Cost of Sales Tool Template

Manufacturing a product requires using various materials, all of which have a cost. The accumulated cost brings us to what we call the cost of sales, a technical term used by accountants, consultants, and retailers. The cost of sales is an important calculation on its own and also aids in calculating profits, gross profit, and even net profit.

The gross profit can be calculated by subtracting the cost of sales from sales. The cost of sales is a combination of raw materials expense, labor rate, and any overheads incurred. It has a very simple formula.

Cost of sales = opening inventory + purchases – closing inventory

The cost of sales can be used in varying terms by different industries. Although the calculation is simple and easy, the importance of sales costs cannot be denied. Before the development of a product, it needs a product design that includes a lot of factors.

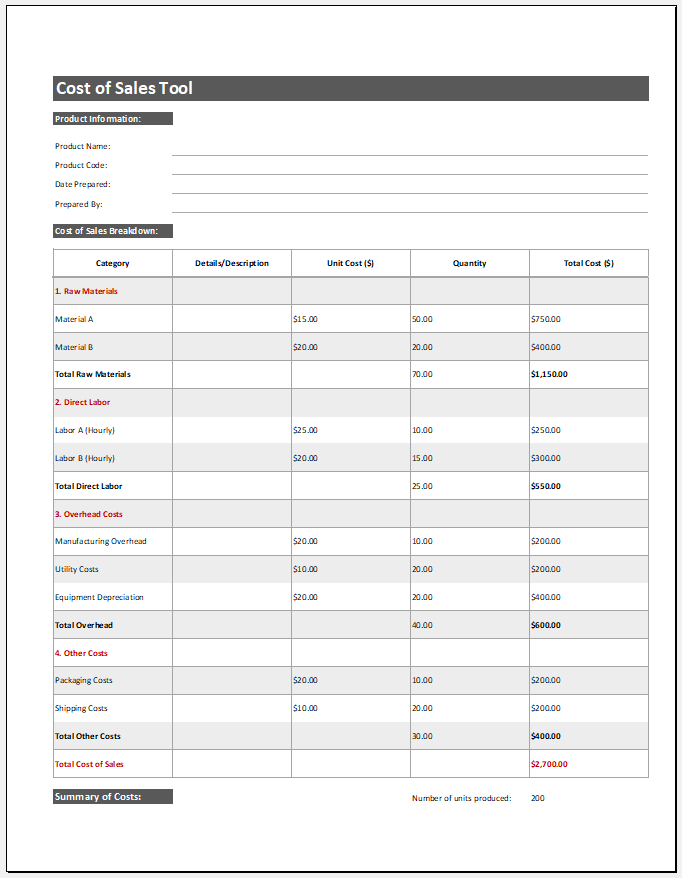

[Template -1]

Download Excel File

One factor is designing a product while keeping the cost of production under control. The cost of sales is a way to keep product costs under control. It is mostly dependent on production-related expenses. Any cost relevant to sales or administration is not part of the cost of sales.

Keeping a record of the costs incurred is very important for any company or business. The most common term in business is profit, but the cost of sales is equally important. It is very important to understand your cost of sales to manage your business operations better. One key factor in business failure is not having a record of the goods or inventory that a company/business maintains.

The main goal of any business is to make a profit. To ensure the correct profits, it is very important to maintain proper records. However, if a company ignores its cost of sales, it can never analyze its profit. The cost of sales tool is a good way to calculate and record the expenses incurred.

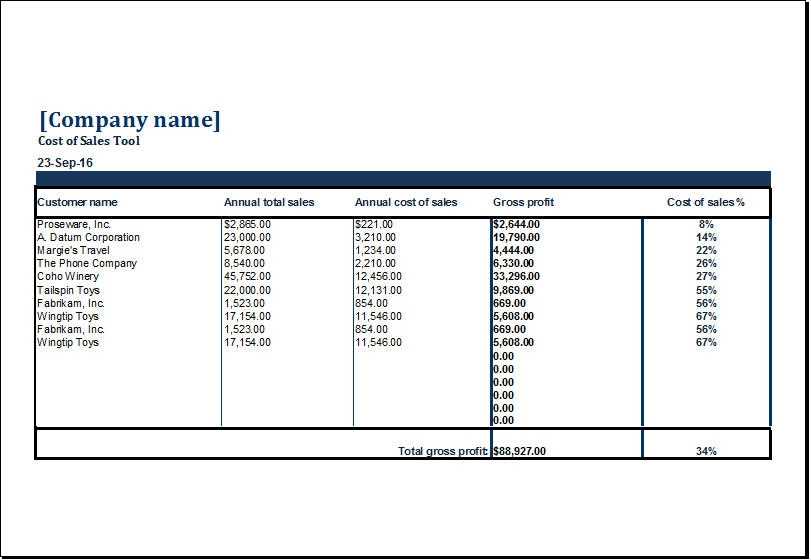

This tool takes into account sales and costs, which calculate gross profit. It can be converted into percentages, which makes it easier to understand the expenses incurred in percentage terms.

The cost of sales is the collective sum of all costs used to organize a new product or to start offering services; in summary, it is a business’s total investment. The term is more common among retailers and finance professionals than among ordinary people.

A manufacturer is more likely to use the term cost of goods sold. The cost of sales line items appears close to the header of the income statement as a subtraction from net sales. The result of this calculation is the gross margin earned by the reporting party.

In business, it really is necessary to keep a record of just about everything that you do in order to run productively. Thus, you must use the Excel cost of sales tool templates to help figure out how much profit you are really making on certain things that you have sold to your customers.

With this template, you won’t miss out on the weaknesses of your transactions. The completely operative template also calculates stuff and applies several mathematical operations, which saves the user a huge amount of time.

Such templates are available online for free. These templates are simple to use, and one can make as many copies as he wants, probably for multiple businesses you operate or just for the monthly division. After installation, you will not need a network connection to use the templates. One can also customize his templates according to his needs.

[Template -2]

Download your file below.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Equity Reconciliation Report TemplateNext Article →

Family Event Calendar Template

Leave a Reply