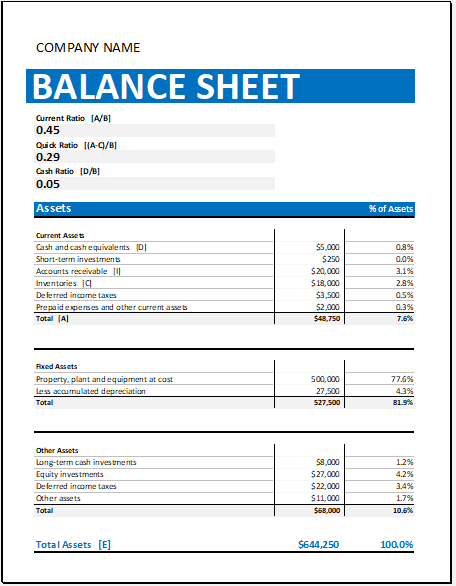

Calculating Ratios Balance Sheet

A balance sheet is a document used to calculate various ratios, such as debt ratio, cash ratio, quick ratio, etc. One should be aware of financial ratios to prepare a balance sheet of any type. The purpose of evaluating financial ratios is to determine a business’s performance and liquidity effectively.

A special branch of finance is ratio analysis, in which ratios are analyzed. Ratio analysis helps determine a company’s financial health and performance.

A company analyzes ratios by comparing data from previous and current financial statements.

Knowing your assets and liabilities is extremely important for any company or business. This helps the organization determine its current financial position and make decisions that will improve its financial state. For this, an organization needs to have a balance sheet.

The result obtained from calculating ratios enables the company to understand whether it is improving its performance or not. Comparing the company to other competitive companies can also help achieve better results.

A balance sheet is a statement that helps the organization know how many assets it has and how many liabilities it needs to fulfill. Apart from this, through a balance sheet, a company can understand what it owns, how much it owes to other people, and who owns it. This is why an organization always refers to a balance sheet when it wants to know how much it owns and how much it needs to pay back to other people.

An organization’s balance sheet uses various ratios to help it determine its current financial position and what it needs to do to improve or reach its desired position.

Various ratios, such as the current ratio, help the organization determine the current position of the company, the inventories, etc. With all of this, an organization can have a sneak peek not only into the future but into the present. A professional should be hired to check the balance sheet as well.

There are many ratios that are very easy to calculate. However, as you dig into the details, the calculation of ratios becomes complex. Many companies hire professional experts to create and handle the ratios balance sheet.

There are many templates available for calculating ratios on a balance sheet. This balance sheet is readymade, saving the company from having to create it or hiring a professional. The predefined formulas in the balance sheet make it easier for the company to perform different ratio calculations.

This sheet template is prepared in MS Excel format. The user must fill out different fields. Once the user finishes providing details, the template does its job. The user can print the template or use the emailed softcopy.

Although the balance sheet is an effective tool for ratio calculations, one should always be aware of all those factors not covered by the balance sheet. Like any other document, the balance sheet also has some limitations and shortcomings that should be considered before you come up with any solution.

File: (.xlsx) FREE Download

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Semi Monthly Home Budget SheetNext Article →

Comparative Balance Sheet

Leave a Reply