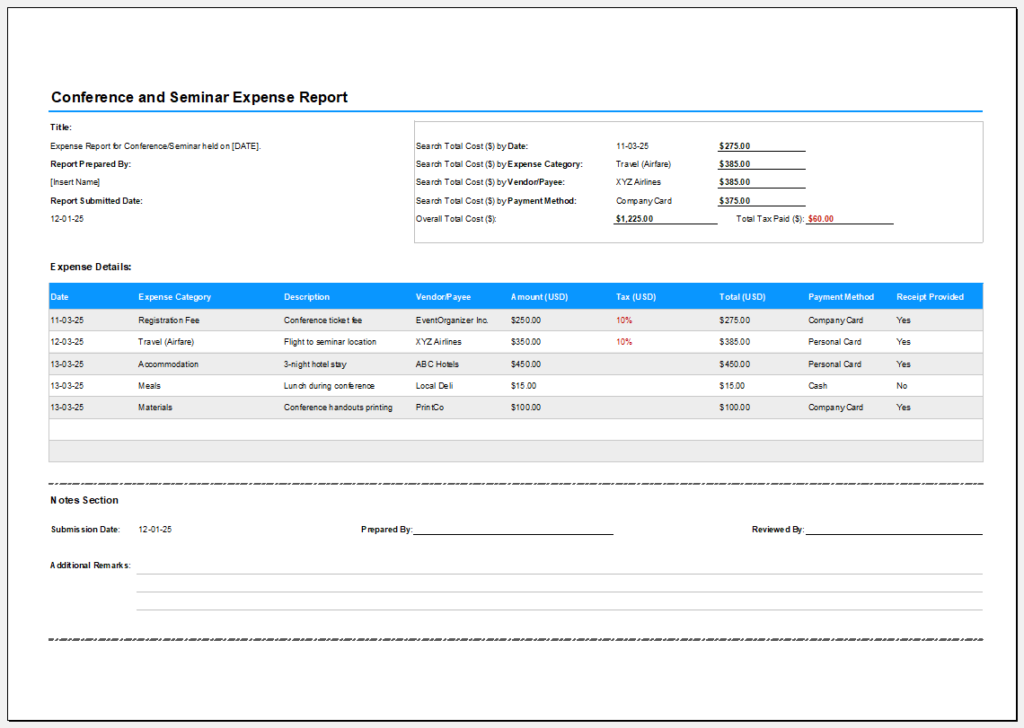

#11 Conference & Seminar Expense Report

Size: 124 KB

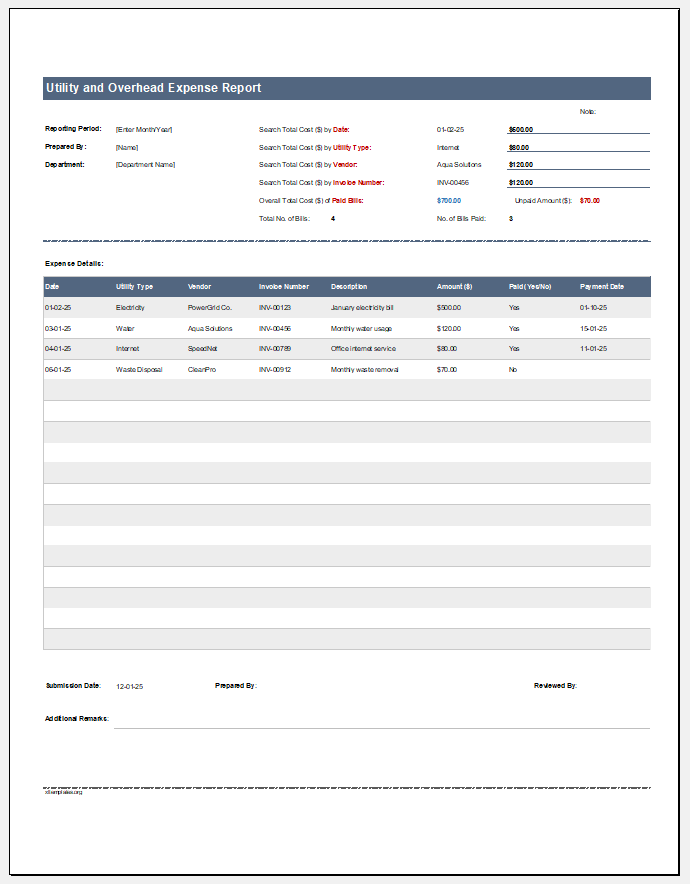

#12 Utility and Overhead Expense Report

Size: 124 KB

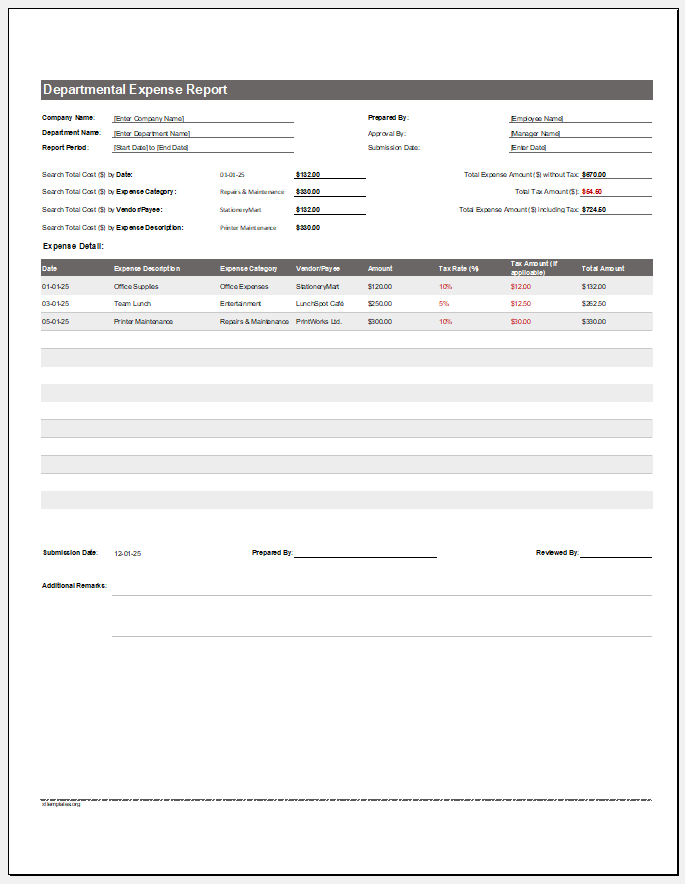

#13 Departmental Expense Report

Size: 124 KB

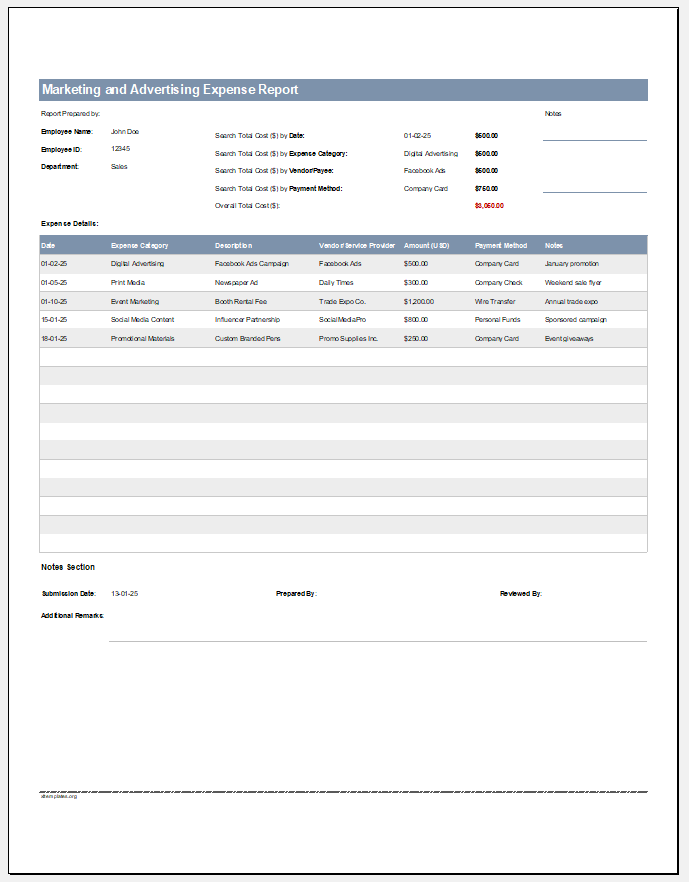

#14 Marketing and Advertising Expense Report

Size: 124 KB

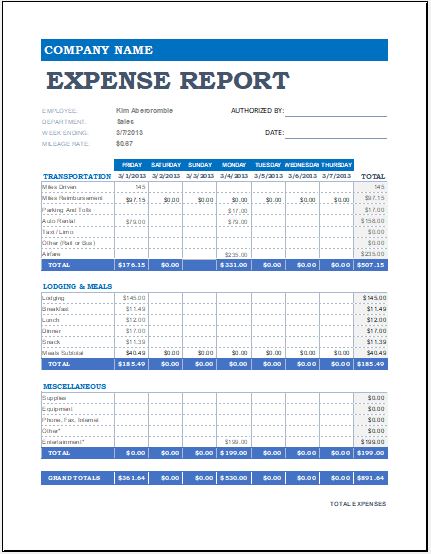

All in one expense report. Include details for various categories.

Size: 23 KB

How to make Expense Reports?

The following points can be considered when making expense reports:

Format of expense report:

This is a professional document and should have a formal format so that it can be used in a business setting. Include a heading such as “Expense Report” and make sure you avoid adding any irrelevant details. State the purpose of the expense report. The statement number should be present. The pay period can be mentioned.

Company details:

The name, address, and contact details of the company need to be included. They can be present on the header of the document.

Employee details:

This will include the name and email address of the employee. The department he/she is working in must be mentioned. The post of the employee can be stated. You can note down the employee ID and the name of the manager on the document.

Make a table:

The business-related expenses can be included in a table. There can be a column for a date that notes the date the expense was incurred. There can be a column for a category that will state the category the expense is in.

A column for description needs to be present so that the expense can be stated. You can include a column for notes that briefly mentions any details related to the expense. A column for the amount will mention the cost of the expense. At the bottom of the table include a row for total so that the total amount can be calculated.

Signature:

The signature of the employee needs to be present on the expense report to make it valid. Mention the date as well.

Simple and straightforward:

Make sure the expense report does not include any unnecessary details. It should be simple and precise so that those who need to use it can do so easily.

Employees can be sure that they will be reimbursed for business-related expenses when they can record these and communicate them to the employer in a formal way with the help of an expense report.

- Winter Clothing & Gear Budget Sheet

- Winter Utility Expense Template

- Fuel & Equipment Sheets

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

← Previous Article

Event Budget TemplateNext Article →

Monthly Sales Report Template

Leave a Reply