Commercial Bill/Invoice Templates

What is a commercial bill?

A commercial bill is a formal document issued by the seller to his buyer to get the value of goods and services used by the buyer. The time duration for which the commercial bills are valid is known as the maturity period. A typical commercial bill has a maturity period of 30, 60 or 90 days.

In order to request the money, the seller or the commercial service provider needs to create a commercial bill and submit it to the buyer. The purpose of sending the bill to the buyer is to ask him for acceptance. Once the buyer accepts the bill, he has to pay the total amount mentioned in the bill.

Sometimes, sellers use banks to get their commercial bills accepted. The bank charges the seller a commission for getting the bill received by the buyer. After the buyer’s acceptance, the seller gets the right to sell his products in the commercial market.

The seller contacts the bank to get a discount on the bill. The bank pays the total amount mentioned on the commercial bill after deducting the interest rate, which is known as a discount on the bill.

Many businesses conduct short-term finances when they run short of money. Commercial bills are also a type of short-term finance. Whenever the business needs money urgently, it can sell its commercial bills to the bank.

Although the commercial bill system is very useful and effective for many businesses, many people still don’t believe in using short-term financing like the commercial bill. There are two reasons for which the commercial bills are not given much importance:

- The banks, instead of lending with the help of commercial bills, offer the credit card to lend through

- Many businesses do not like the payment mode of commercial bills

If you are one of those people facing loss in your business, you can use a commercial bill. The commercial bill template can also be used if you want a ready-made and professional-looking bill.

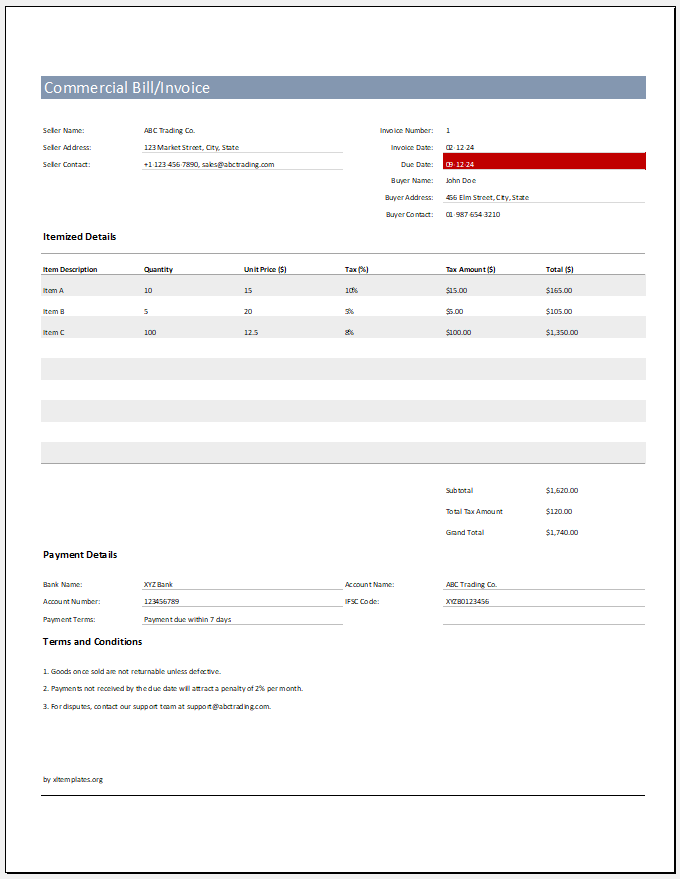

Preview

The template is designed for businesses to provide itemized billing to customers. It includes fields for customer details, item descriptions, quantities, unit prices, taxes, and totals.

