Vehicle Mileage Logbook

A vehicle logbook records the miles a vehicle travels using a certain amount of fuel within a specific period. The record book is usually carried and maintained by workers who frequently go on office tours and use their cars and expenses. All expenses are noted down and later claimed by the company.

A vehicle logbook is vital for tax substantiation for the workers who take their car for official work. A vehicle logbook is required:

- INCOME TAX:

An employee uses this maintained logbook to claim a deduction of work-related car expenses from the organization.

- FBT COMPLIANCE:

This is used when employers ask employees to maintain a proper vehicle logbook for fringe benefits tax.

Download Excel File

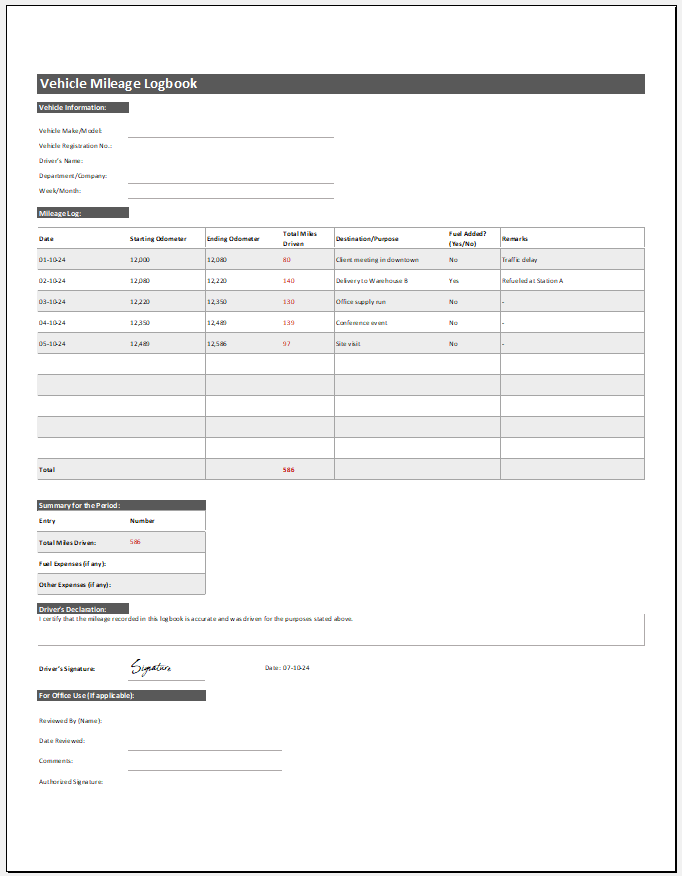

Structure of vehicle logbook:

A typical vehicle logbook consists of the following information:

- Name of the company.

- Name of driver and number plate of vehicle used for the trip.

- Date and destination of the trip.

- Purpose of the trip.

- Odometer reading (start reading- end reading)

- The number of kilometres travelled.

- The total number of kilometres travelled for some time.

- Signatures

What are the basic requirements of a valid vehicle logbook?

For keeping a record of mileages travelled and maintaining a logbook for making claims or income tax, the employee shall make sure that:

- A vehicle logbook is valid for only five years.

- The vehicle logbook must keep the odometer record to estimate the miles travelled for official purposes during a year.

- The logbook must show the business travel of the vehicle by writing down the destination and purpose of travel.

- For income tax purposes, if an employee uses more than one car for official trips, the logbook of each car must cover the same period.

A vehicle logbook can be maintained by keeping a register in your vehicle, which is used for official trips so that no data is missed. If you want an advanced system, a vehicle logbook template can be easily downloaded from any good website, which is time-efficient and user-friendly.

Thus, a vehicle logbook is proof of ownership and satisfaction to the car’s driver.

Mileage logbooks & MS Excel sheets

The best way to note down the miles used for each trip is to use a vehicle mileage logbook. It helps you keep a record of the miles driven on each of the trips you have made. There are various types and many distinct ways to keep them so that you can use them and have a note of all the miles that you have driven so far. This helps you manage the expense of fuel whenever you must do so.

Depending on your needs, you can customize your vehicle mileage logbook according to your use and then add miles whenever you have the next trip due. Such a vehicle logbook has many advantages, as it helps you quickly record your mileage and fuel.

There are various templates for such logbooks available on the internet. You can download some and make your vehicle mileage logbook easily. This way, you will have track of the money you are spending on your fuel every month, and you will be able to save on that if needed.

It will also help you maintain your car, as you will know how much it has been driven and when the next servicing is due.

Download template file-2:

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

New Product Sales and Profit Forecasting ModelNext Article →

Employee Orientation Checklist

Leave a Reply