Home Office Tax Comparison Benefits Sheet

Many people use their houses as offices. These are the people who run a small business or work part-time from their homes. Many don’t know that they can reduce the money spent on taxes if they claim the Home Office Tax Benefits. This allows people who use a part of their house regularly and exclusively for business purposes to reduce the expenses spent on taxes or their business.

Before 2013, there was just the traditional method of claiming the home office tax benefit, but after 2013, IRIS came up with another option called the simplified home office deduction. Both have the same qualifications criteria but some different requirements. Choosing between the two could be a hassle, and you would want to choose the method that gives you the most benefits.

Home office tax comparison must be made by the person who runs a comparatively small business from his home. The purpose of the tax comparison is to know how much he should pay as a tax.

When it comes to starting a new business, the most important decision a business owner must make is in which form a business should operate. Considering the forms of running a business becomes totally out of the question when you run the business from home. However, there are some situations in which a business is liable to pay.

In most cases, the person using the home office is not liable to pay the tax since he uses a place in the house as an office. However, if the business is making a considerable profit, then the business owner should pay the tax.

In fact, tax comparison is not easy, especially in today’s world, where there are many restrictions and conditions to fulfill. Different tax-related laws exist in different countries, and these tax laws affect everyone differently.

There are three types of taxes:

- Sales tax

- Individual tax

- Corporate tax

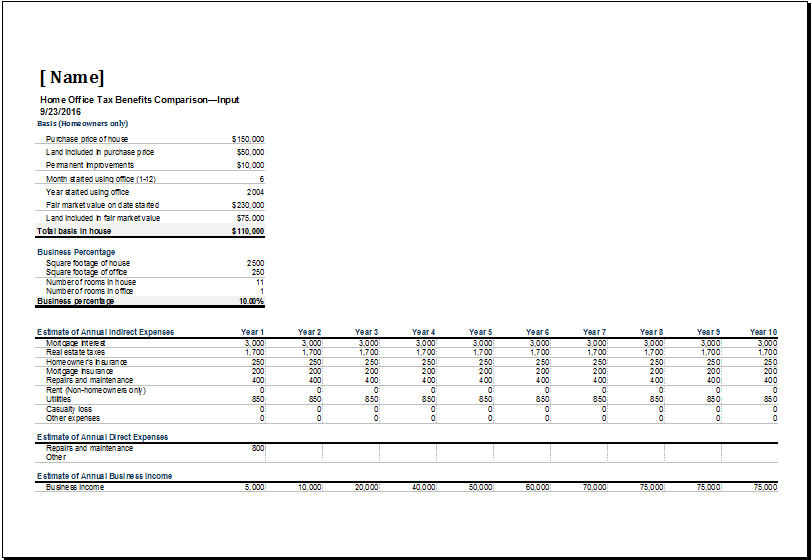

To choose the best option for you and your business, you need to make a comparison table that includes the pros and cons of both methods, along with the calculation of what you will benefit from when choosing either method. The calculation would be according to the requirements of the IRIS. Make sure that you involve an accountant to help you with the calculation if you doubt yours or are unsure as to what should be added or what shouldn’t be included.

Always remember to take some time to compare thoroughly the option you choose since it will be for a whole year, and once filed, you won’t be able to make any changes.

What is the best way to make a tax comparison?

Tax comparison is very important and should conform to the laws of the state where you reside. The sales taxes vary from country to country and should be checked carefully. Tax comparisons must be made often when you decide to move your home office business to another state.

To make a good comparison successfully, you should be well aware of the laws and regulations of the state. You can also use the internet to determine the tax rate of each state you want to compare. Write the tax details of each state side by side to see a clear picture. You can also use the tax comparison template to save time and compare the intricate information effortlessly.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Special Order Pricing TemplateNext Article →

Business Planning Checklist Template

Leave a Reply