Vehicle Mortgage Payment Calculator

A vehicle mortgage is a loan of money by the bank to someone who wants to buy a vehicle but cannot afford to pay in one-time payments. Whatever you buy through a mortgage is tied to the terms and conditions specified by the loan agreement and you are restricted to follow those terms and conditions. People who are in need to buy a vehicle but don’t have enough money for it can pay the vehicle mortgage. He gets ownership of the vehicle once the payment of the vehicle.

Although it seems very attractive and economical to go for the option of car financing. However, it is not that simple. When you practically start paying the installments on a monthly basis, you often realize that it was not a good option and that you should not have chosen it. To prevent yourself from regretting later, you can always use a calculator for the calculation of a vehicle mortgage.

What is a vehicle mortgage calculator?

It is a simple yet very useful calculating tool that lets a person see a clear picture of how his finances will look after he has started to pay off the loan through monthly installments. This tool is equally useful for people who buy commercial vehicles or for those who go for personal vehicles.

What is the main role of the mortgage calculator for car buyers?

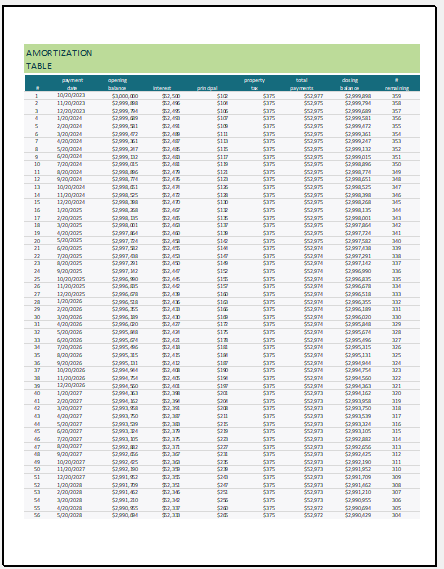

The basic role played by this calculator is to estimate the down payment, monthly installments, interest rate, and several other hidden payments to calculate for the potential car buyer. It tells a lump sum a debtor will have to pay.

This way, the debtor can see if he can afford to have a vehicle in installments and then, it becomes easy for him to decide which vehicle he can afford, which payment he can choose so that he does not get bankrupted, how much interest rate he should agree to pay, how much down payment he can pay to avoid the financial burden that he might end up putting on himself if he does not make a right decision.

What are the elements of the vehicle mortgage calculator?

The mortgage calculator works by collecting different details about the vehicle and various payment plans before it can provide information to the user. This calculator collects information including:

The total price of the vehicle:

This section of the calculator asks you to give the exact price of the vehicle on which the manufacturer enters the trade market. This tells how much it is going to cost a purchaser.

Down payment:

Whenever you decide to choose an option of payment for buying a vehicle on credit, you will be provided various options regarding how much you are ready to pay upfront. How much down payment you can afford to pay mehndi depends on the monthly installments.

If you don’t want to pay a high monthly installment, you can pay more down payment. The calculator calculates the down payment depending on the total price of the vehicle, and the total interest rate you find reasonable for yourself.

Loan term:

One of the important factors to be considered while you are trying to determine whether you should buy a vehicle on loan also depends on the term for which you want to stay in debt. As the term of the loan increases, the monthly payment decreases. However, it increases the amount to be paid. So, it depends on you and your financial situation what you choose.

The total rate of interest:

When you are buying a vehicle on credit, you will have to pay an interest rate to the institute that is offering you a mortgage option. The interest rate can increase or decrease depending on your personal preference.

People who consider the high-interest rate to be an unfair deal pay a more down payment and choose a slightly short-term loan. The calculator lets them know which is a fair deal for them and how they can make an informed decision.

Using a template:

Many such online tools are being used these days for calculating car mortgages. These tools also help a person remain focused on whether to consider this option of car financing or not because many people lose sight of the real scenario they are shown through the calculator and make a bad decision.

- Budget Vs Actual Statement

- Vehicle Mortgage Payment Calculator

- Spending and Savings Worksheet

- Personal Financial Transaction Register

- Wedding Expense Sheet Template

- Living Expense Calculator Template

- School Farewell Party Budget Worksheet

- Recreational Activity Budget Worksheet

- Friends Trip Budget Worksheet

- One Day Party Budget Worksheet

- Daily Food Expense in Office Worksheet

- Bar-b-que Party Budget Worksheet

- Summer Party Budget Worksheet

- Office Party Budget Worksheet

- Music Concert Budget Worksheet

← Previous Article

Spending and Savings WorksheetNext Article →

Children Safety Checklist Template