Credit Card Log Template

It is not always important to have a lot of money or any money in our hands. Credit cards have made the lives of a lot of people very easy. Now you can spend or borrow money from your bank even when you do not have a single penny on you. Most of the banks offer a 25-30 days limit to pay back all the borrowed amount. If the money is paid back in the allowed time, you do not need to pay anything extra.

Using a credit card has its advantages and disadvantages. A large purchase can be made using a credit card and it can be paid back in installments.

For a lot of people, they can manage their finances in a better way by using credit cards. It makes budgeting easier. A credit card makes you free of the hassle of carrying cash. Traveling around the globe and carrying cards are easy rather than carrying cash and looking after your money. Credit cards help to build up a credit history which can be useful later.

File: Excel (.xlsx) 2007/10

Size 10 KB

However, credit cards can have disadvantages as well. You can spend more when you know that you have time to pay and this way you can exceed your decided budget. The interest rates can make your debt look larger than it is.

Credit cards come in different ranges and amounts. You can choose the credit card according to your spending and the ability to pay back. Using a credit card with responsibility can get you bonus points which a debit card will not. You get points that can be used when you pay for air travel or even on regular purchases. Selecting the right type of credit card can help you earn or save 1-5% of the credit on your purchases.

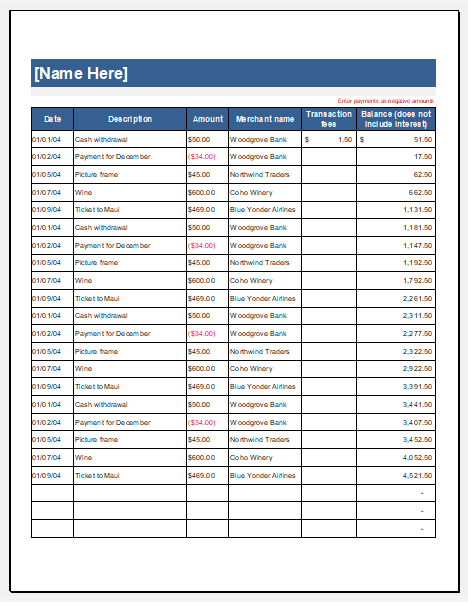

Debit card frauds are more common than credit cards as the credit cards have no money in them. Maintaining a credit card use log can help keep an eye on the expenses made. An individual can write down all the dates when the card was used for the expense incurred. The bank fee can also be mentioned to know the exact spending. The interest payment can also be calculated and added back to the expenses.

Today undoubtedly credit cards are the safest and preferable agent for holding business transactions whether it is payment or purchase. These cards today in the modern complex world are not only limited to multimillionaire businessmen but also find stuff to do being held by the commons of a region. Usually, in emergency cases, it is a very powerful tool when one has to make urgent payments.

Carrying a heavy amount of cash is an ordeal not only because of the safety and risk of theft prospect but also because it just requires much more space. As for the card just insert it inside your wallet and block it in case it gets lost or stolen.

Credit cards are highly advantageous but to use them with their maximum capacity and efficiency is a key to making bill payments beforehand and keeping a record of all the stuff you do with the card.

Sometimes one just forgets his transactions and that cost has to be paid by the budget. When the bill arrives home and completely disturbs the finances. Hence maintaining a proper log of card usage is a must at least for bourgeois households.

But, Is making a written log difficult? use your PC is still difficult to make one. Using Excel tools here is a perfect solution for which to go to the internet and just install some credit card log templates.

These templates are available online on the internet to use for free. Such templates are simple to use, and one will get rapid tracking and reporting regarding monetary dealings. You may also download the templates to your computer. After installation, you will not need a network connection to use the templates. One can also customize his templates according to his needs.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Restaurant Food Inventory TemplatesNext Article →

Profit and Loss Statement Template