Debit Memo Template for Excel

Customers need to pay in time if a business is to function and provide the right services to people. If customers do not pay what they owe, a business will not be able to function. A company needs to know how customers are paying and when. Businesses that do not focus on this will not be able to function properly.

Sometimes a business may need to request customers to pay how much they owe the company. The customer needs to be told of this and the business should be able to communicate this professionally to the customer. This is where debit memos come in.

What is a debit memo?

This is a document that a company gives to a particular customer whereby payment is requested for the money that is owed. If for instance, the business has increased the amount that is owed, the debit memo is sent in this case as well.

The document allows a company to communicate professionally with a customer when it needs to let a customer know that they need to pay money to the company. In case there were any billing mistakes the debit memo will let the customer know about this as the mistake will be fixed with it. The debit memo lets a customer know how much they need to pay.

Excel (.xlsx) File

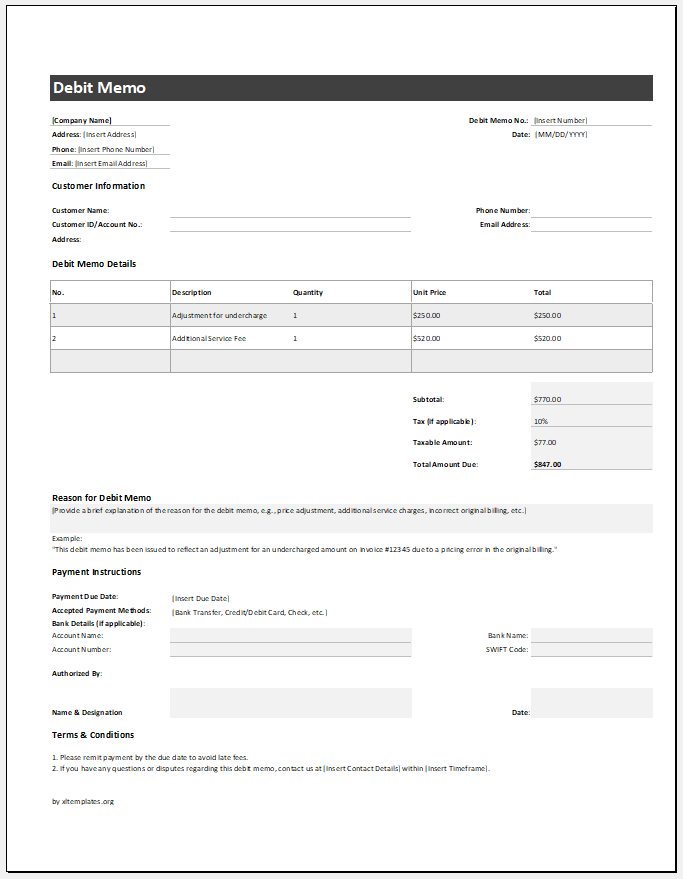

This professional document must be made carefully so that the customer understands what the company is trying to communicate to them. The format will differ depending on which industry the debit memo is concerned with. The following are some common elements which need to be present in a debit memo:

Format of memo:

You can prepare a debit memo in an application like Microsoft Excel. The heading of the worksheet can be “Debit Memo”.

Company details:

The name of the company issuing the document needs to be included as well as its address and contact information like its phone number, website, etc.

Receiver address:

You can include a heading like “Billing to” and note down the name as well as the address of the consumer or vendor to who the debit memo is being sent.

Order number:

Include the order number, date, reference number, credit terms, salesperson involved, etc. on the document so that this information can be known. The seller as well as the buyer’s tax information should be included. Mention the reason for the debit.

Subject line:

Include a subject line that precisely mentions why the debit memo is being issued. This should be brief.

Details of invoice:

This information can be included in a table. A column for “Item” or “Service” will mention the name of the item or service being considered. Include a column for “Description” so that a brief description of the item can be noted down. A column for “Quantity” will mention the quantity ordered. Include a column for “Unit Price” so that this can be mentioned.

A column for “Amount” will note down the total amount of the product. At the bottom of the table, there can be a part that mentions the total amount before tax; the total amount after tax; the amount paid; and the balance due. There can be an area for any comments and payment terms plus conditions. Include a line where the customer is thanked.

Signature:

The signature of the individual authorizing the debit memo should be present so that the document can be legitimate.

Maintain accurate financial records.

This document is important as it aids a company in maintaining and keeping accurate financial records. The debit memo lets sellers communicate with buyers about details related to financial adjustments so that misunderstandings can be prevented. The document will allow a company to adjust and fix any accounts where mistakes are present.

The company can do this professionally so that the customer will know details about this. When a debit memo is presented to customers in a timely way, the customer will know about any refunds and adjustments so that they can arrange to pay these. The document helps increase transparency between all parties involved.

- Winter Clothing & Gear Budget Sheet

- Winter Utility Expense Template

- Fuel & Equipment Sheets

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

← Previous Article

Winter Attire InventoryNext Article →

Product Sales Tracker Template