Cashier Closing Checklist Template

A cashier is an individual whose job is critical for an organization. He must be intelligent and active to perform his job responsibilities effectively. Handling cash is sometimes very complex, so a professional cashier uses numerous tools to make the job easy for him.

What is a cashier closing checklist?

It is one of the valuable tools used to enlist all the responsibilities and tasks to do. A cash register is completed to record the inflow and outflow of the cash in the day. Before the register’s closing, there are so many operations to perform at the end of an accountant. For this purpose, a cashier closing checklist is used.

MS Excel (.xlsx) File

Why does a professional bookkeeper like to use a cash closing checklist?

There is nothing more precious than peace of mind for an accountant. The closing checklist plays a significant role in enabling all the necessary procedures to be completed accurately. This checklist is beneficial in preparing the cashier for the next business day. A bookkeeper knows that he will have to be responsible for all the discrepancies that may arise in the cash register.

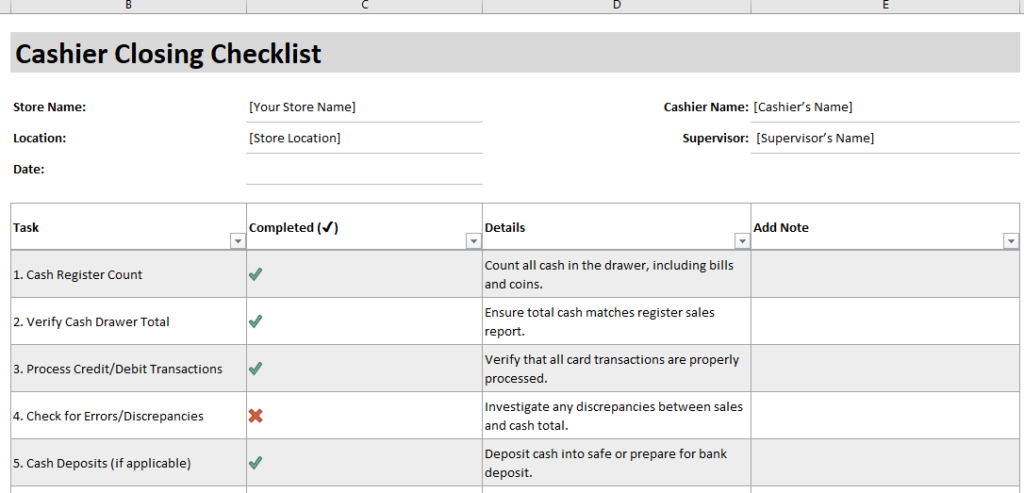

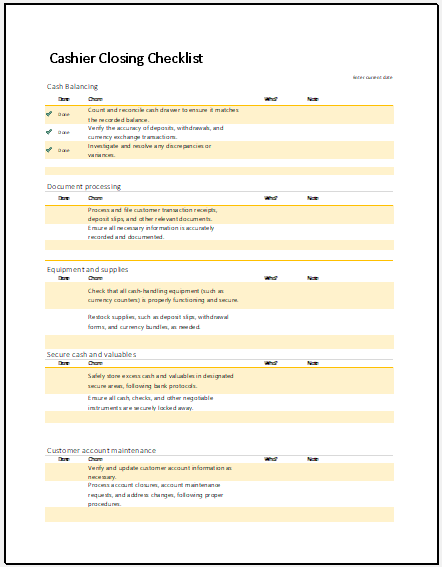

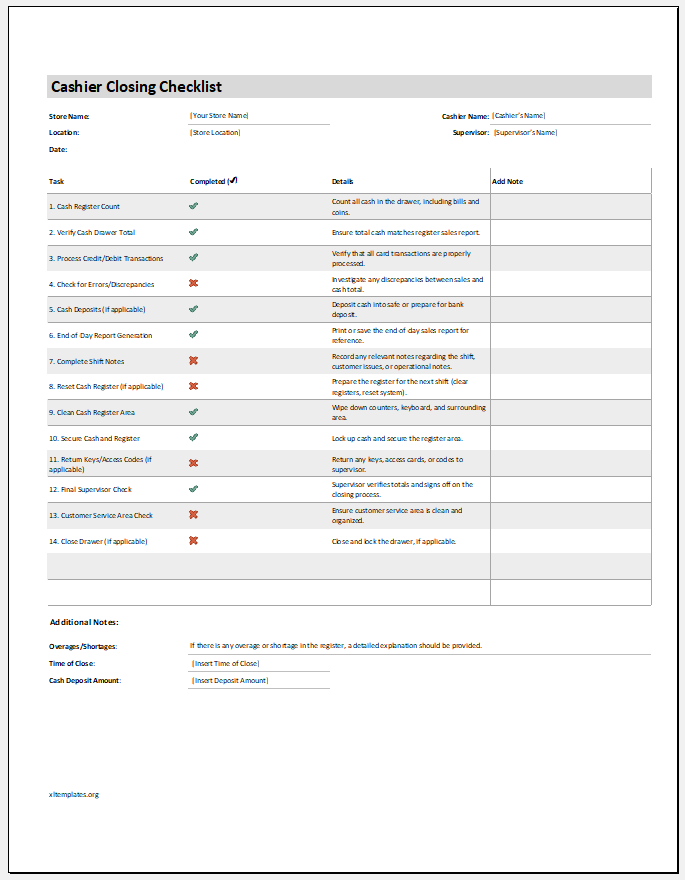

Tasks included in the checklist:

Since the purpose of any checklist is to help the user remember the tasks he has to perform in a day, this checklist makes a list of things to be done before the closing, including counting the cash, recording all the transactions, securing the cash, and much more. These are some general tasks an accountant performs that you will see on almost every checklist.

However, some other activities are performed only by specific companies, and these tasks vary from company to company. You can also add tasks related to your work in the checklist to make it more coherent with your job.

What are the advantages of the cashier closing checklist?

Every cashier reaps some or many benefits from this list of tasks. Here are a few of them to be taken into account:

It maintains financial accountability:

Dealing with cash daily is not easy. A slight change in the total amount can hold you accountable as an accountant. If you use a checklist, you will go through a proper process. If the stakeholders hold you accountable and ask you anything about the cash you have been managing, you can defend yourself by staying disciplined and using a checklist.

The bookkeeper does not miss anything:

There are so many operations associated with managing cash before closing that it is normal for people to miss anything important. However, when a checklist is used daily, the cashier becomes accustomed to using it, and then all the tasks are performed in an automated way without any of them being skipped.

It ensures the safety of the cash:

Using a checklist enforces an appropriate cash management procedure in the company. For instance, the accountant always remembers to use the checklist to count the cash, put it in a safe place such as a drawer, and have a proper mechanism to keep it safe. This way, unauthorized access to the money is significantly prevented.

It makes the transition smoother:

In some companies, multiple people work in one position on different shifts. The checklist enables a smooth transition. One cashier can quickly resume cash management activities after the other due to the records of the data and the sequence in which all the operations are performed. Every person in such a system knows where to start the cash processing work before the closing and then closing the entire system efficiently.

Even if one accountant leaves the job, the company can easily hand over this list of operations to the new person and ask him to start following it instead of getting into the complexities of how everything works.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

School Farewell Party Budget WorksheetNext Article →

Restaurant Daily Opening Checklist