Business Expense Reports

An expense report is mainly used for recording different business expenses, such as travel, transportation, food, lodging, and conference-related fees. The primary purpose of an expense report is to properly document or record any business expense that the employer needs to reimburse the organization later.

A report can be an excellent tool for any business as it accurately records all business-related costs and expenses. The expense report can make the budget planning and tax reporting process easier. Filing taxes and completing audit reports can become less messy if all the expenses and reimbursement details are summarised. Furthermore, this report ensures that the management spends the money wisely, as it is an organizational asset that must be paid for well and wisely.

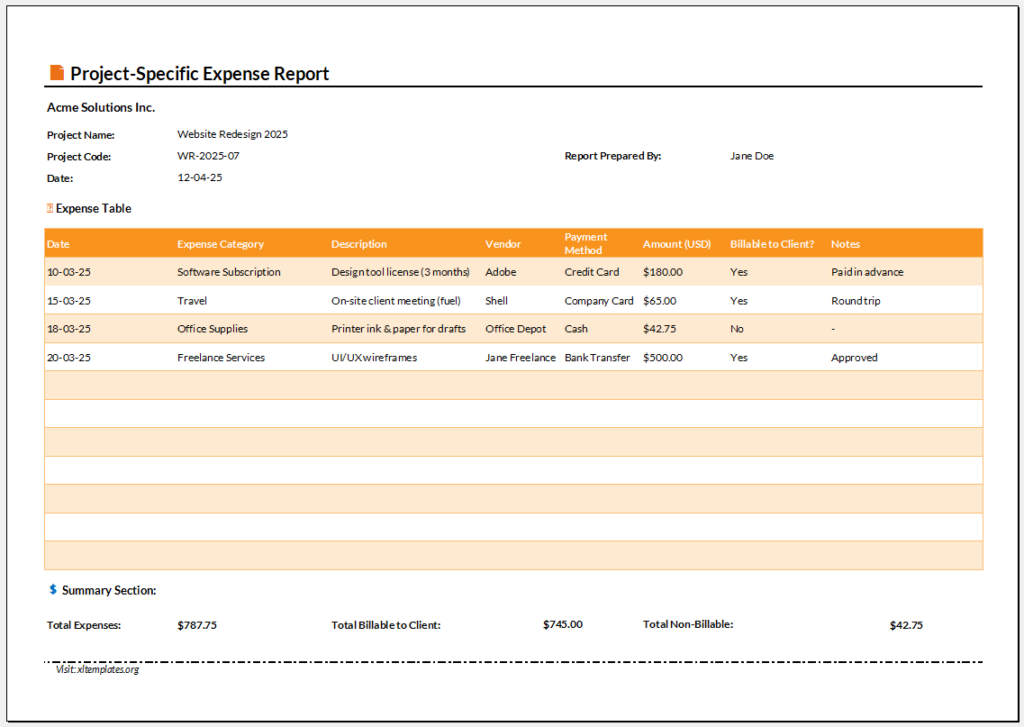

Here are the commonly used types of business expense reports given as an Excel template.

