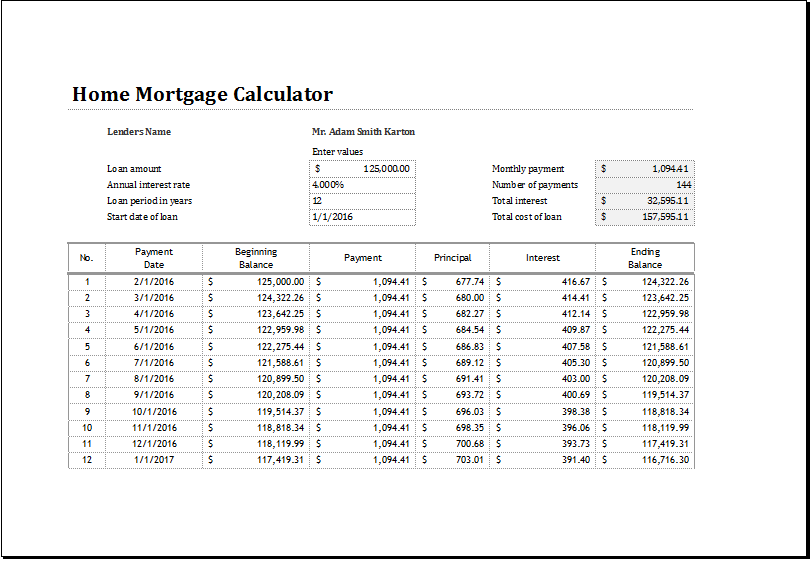

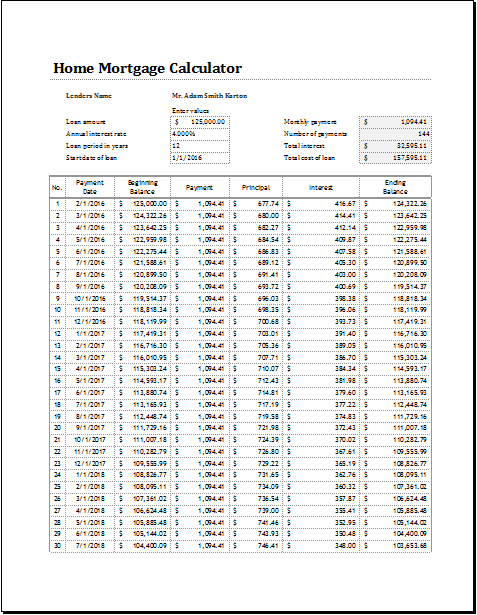

Home Mortgage Calculator

Everybody wants to have their own home where they can spend their time, and they don’t have to worry about paying rent every month or the fear of being evicted or having to search for new homes every time the rent period finishes.

Everybody wants to own a home, and this is why they seek to have their own house. This house can be a bit expensive and nobody has a lot of money lying around, they need to be able to borrow money from someone they can trust. This money can be loaned in the form of a mortgage from a bank or a mortgage company, and the money is to be paid back on a monthly basis for a specific period of time.

This mortgage can become a bit costly if one has no idea as to how much it is going to cost monthly. That is why a home mortgage calculator is to be made use of.

If you are one of those people who is thinking of buying a home but are afraid of a mortgage, which is holding them back from buying a home, the mortgage calculator is for you. There are many reasons that stop a person from buying a home, such as uncertainty about the job, unaffordability and lots of other things.

One of the major things that influence the decision you must make is the information you have. Before you decide to buy a home, you should collect the maximum amount of information about the financial factors to be considered. One of the most important information you should get before deciding to buy a home is the type of mortgage you will get.

What is a home mortgage calculator?

The home mortgage calculator is used when you want to obtain information about the amount you have to pay on a potential mortgage. The information that should be provided to the home mortgage calculator is

- Value of the house you want to purchase

- Down payment

- Interest rate

- Value of depreciation of the house

What are the benefits of the home mortgage calculator?

- They promote saving:

Since the mortgage calculator tells you the best value you can choose, you can save a lot of money by calculating the interest rate, down payment, and other details before buying the property.

- They provide a lot of information:

The home mortgage calculator tells the user about different aspects. The criteria on which different institutes base their calculations are also known with the help of a mortgage calculator. The calculator enables the user to calculate the percentage of interest rate he can afford. This makes it easier for the user to choose the terms that are more appropriate for him.

- They help manage the credit:

The credit score of the user increases when the mortgage payments are made on time. Timely payments are possible when the payment details are always kept in mind. A mortgage calculator plays the main role in enabling the person to increase their credit score so that he can refinance.

In this calculator, one needs to enter the home’s value, how much has been borrowed (loan), what the interest rate is, how long the mortgage period is, and when it starts. just hit enter, and then VOILA, one has the exact amount that is to pay on a monthly basis, how many payments are to be made, when the loan will be paid, etc. This helps in making better decisions and the right choice regarding the mortgage.

Preview

Download your file below.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Projected Balance SheetNext Article →

Opening Day Balance Sheet

Leave a Reply