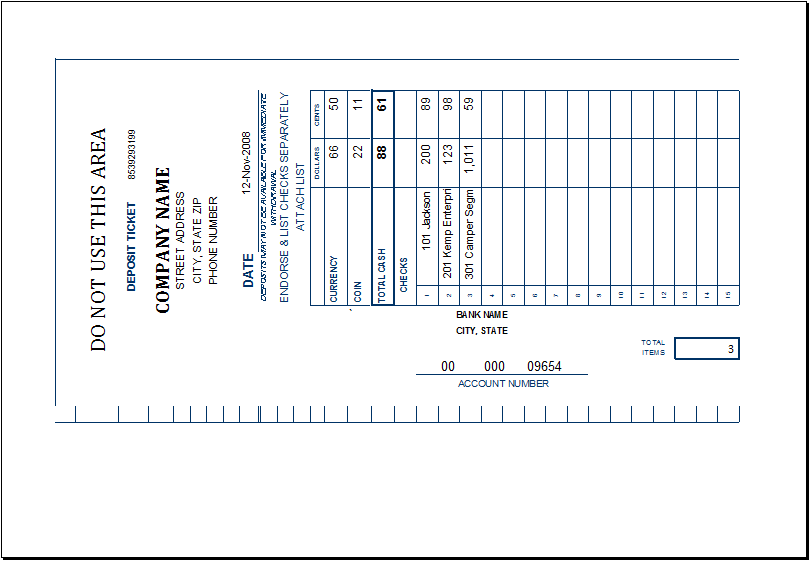

Cash Deposit Tickets

A deposit ticket is proof that the bank has received the deposit. It acts as a receipt that the deposit has been made. Commercial and even private banks play an important role in our lives. Banking systems can help economies grow. No bank generates money or income but they do save your money and provide you with options to invest your money.

Banks can have various benefits, and one of the benefits that attracts businesses and customers is the option to borrow money and get loans. Collecting deposits and lending them to borrowers is the basic function of every bank. Banks do not just collect deposits; they also provide their customers with various types of bank accounts.

With the increase in vulnerability in today’s world, people prefer to keep checks, bills of exchange, and drafts. Traders and businessmen keep huge amounts of cash with them, and they need to transfer their money regularly to vendors. This facility provided by the bank helps communities grow and flourish.

Saving is a good habit but saving money can be hard for some people. Banks provide you with an easy way to save your money. These savings not only help you in your future, but they also help the banks to make profitable investments, hence these savings eventually help economic growth.

We all come through situations in our lives when we spend more than we have. But the banking overdraft facility acts as our savior in such situations. Commercial banks play a very important role in the growth of economies. Commercial banks help in the creation and distribution of money by spending and purchasing securities and investments.

A deposit ticket can be good proof that the payment has been made. Sometimes, an amount has been paid to a certain account, and the bank takes the time to process the payment. In such situations, the deposit ticket can be useful as it is proof that the payment has been submitted. The deposit ticket includes the currency of the payment. It also includes the details of the company or the payee.

A deposit ticket is a form that has to be filled out when you are depositing something into the bank. The item is categorized in a transaction as follows: type of item, check/cheese, resources, and its origin. The banker deposits the slip along with the item and provides a receipt to the depositor for proof.

The employee of the bank who is handling deposits is not permitted to access the accounts or have a right to evaluate transactions. This exclusion of duties is crucial so that no stealing will take place and the bank can run on reliable services.

It also avoids the fraud of not recording the deposit and documenting a smaller amount of deposit in the ticket issued. For business, the bookkeeper records, and the cashier in charge deposits the money. After matching the deposit ticket with the cash, a receipt is then performed to ensure the validity of the procedure. Deposit tickets have a column in which the account holder’s details are filled in with name account number, deposit amount information, and signature. This will include an exclusive section for cash deposits. And another section for cheese.

This is a somewhat complex procedure,, and to simplify the whole format, several free online templates are designed as pre-formatted deposit tickets. All you need to download your choice of template with customizable features and get copies of the ticket to ease the deposit ticket writing procedures.

Download your file below.

File Size: 52 KB

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Price List InventoryNext Article →

Cash or Funds Donation Receipt