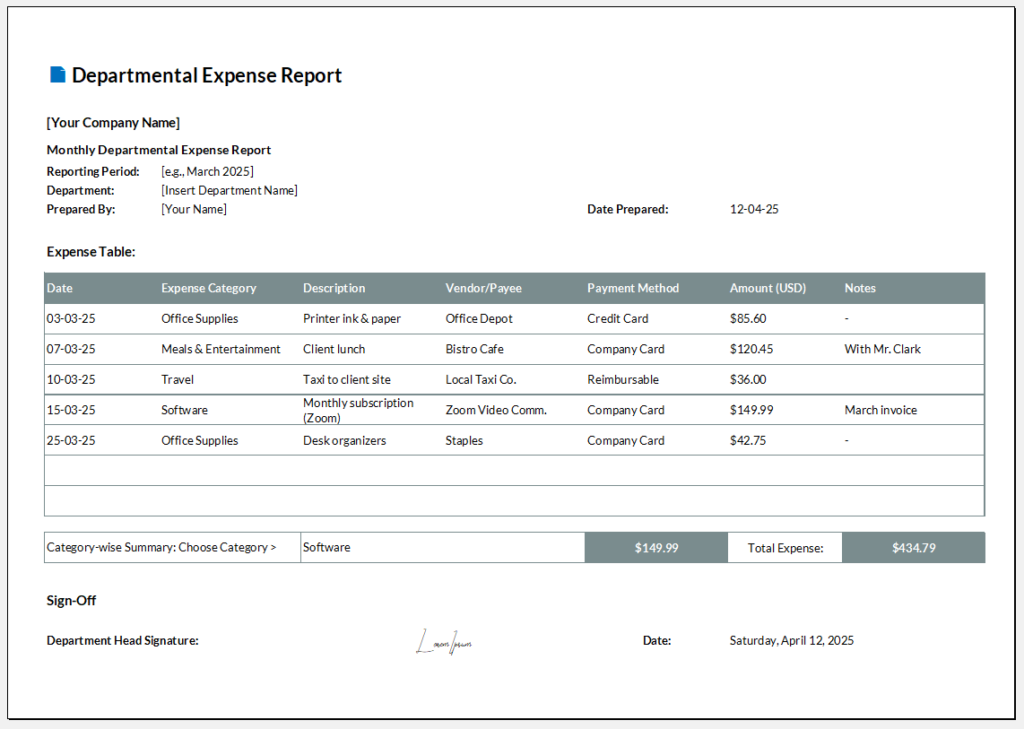

Monthly Departmental Expense Report provides a clear summary of all departmental spending within a specific month.

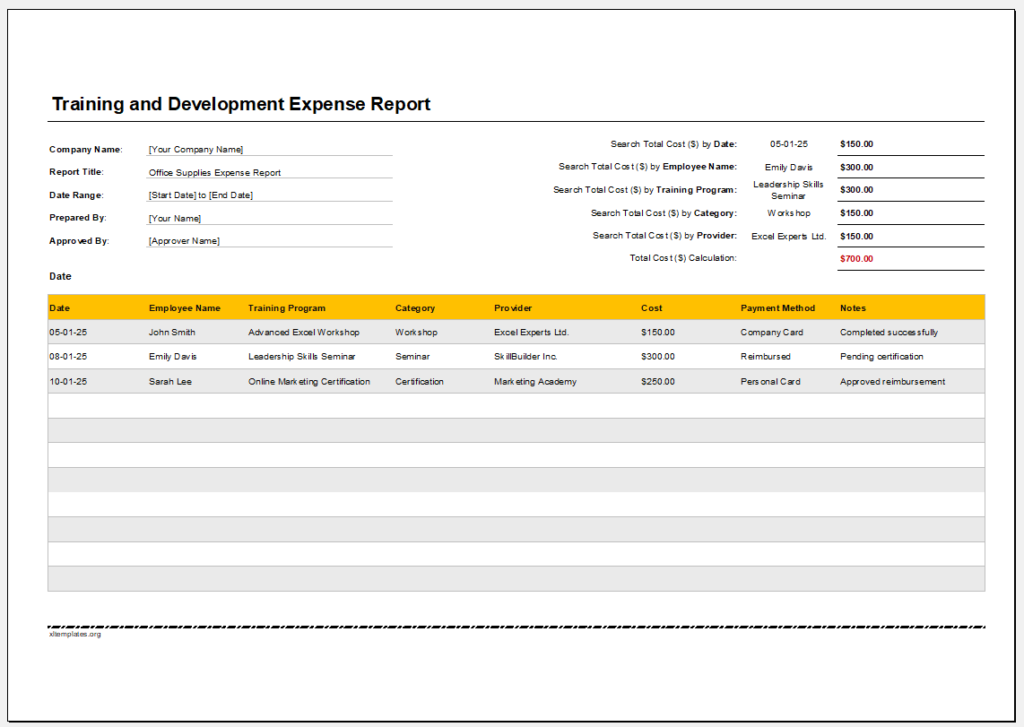

The Training and Development Expense Report is used to track costs related to employee training sessions, workshops, certifications, etc.

