Cash Reconciliation Sheet Template

Businesses have different procedures for handling finances. The company must choose a transparent method so that all concerned can know where the money is. Sales transactions are vital here, and a company needs to verify these to see if they are authentic.

Cash reconciliation is a term used here. It is essential to know what this is to figure out how it can help your company’s finances. All businesses need to reconcile cash, and a cash reconciliation sheet is a document that can be considered here.

What is a cash reconciliation sheet?

This sheet compares a company’s cash balance, which may be present in its register or even point-of-sale area, to its sales receipts. It will determine the authenticity of the cash balance within a certain period.

The sheet helps a business compare the amount of cash it has on hand with recorded cash transactions. This process can occur when the day ends, or a particular employee’s shift ends. The sheet will look at the cash in the register by comparing it to transaction receipts.

Format: MS Excel (.xlsx)

Format: MS Excel (.xlsx)

This financial document needs to be made carefully so that it is transparent. The following are some points that you can keep in mind when making a cash reconciliation sheet:

Format of sheet:

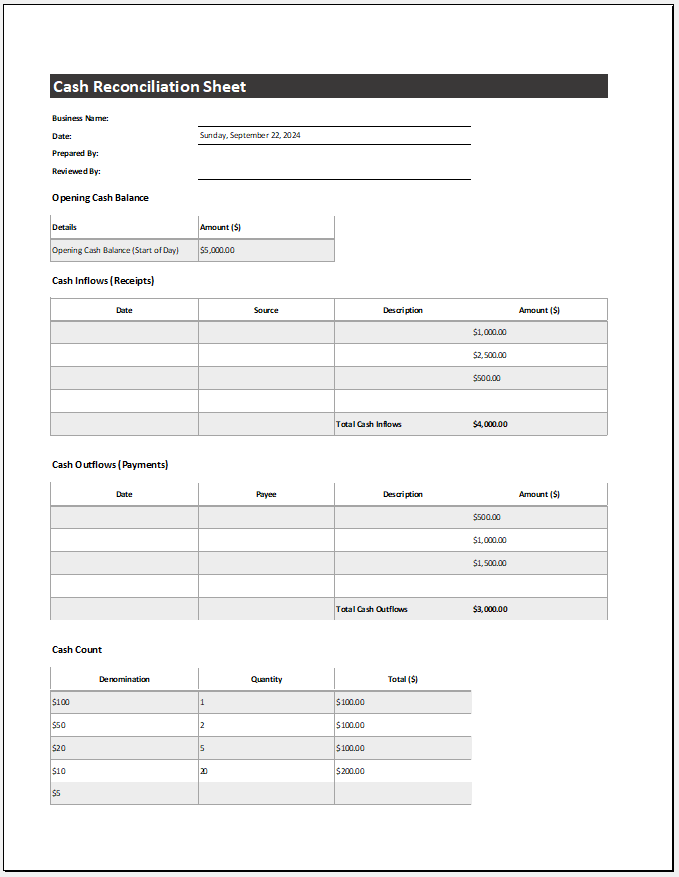

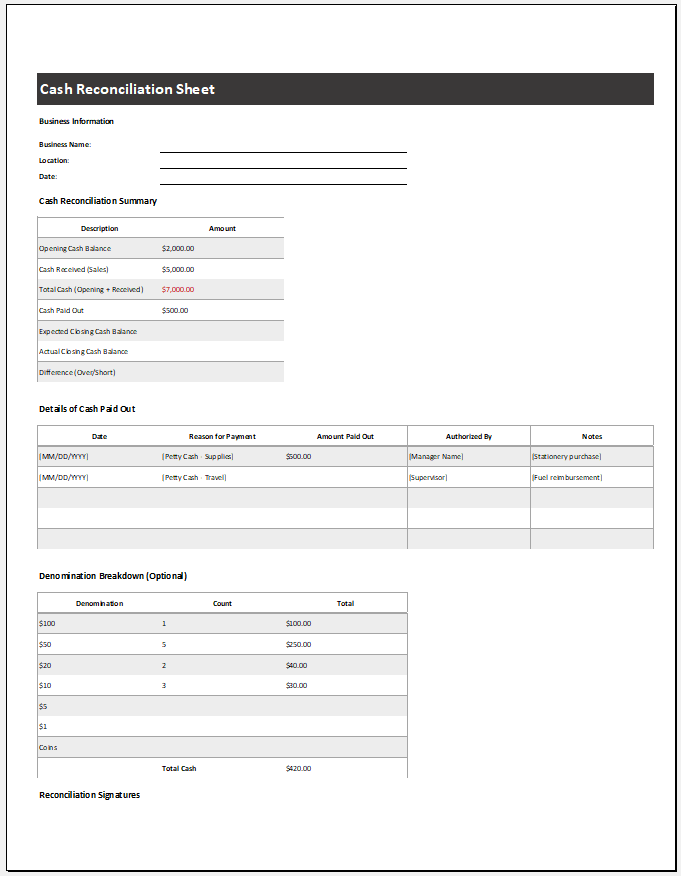

The heading of the sheet can be “Cash Reconciliation Sheet”. Please include the name of your company and its address on the document. Please include the date on the sheet to know what day it deals with. If applicable, you can use the register number or location. After this, you can make a table to include the essential details related to cash reconciliation.

Create table:

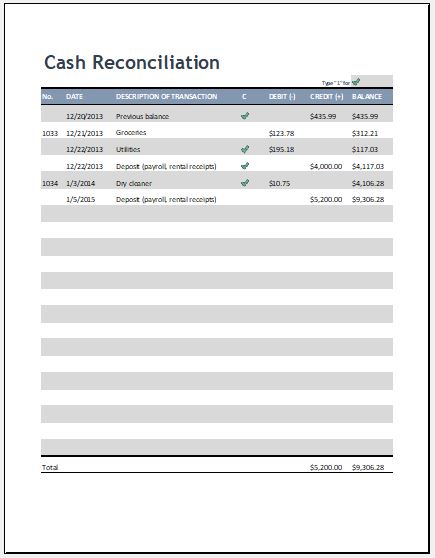

The table will include employee names, which will help the reader know which employee handled the transactions. A column for the starting balance should also be included, letting you note how much cash is already present.

A column for cash records how much cash came in on that date. You also need a column for cash out to calculate how much cash was used on a certain day. A column for ending balance notes how much balance is left after all transactions.

It is helpful to have a column for notes. Here, you can add any extra details precisely and simply so that it is easy to extract details from the table. At the end of the table, you can have a row for closing balance so that you can calculate how much money was earned during a certain period, such as one working day.

It can detect any inconsistency in financial records:

This sheet is essential for any company, business, organization, etc., as it detects any discrepancies in financial records. You will be able to know whether there is any fraud occurring in the company when cash in and cash out are measured. Accounting accuracy can be present with the help of this sheet, as financial transactions will be considered.

The sheet can help detect errors in a timely manner. It will help you easily identify missing transactions and fraudulent activity. It is important to make this sheet carefully so that you can identify unusual transactions. If this occurs, action can be taken immediately so that the fraud cannot harm the company further.

The sheet will be able to notice any cash discrepancies before these advances in the company and cause significant accounting problems. Companies need to pursue financial forecasting to predict how they will perform financially in the future. This sheet can be used as the information present can help let a company know how much it is earning and can carry out better predictions.

Preview

Format: MS Excel (.xlsx)

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Regional Sales Report TemplateNext Article →

Motor Vehicle Bill of Sale

Leave a Reply