Format: MS Excel [.xlsx]

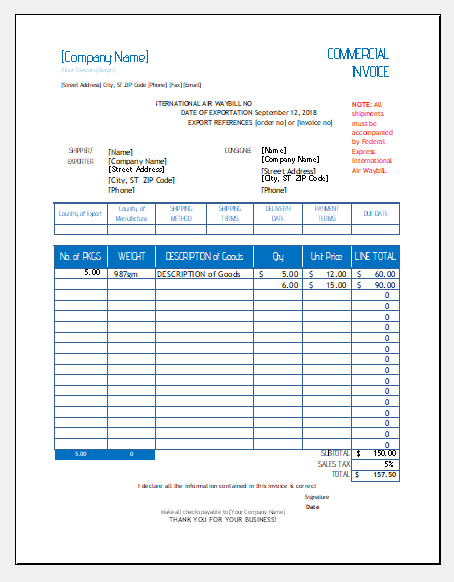

Format: MS Excel [.xlsx]

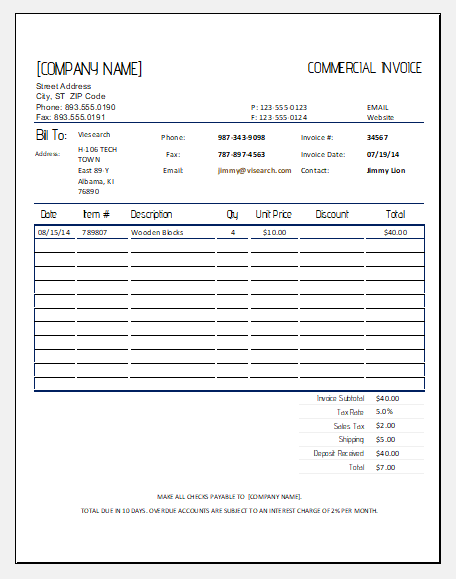

Format: MS Excel [.xlsx]

It’s a valid document describing goods sold and the amount due on the customer’s end. It’s legal evidence of foreign trade between a supplier and a buyer. It is beneficial for determining custom duties and taxes, the actual price of the goods imposed by the customs department. Business transactions done between trading parties are verified by this official document.

It must identify:

- Buyer and seller information

- Invoice Number

- Shipment Mode

- Date and terms of sale and purchase

- Quantity, volume, and weight of the shipment

- Type of packaging done for the materials

- The complete description of the products

- Unit and gross value

- Insurance applied

- Shipment charges applied

Benefits of Commercial Invoice:

Record Keeping:

It not only aids in maintaining records efficiently but also caters for determining your stock level assigned per period.

Sales Evidence:

You cannot deny the transaction, and you cannot prevent it by hiding it. It allows you to make the payment legally on time. It also serves as proof in fighting for your case in the law court, depicting the buyer’s approval of the sold material.

Exploitation Prevention:

Corruption factor is minimized for merchants as it bears the detailed credentials for exposing the fraud purchaser or seller. You cannot make your witty tricks work in this scenario where an invoice generation culture is practised strictly.

Payment Assurance:

A vendor could refer to an unpaid debt with the provision of a commercial invoice as a payment assurance document. This would consistently push the buyer to pay the arrears or the unpaid amount.

Accuracy Check:

It provides enough information for an importer to inspect the orders and receipts accurately. The goods supplied can be checked to correspond with the demanded quantity and quality of the shipment.

Due Payment Notice:

An alarm will be set to alert you to the due payment. This is a tool harnessed to prompt payment swiftly and manage customers in a friendly way.

As professional template providers, we have come up on the surface to enhance the healthy relationship and better consignment dealings between the client and the customer through our easy-to-use commercial invoice templates. For speedy transit, grab the comprehensive one for your smooth business flow. Get away with the fret of managing important data manually.

This template is solely made for customer satisfaction and flexible guidance. The signature authority is responsible for completing the required fields and submitting the bill. Do you want to know the secret of smooth custom handling? Well, it is hidden in filling out the invoice details properly and vigilantly while making sure all the necessary details are penned down in a timely manner to avoid delay.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Computer Repair Bill/Invoice TemplatesNext Article →

Commission Bill (Invoice) Templates