Cash Flow Statement Template

There are different ways that a company can manage its finances so that it can remain profitable. A business should handle its finances carefully if it wants to remain functioning. A cash flow statement is an important tool that can be considered here. The statement lets a company know its financial health status.

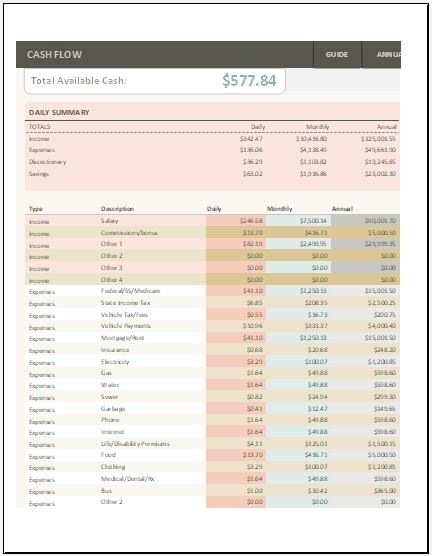

A daily monthly and annual cash flow statement can be useful. This is a financial report that lets one know the cash that a company generates as well as spends. It will be over a certain period like a day, month, or even year.

A daily monthly and annual cash flow statement is important as it lets one get an idea of a business’s financial health as well as operational efficiency. The statement will let one know how effectively the company handles its cash position. One will even get an idea of how effectively the company generates cash so that its debt can be paid and so that it can fund operating costs.

The statement is a financial one that includes details about the expenses that the business faced in the period. It includes information about the income that the business got as well. The costs of these are calculated so that the overall expenses and income can be known.

Benefits of Cash Flow Statement:

The following are some benefits that a daily monthly and annual cash flow statement may have:

- The statement helps let a company know where money is coming from as well as where it is going. It therefore gives one an accurate image of the company’s financial health status.

- The statement lets one figure out when the company has much cash and even when it has too little money. Therefore better decision making can occur.

- The statement can let a company predict any future cash flow. This can be helpful when it comes to budgeting.

- Investors can know about a business’s financial health when they look at this document.

- The statement allows one to monitor incoming as well as outgoing cash.

- The flow of cash can be known amongst a company, its owners, as well as its creditors.

The following are some limitations that a cash flow statement may have:

- It may not be possible to accurately figure out a company’s profitability as non-cash expenses may be ignored when calculating cash flows occurring from operating tasks.

- The statement is prepared employing past information so it does not give complete details that one can use to analyze future cash flows. Therefore by itself, the document may not be employed to figure out a company’s financial position accurately. Other financial documents will even be required.

How to make a Daily Monthly & Annual Cash Flow Statement?

The following are some points that you can keep in mind when making a daily monthly and annual cash flow statement:

Structure of cash flow statement:

The financial document should have a heading such as “Daily Monthly & Annual Cash Flow Statement”. Include the year it is dealing with. The name, address, and contact details of the business can be mentioned on the document. There can be a place that notes down the name of the manager and the name of the person who has made the statement. The date that it has been completed can be mentioned. There can be sections to include the different details.

Beginning balance:

There can be a section for this that notes down the cash on hand.

Create sections:

A section for the cash receipts will note these down. There can be a column for cash receipts where details such as cash sales, tax refund, interest income, etc. can be mentioned. There will be columns for the months of the year. At the bottom of this section, the total cash receipts can be calculated.

There can be a section for cash payments and cost of goods sold which will have the same columns as above. You can have a section for operating expenses as well where these can be mentioned in rows.

A section for additional expenses can be included. At the bottom of these, the total cash payments can be calculated as well as the month-ending cash position.

Avoid distractions:

The document should not be confusing and therefore must not include irrelevant details that can end up confusing people.

A company needs to make a daily monthly and annual cash flow statement along with other financial documents if it wants to manage its finances effectively.

Preview

Microsoft Excel (.xlsx) File: 60 KB

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Home Construction Expense Calculator WorksheetNext Article →

Petty Cash Reconciliation Sheet

Leave a Reply