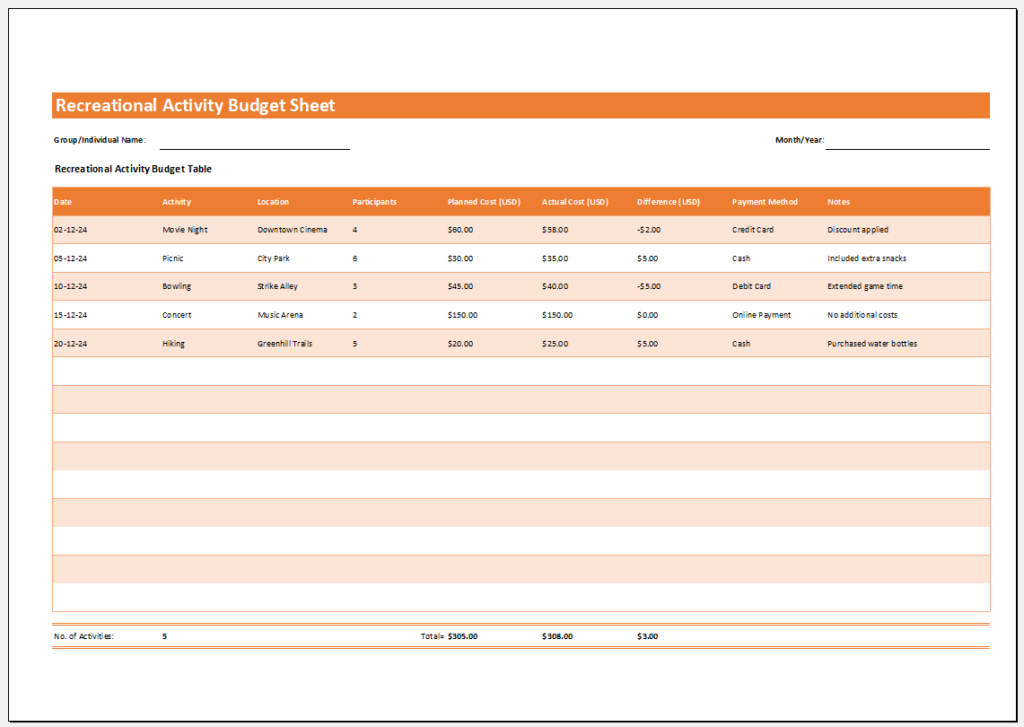

Recreational Activity Budget Worksheet

Participating in recreational activities is essential for people of every age because participating in these activities enables a person to relax and feel pleasure in doing several things. Although these activities are very healthy, they also need a person to spend money.

We usually create a monthly budget for all the important daily life tasks. These tasks are not always related to our duties. Some of these tasks are also related to leisure time activities. Therefore, we can make a budget worksheet to control the expenses.

What is a recreational activity budget worksheet?

The budget worksheet is a document that also acts as a tool to manage our finances when we use it to plan our future spending. This document is handy for people with a limited budget who spend too much on recreational activities.

What are the benefits of the recreational activity budget worksheet?

People use this sheet because of the surfeit of benefits they reap. Some of the most prominent benefits are discussed below:

It helps organize your finances:

Many people fail to balance spending and income. When participating in recreational activities, they are so busy that they suddenly realize they are short of money and will have to control their expenses. Some people also fall into debt because they cannot organize their finances. So, the budget worksheet enables them to manage their finances.

It helps achieve the saving goal:

Sometimes, you don’t want to spend money on any leisure club activity because you have saved up for a huge activity. When this happens, you must see how much money you save to achieve a particular goal. The budget worksheet is helpful in accurately estimating the cost so that those interested in these recreational activities can save enough money to fulfill their desires.

It prevents overspending:

Those fond of recreational activities often fail to control their expenses and spend more than required. This can shock them when they discover they have spent more than needed. To prevent this situation, using a budget worksheet can be useful. This will eventually help you save money.

How to use a budget worksheet for healthy activities?

You cannot reap the benefits of a practical worksheet unless you know how to use this tool efficiently. Therefore, read the guidelines given below to see the best way to use this tool:

Know your total income:

To make a budget, you must consider the total incoming cash flow. You cannot create and control your recreational activities budget unless you know how much money you have. So, you should know your total income or pocket money allocated to different healthy activities you want to perform at a specific time.

Set your goals:

Determine how many activities you want to take part in and what their type will be. After this, you can see clearly which activity needs how much money. The activities you want to perform in a period are usually considered a person’s goal. When the goal is clear, the pathway can be set.

Impose a restriction:

If you want to see when you have reached the end of the budget, you should impose restrictions on the budget, meaning that you don’t have an unlimited amount to spend on recreational activities. These restrictions or borderlines will never let you overspend, and you will always remain within your budget constraints no matter what.

However, it is important to keep this budget worksheet with you so that you can see it after every regular interval of time.

Check how much you save:

It is possible that, at some point, you save up on the money you allocate to these recreational activities. You can add the saved money to the next month’s budget. The worksheet helps you know how much you have saved.

- Budget Vs Actual Statement

- Vehicle Mortgage Payment Calculator

- Spending and Savings Worksheet

- Personal Financial Transaction Register

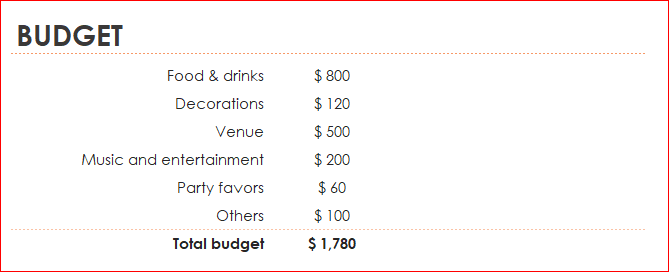

- Wedding Expense Sheet Template

- Living Expense Calculator Template

- School Farewell Party Budget Worksheet

- Recreational Activity Budget Worksheet

- Friends Trip Budget Worksheet

- One Day Party Budget Worksheet

- Daily Food Expense in Office Worksheet

- Bar-b-que Party Budget Worksheet

- Summer Party Budget Worksheet

- Office Party Budget Worksheet

- Music Concert Budget Worksheet

← Previous Article

Friends Trip Budget WorksheetNext Article →

Project Completion Certificate from Client