Cash Memos, Receipts & Invoices

The success of a business is measured in monetary terms and affects all its processes. Whether a small business or a big one, thousands of transactions occur in every industry.

Every business deals with transactions, and there are different situations when a customer is required to pay immediately or later. Based on when the money is paid, businesses make different documents that reflect various meanings of payment requirements.

A cash memo, receipt, and invoice have slightly different meanings when making a payment. For example, a cash memo is issued to a customer when the payment has been made in cash at the point of sale. If the payment mode is optional, e.g., cash, credit, or check, the customer will receive a receipt. An invoice is issued to a customer who has purchased goods or availed of the services and must have made a payment now. It can also be sent in advance.

The following table will summarise the difference between the three.Aspect Cash Memo Receipt Invoice Definition A document issued at the point of sale when a customer pays for goods or services in cash. A document issued to confirm that payment has been received, regardless of payment method (cash, credit, check, etc.). A document issued by a seller to request payment for goods or services provided. It is typically used in credit transactions. Purpose Proof of cash sale Proof of payment received Request for payment Payment Method Cash only Various -any (cash, credit, check, online) At the time of the sale Timing At the time of sale After payment is received Before or after goods/services are delivered Issued By Seller Seller Seller Issued To Buyer Payer Buyer Tax Details Sometimes included Sometimes included Always included

The following are templates given for each.

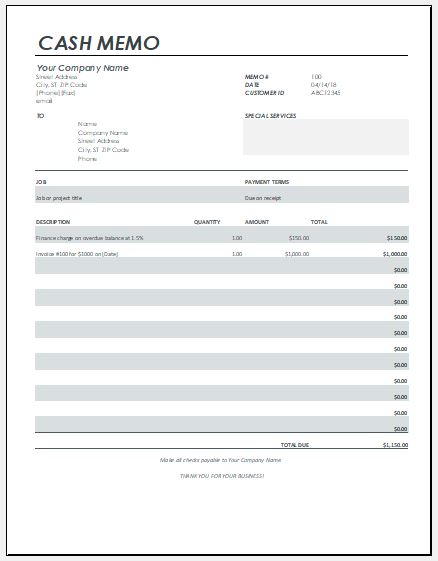

Cash Memo:

A cash memo is a document that shows information about cash received from selling goods. In other words, it is a bill that has been paid.

This document is different from many others as it documents the amount paid in cash rather than bank transactions. One key benefit of using this memo is that the user must remember every detail regarding sales and purchases.

File: MS Excel. Size: 19 KB

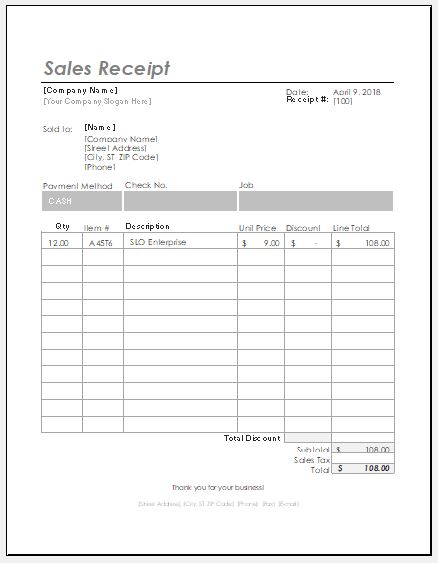

Receipt:

A receipt is similar to a cash memo with some minor differences. It includes the details of the money transaction, which can be in the form of cash or a bank transaction.

Some businesses also prepare the receipt at their client’s request. The receipt always serves as a record of the sale that was conducted.

A receipt records when a person sells his high-value assets to someone and wants to record the transaction. There are many other reasons why receipts are the best documents for retailers to use.

Recording all these transactions becomes crucial for a business that uses several commercial documents to record different transactions.

File: MS Excel. Size: 76 KB

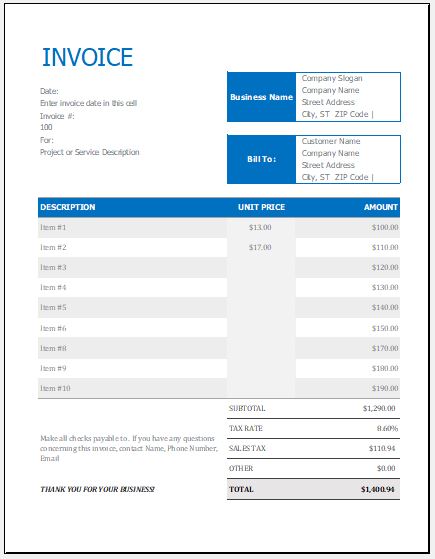

Invoice:

An invoice is a legal document used to authorize several types of transactions. It is sent to vendors and customers to authorize them to conduct the transaction.

The seller uses the invoice to request the buyer for payment. This document is sent before/after the payment.

File: MS Excel. Size: 109 KB

You can download the cash memo, invoice, and receipt templates here. They are easy to modify and customize.

- Construction Quotation Template

- Commission Invoice Format for Excel

- Bill of Material Template

- Cash Memo Formats and Template

- Doctor Bill Template

- Cash Bill Template

- Daycare Service Bill Template

- Dental Service Bill Template

- House Cleaning Service Bill Template

- Catering Service Bill/Invoice Templates

- Hourly Service Bill/Invoice Templates

- Consulting Service Bill/Invoice Templates

- Cleaning Service Bill/Invoice Templates

- Tow Service Bill/Invoice Templates

- Work Order Bill/Invoice Templates

← Previous Article

Equipment Maintenance ChecklistNext Article →

Tools and Equipment Register Template

Leave a Reply