Employee Payslip Sheet for Excel

Organizations hire many employees, and the payment structure is not often the same for all employees. In addition, an employee’s hierarchical level also determines their payments and deductions. If an organization has several employees, recording and calculating every employee’s payment manually might become a hassle.

Even for small organizations, calculating the payment amount every time a salary is to be paid can unnecessarily take a lot of time. The employee payslip sheets for Excel can resolve this problem.

What is an employee payslip sheet for Excel?

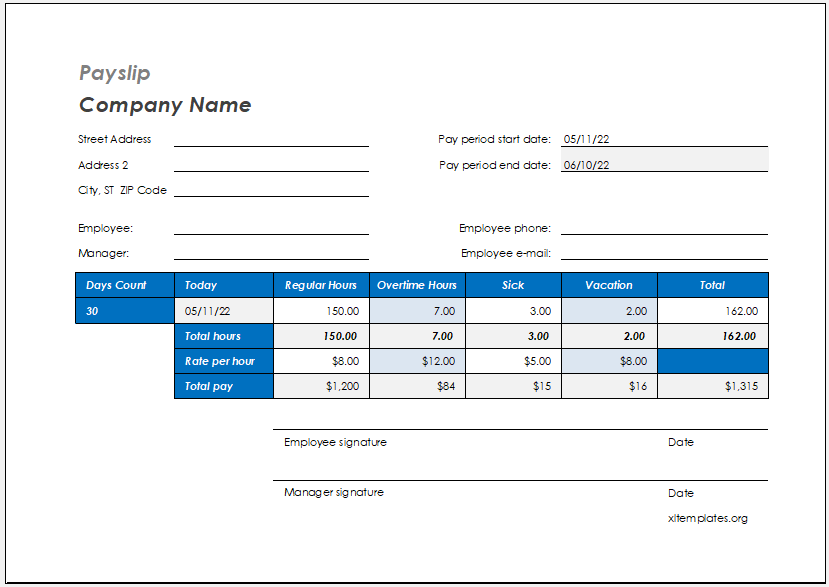

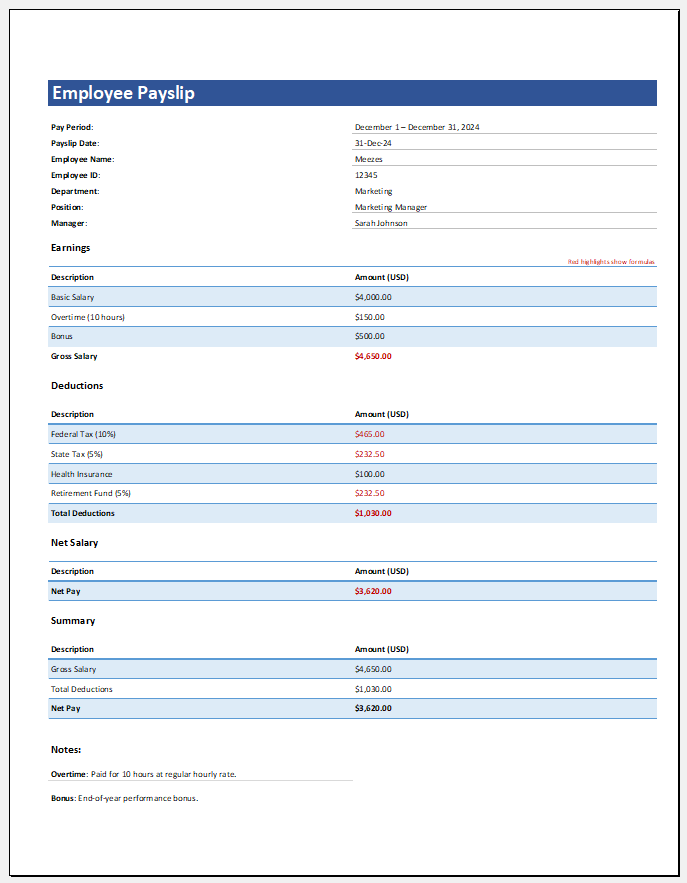

An employee payslip sheet is an Excel worksheet that records and tracks all the relevant and individual details of the employees’ payments, including the basic salary, additional expenses, and any deductions. It is a payroll document that calculates and indicates the total amount due to each employee.

This sheet can be maintained weekly, monthly, quarterly, or on an interval basis, for which the organization releases the employees’ payments. The salary slips of the individual employees can be generated from this sheet and given to the employees or kept in their employee files.

Excel (.xlsx) File: 91 Kb

What are the advantages of Excel employee payslip sheets?

These sheets can prove to be advantageous in many ways, including:

Provides detailed information on the payments.

The sheet records individual details of the employees and all the detailed components. Management can analyze these sheets for payment, analysis, and performance purposes.

Maintains the employees’ financial records.

The historical record in these types of sheets is also kept so that the salary payments of different employees can be viewed over time. An organization can use this information to assess employees’ performance and compare it with their payments to deduce whether an employee is an expense or an investment.

Calculates the payments automatically.

Even if an Excel template is being used or the organization has designed a sheet, the built-in formula in the sheet minimizes the manual work and calculates the salary payments automatically.

Generates the salary slips of individual employees.

The data in these sheets can be generated from the salary slips, which will be given to the employees or kept in their employee files.

What are the main points of the payslip sheets?

The components of this sheet can vary as per the organisation’s requirements as well as the types of payments an organization makes to its employees. However, generally, this type of sheet contains the following components:

- Date and year.

- Details of the organization.

- Serial number.

- Details of the employees are individually listed.

- Components of the salary, e.g., basic salary, commissions, bonuses, etc.

- Total gross salary.

- Components of the deductions include provident funds, salary cuts for absenteeism, etc.

- Total deductions.

- Total net salary.

- Signature of the person preparing the sheet.

Preview

See also:

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

- Monthly Study Reminder & Planner

← Previous Article

Business Startup Cost EstimatorNext Article →

Equipment Request Log Template