Daily Deposit Report Template

What is a daily deposit report?

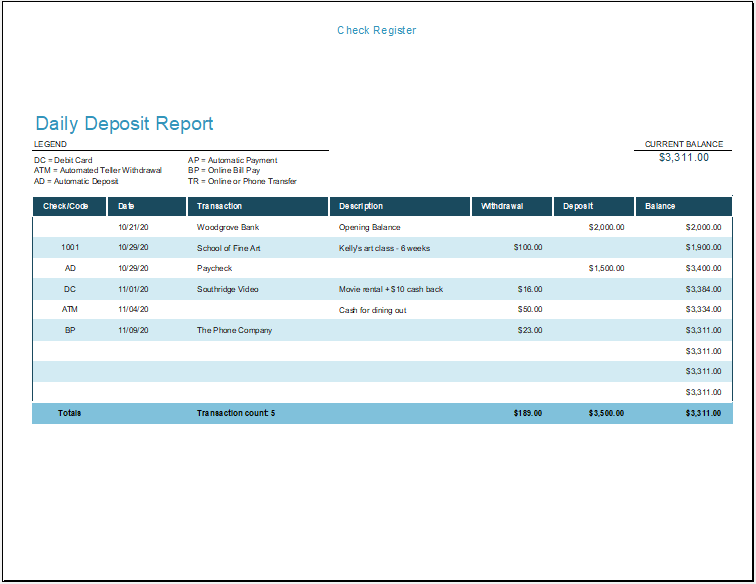

Institutes where money or other assets are deposited daily would like to receive a daily report summarizing these deposits.

Why is a daily deposit report created?

Every financial institution must keep track of the money being deposited there. This is very important, especially when keeping tabs on what an institute is receiving in the form of money from people is required. A bank generally creates the daily deposit report since many people deposit cash into their accounts in that bank.

Why is the daily deposit report important?

Cash inflow and outflow are important parameters that determine the financial health of any institute. How much money an institute has received in deposits tells about the number of accounts in that institute and many other details. Based on the cash received, the liability of these institutes for paying the tax is also evaluated. The daily cash deposit report is also generated for many different purposes.

What information is provided by the daily deposit report?

Let us break down this report into various parts to determine what information this report collects:

Name of the institute:

The deposit report is different for every institute. Therefore, there should be a distinction between every report. To maintain this distinction, the name of the institute for which the report is being created should be mentioned.

Date of report generation:

Since the deposit report is created daily, it is important to mention its creation date. This data helps in recordkeeping.

Deposit details:

The cash in the bank is usually deposited in two forms: cash and checks. The report must tell how much money has been deposited in cash and how many checks the bank has received for cash deposition. After providing details about both types of deposits, the report should also mention the total of all deposits.

Credit card details:

Some people pay or deposit money through their credit cards. In this situation, the bank must track which customer has deposited the money and from which source.

Comments section:

A daily deposit receipt includes a separate section for commenting on daily deposit records. This information is useful when something special is associated with the deposit, and you want to mention it in the comments section.

Signatures:

Once the deposit receipt is complete, it should be signed by the person who created it. The person who signs this receipt becomes responsible for answering all the information he has provided. After the operator has signed the record sheet, it is sent to the reviewer, who reviews it and signs it.

What is a daily deposit report template?

This template is software that provides a structured daily deposit report. Using this template helps the user in creating the daily report. When a report is required to be made daily, it becomes challenging to create a deposit report. So, when a template is used, creating a daily report is a piece of cake.

Things to remember while creating the template?

Undoubtedly, the daily deposit report template is valuable; knowing how to use it effectively is important. Here are a few tips to help you in this regard:

Fill it properly:

The person using this template must fill in numerous fields in the pre-designed daily deposit receipt. Filling all these fields is important because they collect a certain type of information that one needs to provide about the money deposited in a single day. When users appropriately give these details, they should use the template best.

Attach deposit slips:

It is important to remember that every daily deposit report refers to some deposit receipts or slips issued to depositors when depositing money. These receipts are essential for any institute since they are tangible proof that the money has been deposited on a particular date mentioned on the receipt.

Sometimes, adding information to the report is not enough. You are also required to keep the proof with it. So, it is recommended that you attach the receipts with this report or add the receipt number to the report.

Add accurate details:

When you provide details in numbers, you should ensure that the given data is accurate.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Daily Sales Register TemplateNext Article →

Leave Roster Template