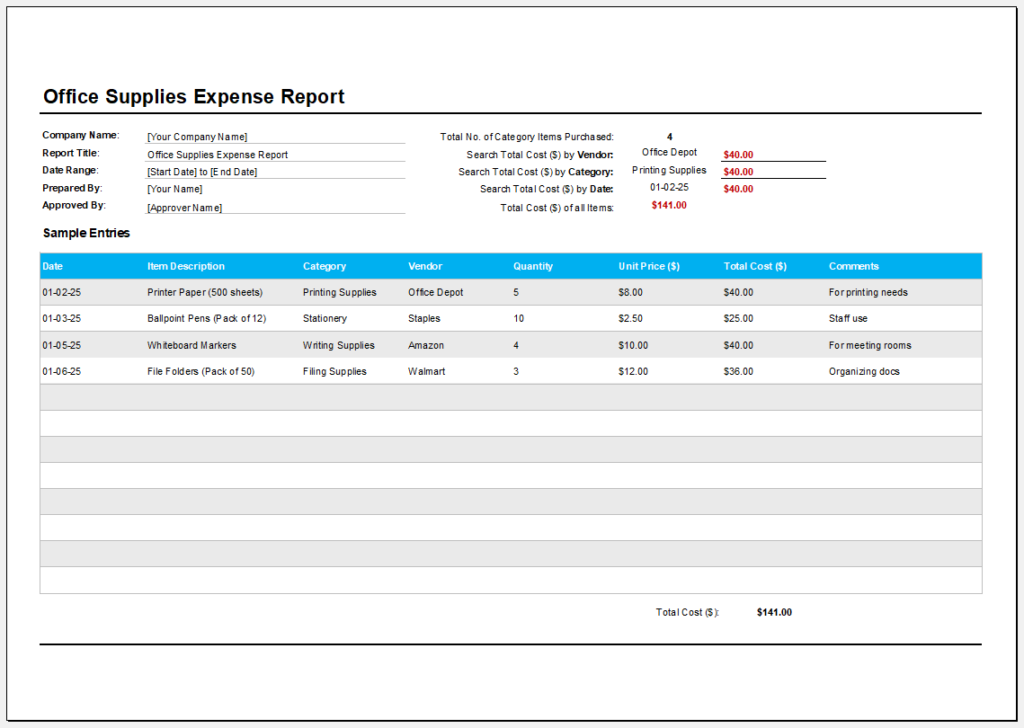

Format & Layout

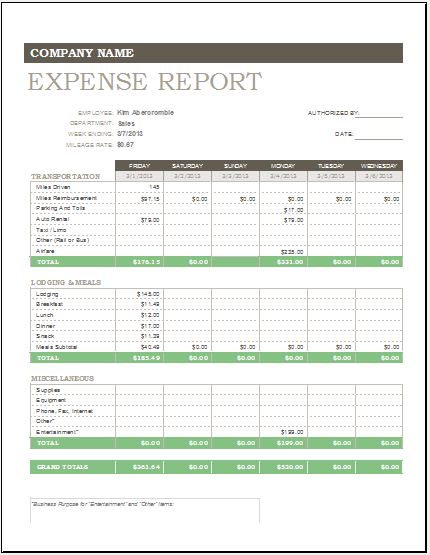

The length and complexity of this report depend on the business’s needs and types of expenditures. It mainly contains the expenses in list form, along with a description of each item. It may be categorized based on mileage, employees, costs, reimbursement period, etc.

The standard basic format of this report should be in tabular form, starting from the subtotal of the expenses on top. The table should have at least six columns, which can be increased based on the complexity of the business.

The first column should describe the date of payment, the second the mode of payment, and the Third should refer to the person to whom it is paid; it may include the employee’s name or ID, depending on the trend followed in the company. The fourth column will provide a detailed description of the expenses.

The fifth column should show the cost of the expenses, and the sixth column will have the subtotal of these expenses after any additions or subtractions of taxes or advance payments. It is important to add a line for the employee’s signature for future reference and to ensure they agree to the report.

Preview: General Expense Report for Excel (.xlsx)

File Format: MS Excel (.xlsx)

File Size: 64 KB

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Weekly Time PlannerNext Article →

T-Ledger Account Sheet

Leave a Reply