Commission Invoice Format for Excel

Invoices are usually used when one party bills another party against the services it provides. Receiving an invoice is a clear message for the receiver that he must pay the amount mentioned on the invoice. Using an invoice is a very effective way to bill others without facing the inconvenience of having to ask them.

What is a commission invoice?

A person who works for a commission provides his services to others and then asks for a commission by sharing the invoice with them. In general, real estate agents and salespersons use this invoice more frequently.

Who uses the commission invoice?

Many individuals work for the sake of commission. Their main job is to help individuals and businesses perform a particular task. Some common examples of people using the commission invoice include advertising agents, real estate agents, salespersons, particular car salespersons, stockbrokers, etc. They get paid when they calculate the percentage of commission of the total amount that the buyer has paid to the seller for buying a product.

How do you design a commission invoice in the correct format?

If you need to charge people for the commission-based work you have done for them, you must issue them an invoice. Those who do commission-based work often need to use an invoice to show how much they need to pay. In this situation, they need to design an invoice. Here is how you can follow the right format for making an invoice:

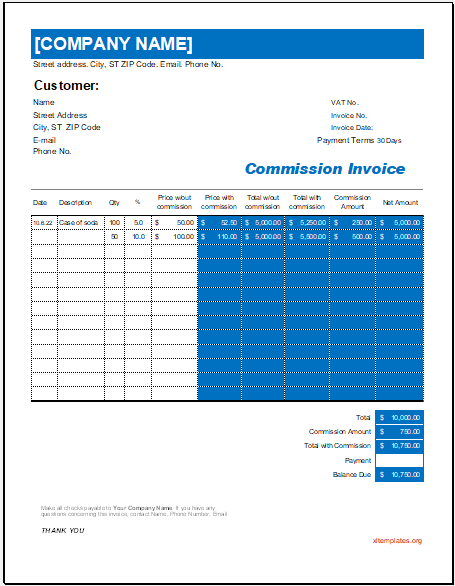

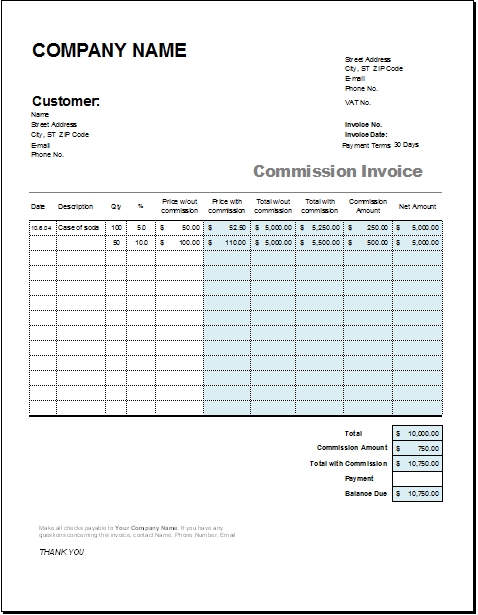

Add the logo of your company:

The logo is an essential part of the invoice. Without a logo, an invoice does not look like a professionally used document. In addition, the logo describes which company it belongs to.

Add the name of the company and other details:

People who receive the logo should be able to learn about the company so that they can contact them when they want to know anything. Sometimes, they deal with the agent and don’t know anything about the company. When they receive the invoice, they learn about the company issuing the invoice. This helps them confirm that the invoice has come from an authentic source and the agent is not trying to perpetrate any scam.

Give details of the invoice:

It is very important to provide details of the invoice, including its unique identification number, the date on which it is being issued, and the purpose of issuing it.

Mention the total amount to be paid:

The agent should mention the total amount he wants to be paid. He can also add a breakdown of the total amount if it comprises various small amounts to be paid. Some customers also try to know the percentage of the total sales amount they are charged. So, also mention the percentage amount you will receive as commission.

File 66 KB

In what way is a commission invoice useful?

A commission invoice, like any other bill, is used to keep the record of the total amount the agent has received as commission. There are many benefits, some of which are discussed below:

It helps in easy tracking of commission:

An invoice keeps track of the total amount received as commission. Every time an invoice is generated, the database associated with it is updated, making tracking easy.

It is helpful in record keeping:

The total amount of commission paid to someone must be recorded. This is beneficial for the company as well as for the commission agent. This record ensures that the agent is not paid twice. Some organizations also pay the commission with the salary at the end of the month.

It leaves no room for confusion:

An invoice is a document that mentions the total amount of commission to be paid by the client. The agent keeps a copy of a document with him and shares another copy with the client. This way, it becomes clear to both parties how much commission is being charged, and no confusion is left. It also prevents many disputes that may have developed due to confusion.

File 66 KB

Excel Templates

- Construction Quotation Template

- Commission Invoice Format for Excel

- Bill of Material Template

- Cash Memo Formats and Template

- Doctor Bill Template

- Cash Bill Template

- Daycare Service Bill Template

- Dental Service Bill Template

- House Cleaning Service Bill Template

- Catering Service Bill/Invoice Templates

- Hourly Service Bill/Invoice Templates

- Consulting Service Bill/Invoice Templates

- Cleaning Service Bill/Invoice Templates

- Tow Service Bill/Invoice Templates

- Work Order Bill/Invoice Templates

← Previous Article

Business Travel Audit WorksheetNext Article →

Construction Quotation Template