Departmental Expense Report Template

To determine how much you have spent in an organization, you need to see a list of expenses incurred. This information cannot be accurate unless you get the costs for each department and then calculate the subtotal to determine the actual expense. This is why organizations ask different departments to create and share their expense reports.

What is a departmental expense report?

It is a document that contains all the expenses that a department in an organization incurs in a given period. The details of the costs are summarized because, at times, the expenses can be innumerable, and adding all of them to the report will make it unnecessarily long. In addition, explaining everything briefly can also make things simple and easy to understand. So, one should focus on it more.

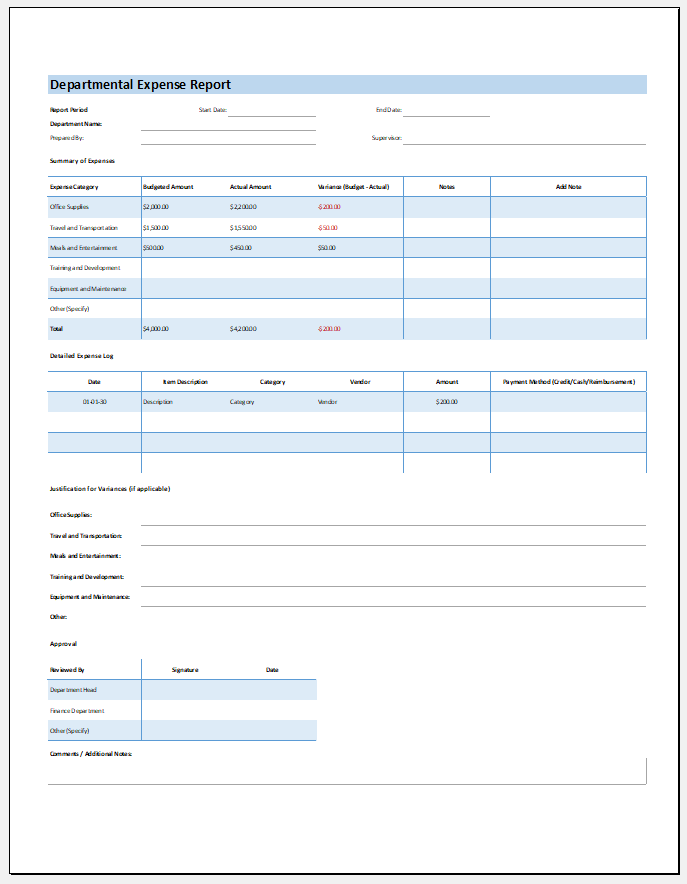

Departmental Expense Report File

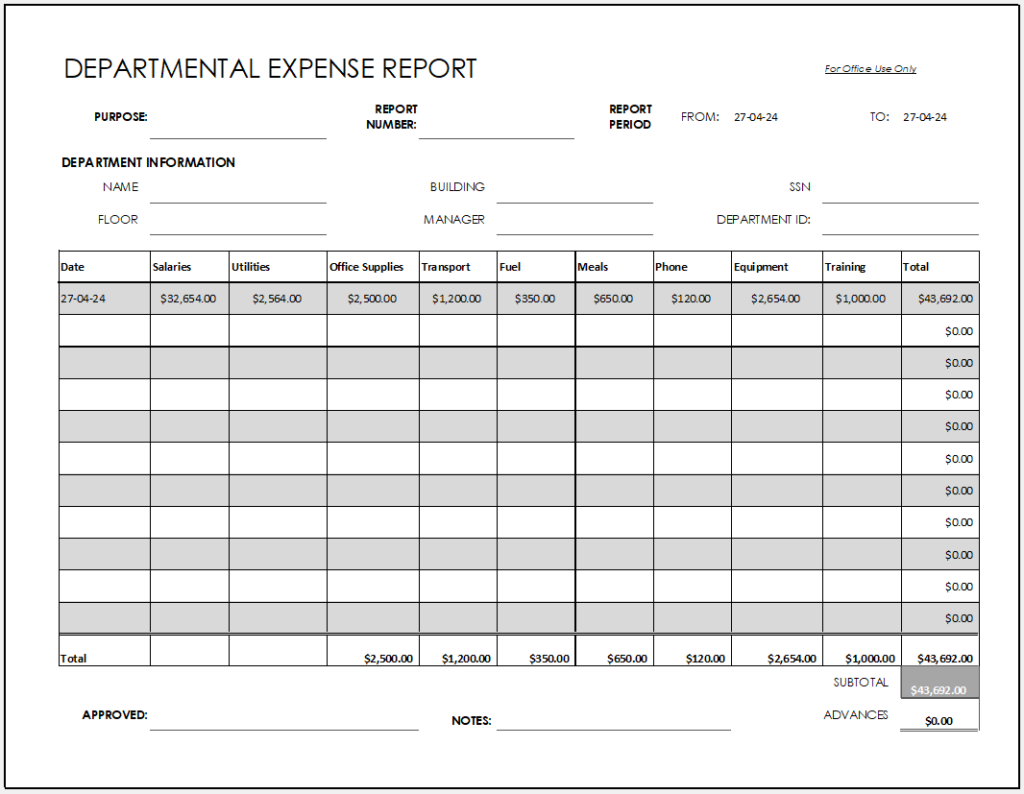

Departmental Expense Report File

What is the format of the departmental expense report?

There is no specific format for an expense report, as different organizations and their departments follow different formats depending on their accounting needs. However, they always try to ensure that the format they have chosen is professional-looking and includes all the details that are usually needed. Those who are conscious of the format typically pay more attention to it, and some also go for the software that creates the report for their format.

What are the benefits of the departmental expense report?

Organizations allow their individuals to keep track of their expenses so that they can have control over how they are spending their money. This is usually achieved by documenting every expense, and an expense report is used for this purpose.

It gives a clear picture to the person who creates it, and he can easily see where his money is going. When an entire department uses it, it also sees how the money is spent and by whom. This way, they can track finances and maintain transparency in the system. Due to this, it becomes easy to show regulatory compliance with the state’s rules. We are going to list some of the critical criticality of this report:

It helps in the management of expenses

When a department needs to create its budget that it follows, it takes help from the expense report. The expense report summarizes all the expenses, and when a budget is to be made, the expense report is used to analyze all the costs. Those making the budget can also identify areas where most expenditures are being spent. It also helps them see if they are overspending or not.

It helps the department with compensation

The expense reports are ideal documents for those who are seeking compensation. When a department has spent a considerable amount on meeting its expenses and now wants compensation, it will be asked to forward its request along with the expense report so that those responsible can see how much to reimburse and to whom.

It helps in compliance

Diffe. Rent states require companies to show compliance with the rules and regulations, and companies then try to make all departments follow the rules and show compliance. It usually includes maintaining the financial record, keeping it transparent, performing internal and external audits, and taking on all the financial responsibilities required to prove that the company and all its departments are working somewhat. There is nothing to hide.

They assist in the design of financial reports

Every organization needs a financial report, usually created monthly, every six months, or yearly. The quality of the report matters a lot, especially when a company wants to manage and control its expenses and wants to grow. The financial report is based on data from all the company departments.

Therefore, department expense reports are created and then integrated to design a financial report that gives everyone a clear picture of the company’s losses, profit, revenue, and all other details that would have never been easier if the expense report had not been created.

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

← Previous Article

Event Planning Gantt ChartNext Article →

Vacation and Leave Tracker Template