Employee Expense Report Sheet to HR

Organizations, usually, have a policy of reimbursement through which they pay back the employee the money that he/she has paid out of his own pocket for the official expenses or the facilities, he is entitled to get the reimbursement for, such as medical bills. However, to bring the uniformity in the way the employees request for their due money, the organizations develop an employee expense report sheet.

What is an employee expense report sheet?

An employee expense report sheet is a form, that is designed by the organization, either by itself, or by customizing a ready-made free template. It is filled by the employees, when they want to request for the reimbursement of the money, they have paid for the official expenses or other reimbursable fringe benefits.

This form is sent, along with the receipts, as evidence, to minimize the chances of cheating and fraud. In short, this sheet is a way to report back the incurred expenses by the employees as well as request the paid amount.

What are the advantages of an employee expense report sheet?

Following are a few of the advantages of these sheets:

Provides an overview of the total reimbursement requests of the employees.

The details of the reimbursement requests made by the employees can be viewed by glancing at this sheet. It can help the organization to analyze the amount of money, that is going toward reimbursing the expenses, to make the relevant decisions.

Brings harmony & minimizes chances of error and speeds up the process.

As all the employees would make the reimbursement requests through the same sheet, it would bring standardization in the reporting process because of which the processing of requests can become fast as well. In addition, as the sheet has in-built formulas, it makes the probability of mistakes in the calculations minimal.

Aids in matching the incurred expenses with the allowed amounts.

The organizations have set limits for different types of expenses. This sheet would let it analyze, if the employees are crossing those limits, and reduce the requested reimbursement amounts accordingly.

Helps in analyzing the trends and bring the relevant facilities on panel for discounts.

The management can analyze the trends of the usual expenses and take the relevant decisions. For instance, if the employees are often traveling for official meetings, and the hoteling expense is costing the organization a lot, it might decide to negotiate with a few hotels, and bring them on a panel, so to avail of the offered discounts.

What are the components of an employee expense report sheet?

Different organizations select different components, as per their requirements, the type of expenses frequently incurred, and the demands of the auditors. However, generally, the following components are present in such sheets:

- Date.

- Time period covered.

- Name of the employee.

- Employee ID.

- Department of the employee.

- Name of the manager.

- Purpose of the report.

- Type of expense.

- Description.

- Any unusual and additional expenses are not mentioned in the fields.

- Amount.

- Gross total of expenses.

- Any advances.

- Total reimbursable amount.

- Notes, if any.

- Disclaimer, if any.

- Signature of the employee.

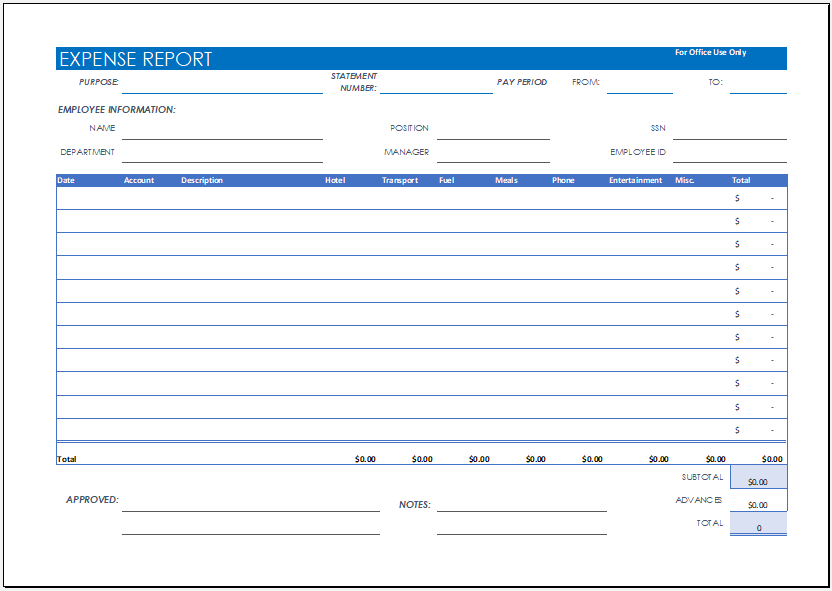

Preview

See also:

- 1 to 10 Multiplication Table for Kids

- 18 Period Budget Template

- 401K Calculator Template

- 7 Day Schedule Worksheet Template

- Academic Activity Budget Worksheet

- Academic Activity Budget Worksheet

- Address List or Address Book

- Adjustable vs Fixed Rate Mortgage Comparison Worksheet

- Advance Payment Invoice

← Previous Article

End of Day Cash Up SheetNext Article →

Vehicle Mileage & Fuel Log Sheet