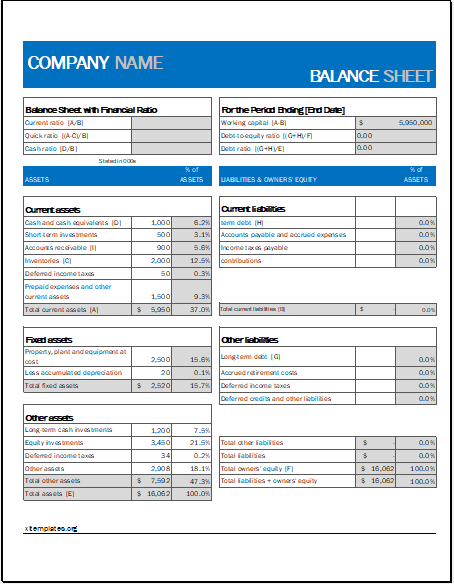

Balance Sheet with Financial Ratio

A balance sheet is a financial statement prepared by a company that shows the economic standing of the company on a particular date. It is a very useful statement for both companies and stakeholders as it shows a company’s worth.

The balance sheet includes the details of current assets, current liabilities, fixed assets, and shareholders’ equity. However, the figures stated in the balance sheet may not be sufficient for many reasons, as they may not give an idea about the required actions or comparisons to other companies or the past year’s figures. For this purpose, financial ratios are calculated from the balance sheet figures.

The financial ratios compare one value against the other to present an understandable picture. Many financial ratios are determined based on balance sheet information. Some of these include:

- Liquidity

- The working capital ratio, also called the current ratio

- The quick ratio, etc.

The higher liquidity ratios show that the company is in a safe zone to pay off its current liabilities. Usually, a ratio greater than 1 indicates an excellent financial position.

- Market

- Book value per share

- Earnings per share

- Price to earnings, etc.

The higher values of market ratios indicate whether the company’s stock is over-priced or underpriced compared to the market prevalent price. Investors usually consider these ratios when making their investment decisions.

- Debt

- Debt to equity

- Debt ratio, etc.

Debt ratios are essential to existing and potential investors as these ratios show how much the company is leveraged,, which means how much debt the company owes and if it can repay it.

- Profitability

- Return on equity

- Return on assets, etc.

As the name states, profitability ratios are an indicator of profits or returns a company has been able to generate for its investors. The higher ratios are considered alluring by the shareholders or the investors.

In addition to the above-stated ratios, there are many other financial ratios that are calculated based on different financial figures presented in the balance sheet, income statement, and cash flow statement. These ratios benefit stakeholders and potential investors as they present a simple and comparable picture. Along with the balance sheet, these ratios are provided in the companies’ financial reports.

A financial statement study involves financial ratios. Ratio Analysis and Financial Statements join hands to decide whether the business is accelerating or pausing. This analysis is a crucial comparison strategy through which the businessmen assess their earnings and find out their marketplace conveniently.

If you find an alert that your business is not doing well, get cautious to bring changes in your operations to protect you from a heavy loss. The following are the examples of some Balance Sheet Ratios

- Liquidity Ratios:

- Current Ratio

- Quick Ratios:

- Leverage Ratio:

- Debt ratio

- Worth ratio

If your business’s current ratio is getting down, you can raise it by

- Paying debts on time.

- I am adding profits again into the business.

About template

These financial statements with business ratios are present online as a free template, and if you want to calculate them for your business financial statements, just download the templates for quick calculations.

The financial ratio analysis is vital as it is a parameter through which an investor decides whether or not to invest in the company. The economic organizations and creditors apply this analysis to check the business performance and compare the current standings of your business with others. They can keep a vigilant eye on business growth and could logically decide whether to invest or not in the future.

A business must compile a comprehensive financial ratio analysis report to boost progress.

Excel Worksheet Template

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Baby Growth Chart TemplateNext Article →

Employee Shift Schedule

Leave a Reply