Asset and Liability Report Balance Sheet

A balance sheet is prepared in order to make a report on the basis of information about the assets and liabilities of a company. The balance sheet usually focuses on the dates to determine the details of the assets and liabilities of the company in a particular time period.

If you are working in the finance department of an organization then you must know about the importance of the report of a balance sheet.

It is necessary for the company to keep all the records of its asset and liability on an annual basis. Whether small or large businesses all have to make their financial statements.

As you know, assets are the things that are controlled or owned by the business whereas liability is the business obligation that they must have to pay off.

Accounting software…

There is a variety of accounting software available to keep a financial record. It is mandatory to make a financial statement for the business. Before using the software, you should know about it completely to avoid silly mistakes.

Therefore, the manual system of making financial statements is replaced by accounting software. You can use software and can make it easily and quickly. While making it, you should be careful because a little mistake in it can lead you to suffer huge losses.

So, you should put an eye on each and every inventory purchase or sale. You should know about the names and addresses of the creditors and debtors of the organization.

Additionally, if you feel that one of your creditors is going to be bankrupt and unable to pay the money then you should add the name of a person as a bad debt in a financial report. So, when the audit of the financial report starts, you can clearly identify the name of the bad debt.

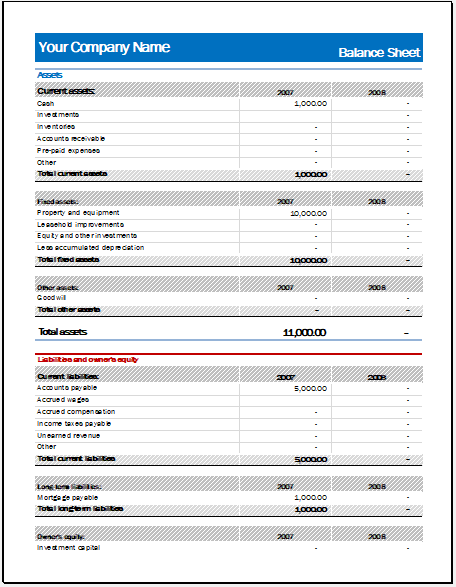

The format of the balance sheet reporting assets and liabilities:

The balance sheet reporting the assets and liabilities has a simple format. Therefore, anyone can create a balance sheet with a professional look. Usually, the balance sheet is created by enlisting all the assets of the company. The assets are organized on the basis of the liquidity of assets. Liquidity means how easily the assets can be converted into cash. After providing asset details, the information about the liabilities is added.

In the balance sheet, the assets are divided into two main categories: current assets and non-current assets

Current assets:

Current assets are those assets that are likely to be sold out by the company within a year.

Non-current assets:

Non-current assets are those assets that a company keeps for a longer period of time particularly more than a year.

Similarly, liabilities are also divided into current and non-current liabilities. The details regarding current liabilities are given under the section of current assets and the details of non-current liabilities are given in the category of non-current assets.

The basic purpose of the asset and liability report balance sheet is to determine the financial position of the company. On the basis of this report, certain important decisions are made.

The balance sheet has a lot of significance for a company since other financial statements are also made on the basis of this report

Although creating a balance sheet for reporting the total assets and liabilities of the company is very easy, you can also download a readymade template to save time and money. Moreover, the predefined formulas used in the balance sheet make the calculation much easier and quicker. The format of the template is designed by professionals and the user is required to input the details in it and the results are calculated by the template itself.

More balance sheet templates…

- Corporate Analysis Balance Sheet Template

- Microsoft Excel Balance Sheet Templates

- Comparative Income Statement Template

- Check Register Balance Sheet

- Daily Cash Sheet Template

- Cash Reconciliation Sheet Template

- Cash Drawer Reconciliation Sheet

- Opening Day Balance Sheet

- Projected Balance Sheet

- Proforma Balance Sheet

← Previous Article

Employee Wages and Holiday RecordNext Article →

Liquor Inventory Sheet