Customer Account and Balance Form

These days, forms are used very commonly because they have turned out to be something really useful for organizations that want to collect details from various people but don’t want to put those in trouble by asking them to write detailed notes. The forms don’t pressure the person to fill them out; he has to fill in all the empty fields and then submit them to the relevant authorities.

Organizations such as banks deal with thousands of customers daily. It is difficult for them to require every customer to write a detailed letter or application. Therefore, the customer account and balance details form is used.

Significance of customer account and balance details form:

Customers who apply for a credit card or loan will be asked to provide their account and balance information. For this purpose, they often visit the bank and then wait in a long queue for their turn to reach the counter and provide their details. This entire process is cumbersome and wastes a lot of customers’ time.

Various financial institutions, such as banks, use the account and balance details form to facilitate customers’ application submissions by providing them with a way to do so without any effort. This also makes the entire application process smooth, as banks get all the pertinent details that they want to collect from their valued customers.

What information is a user required to perform through the form?

The user must fill in various empty fields, and at the end, the user puts in his signature and submits the form. What information needs to be collected depends on the personal needs of the bank. Every general form includes the following details:

Details of the customer:

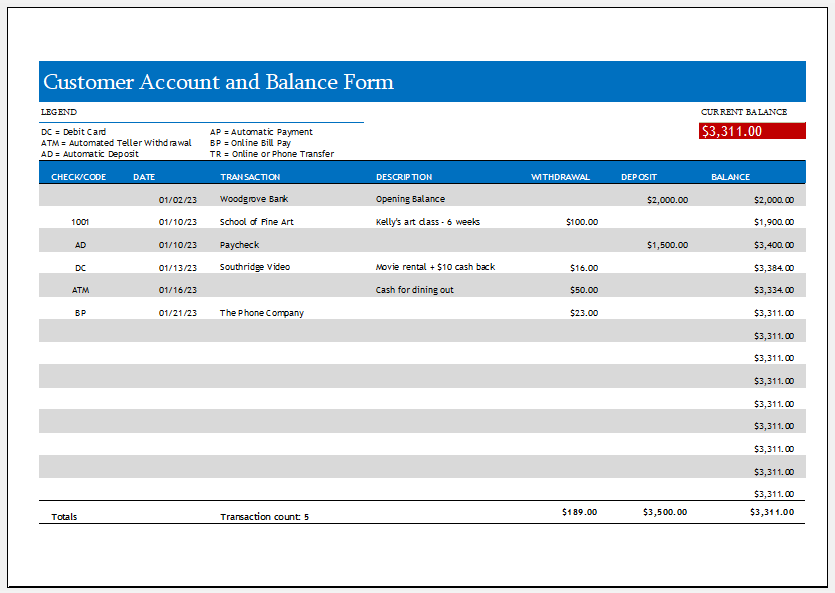

A person who requests for any purpose must provide his details through the form. These details include name, address, contact details, the date the application is being submitted, etc.

Details of the bank:

After providing personal details, the customer must provide details of the bank account to which he/she is referring. The bank details include the name, branch name, branch code, and address of the bank where the customer has his account.

Account details:

The bank cannot collect the customer’s details unless he provides his account details, which are unique to every person. The account type, account name, and other information are provided in this form section.

Balance information:

The customer is also needed to provide details of the total balance in his account. In some cases, the type of application the customer is making depends on the current and closing balance of the customer. So, the customer is asked to mention the total balance he has in his account.

If the form is required, the customer must attach some necessary documents with the form to make the application process smoother and quicker.

Excel Templates

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

← Previous Article

Payslip Template for ExcelNext Article →

Music Concert Budget Worksheet