Employee Pay Stub Template

Companies, organizations, businesses, etc., need to ensure that employees are getting paid what they deserve. If this does not happen, the company can face legal repercussions. Employees even need to be satisfied that they are being rightly paid. A pay stub can be considered. This is a document that summarizes the employee’s pay for a certain pay period.

An employee pay stub needs to be present. Employers tend to use a pre-designed document to create pay stubs for employees. The stub includes various details related to the employee’s pay.

When an employee receives a payment, the company’s primary task is to keep a record. A pay stub is a document that acts as a record of the payment received by the employee. It shows the total earnings in the immediate pay period and the earnings for the whole year. Depending on the organization, the pay stub is also known as a payslip, paycheck, or check stub.

Key elements of pay stub:

Since the pay stub is an important document, it includes important details that can be useful for documenting the payment. The main details are:

- The employee’s name

- Total salary

- Deductions from payment

- Complete date of payment

Benefits of pay stub:

- The pay stub provides the information about the wages.

- It is also advantageous to keep the record accurately without any errors.

- It also serves as proof of income and tax filing.

- The record of accurate payment can be maintained through a pay stub.

Many employees use the electronic version of their pay stubs because the funds are transferred to their account electronically. Those employees who don’t have a bank account use the payroll card issued by the company, which acts as a debit card.

Government agencies also issue paychecks to people from their treasury departments instead of their bank accounts. The payroll provided by the company can be printed to get a hard copy.

Companies that want to save time and streamline the payroll management process can use the pay stub template.

About Template

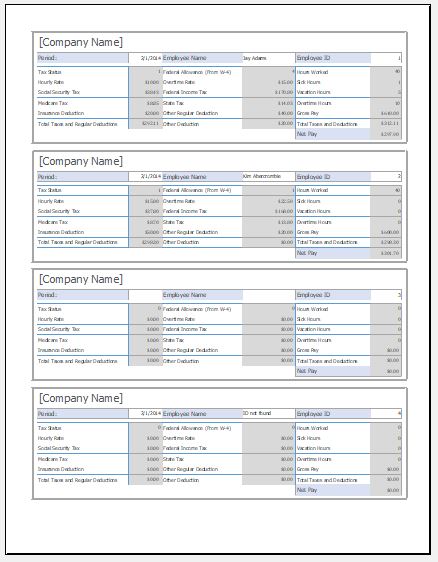

An employee pay stub template is important as it helps ensure transparency regarding employees’ pay. The template can simplify payroll processing procedures for employers and be useful for tax purposes.

The template includes details about the employee, the pay period dates, how many hours they worked, etc. The gross earnings of the employee can be mentioned along with deductions and net pay. The details help employers consistently form accurate pay stubs for every employee.

- The pay stub template is prepared in MS Word, Excel, and PDF format. You can use the format according to your needs. These templates are easy to download and provide an easy interface.

- The template is helpful for people who don’t want to prepare a pay stub from scratch.

- The template has been designed to adapt to any business requirement. One of its best features is that it can be edited as needed.

Template

Format: MS Excel -Size: 37 KB

Benefits of an Employee Pay Stub Template:

The following are some benefits of an employee pay stub template:

- When made accurately, an employee pay stub template can streamline payroll processes.

- Errors in employee pay figures can be minimized when all details are recorded.

- The template helps with accurate tax filings.

- The template allows one to have a structured format for documenting the employee’s earnings and deductions for every pay period, ensuring that all relevant details are included.

- The template may not be able to give a complete breakdown of the earnings, such as bonuses.

- Manual data entry may result in mistakes in calculations. This is especially true when looking at complex payroll features.

How do you make an Employee Pay Stub Template?

This professional document must be made carefully and include only what is relevant. The following points can be kept in mind when making this template:

Relevant details:

The document should include the company’s name and contact details. The heading can be “Employee Pay Stub.” The template can include the date, pay period, and worked days. The name of the employee, their contact details, position in the company, and department they work in can also be mentioned.

Earnings:

A section for earnings can be included. Under this, all the employees’ earnings will be mentioned in a column. This can include basic, incentive pay, meal allowance, etc. A column for amount can be present where the earning amount is mentioned. At the bottom of the table, a row for total earnings will calculate this.

Deductions:

This section will note down all the deductions. There can be a column for this. Deductions can include provident fund, professional tax, etc. A column for the amount will be noted down. You can include a row at the bottom of the table that calculates the total deductions.

Net pay:

There can be a section where the net pay is included in figures and words.

Signatures:

The employer’s and the employee’s signatures can be added to the document.

If a company wants to avoid legal consequences and ensure that all employees are paid correctly, employee pay needs to be calculated accurately. This is where an employee pay stub template can come in. The document helps employees know where their money is going and the amount that is being withheld. Transparency in payment will be present, which can encourage employees to work harder for the company. The template should be simple and precise to make it easy to use and consult.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Work Breakdown Structure TemplateNext Article →

Bill of Materials Template

Leave a Reply