Balloon Loan Payment Calculator

What is a balloon loan?

A balloon loan is a type of loan that comes with a relatively low interest rate. Many home buyers prefer the balloon loan over other types of loans because of the low interest rate and also because it is easy to qualify for. However, some risks are associated with it. The loan duration is usually from 5 to 7 years. When the loan is over, you are asked to pay off the outstanding balance.

Why is the balloon loan payment calculator used?

This calculator is considered to be a useful tool since it enables the user to know how much changes in the principal have come over the life of the loan. Based on the results obtained from the balloon loan payment calculator, you can decide to refinance or sell your home.

Since the balloon loan payment leaves a final payment that is relatively large, this final payment is regarded as a balloon payment.

As the name suggests, the primary purpose of using this calculator is to figure out the final payment your chosen loan option is left with. Another objective of using this calculator is to enable oneself to structure the loan in such a way that it becomes capable of meeting all the needs of the user.

Why use the balloon loan payment calculator?

- When you want to know the periodic payments you will have to make that will result in a balloon loan payment, you will be required to use this calculator.

- The balloon loan payment calculator is also capable of calculating the regular payments that you have already agreed to pay

- If you already set your budget for making the periodic payments as well as the final large payment, you can check how much you are capable of borrowing using the balloon payment.

- The duration of the periodic payments can be different. If you want to change the duration, you will have to use the balloon loan payment calculator to check how changing the period will affect your periodic payments.

How to use the balloon loan payment calculator?

As told above, the purpose of using the balloon loan payment calculator is to figure out the amount to be paid in periodic payments so that you can estimate the balloon payment you will be required to pay at the end.

To make effective use of this calculator, you will first have to calculate the amount of regular loan you need to pay so that you can calculate the balloon loan payment.

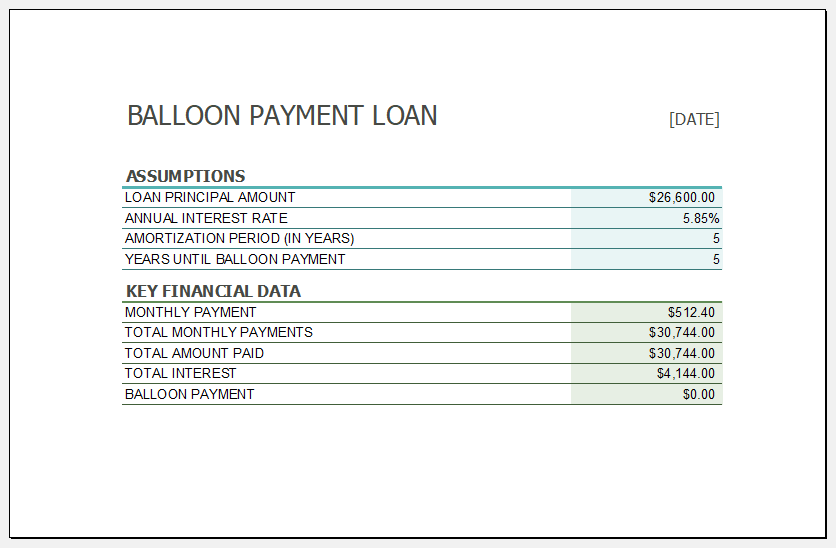

The balloon loan payment calculator will ask you to provide details such as the amount of the loan, the annual rate of interest, the total amount to be paid in periodic payments, etc. The calculator will quickly calculate the final balloon payment. You will also be able to calculate the monthly payment as well as the interest cost.

Preview

Format: MS Excel [.xls & .xlsx]

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

- Monthly Study Reminder & Planner

← Previous Article

College Loan CalculatorNext Article →

Expected Commercial Value Calculator