Credit Control List Template

A credit control list is a tool that is used to keep track of the credit accounts of the customers of the company. This template is a very effective tool for all those people who want to keep track of how many people have their credit accounts with their company.

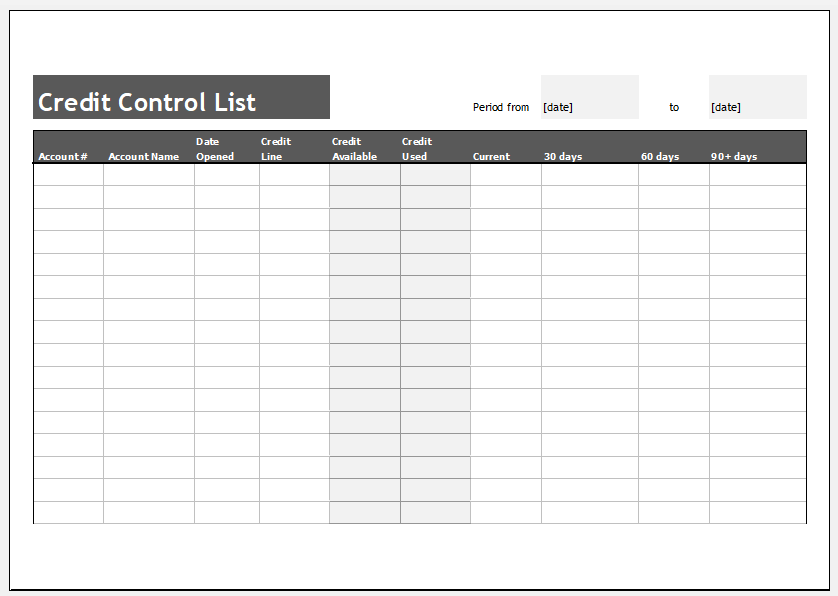

The credit-control list with an aging template is a simple spreadsheet document in which there are separate columns for entering the details such as account number of the customer, date on which the account was opened, the details about credit line, and the current balance available in each credit account of the customer.

Why is it important to use the credit control list template?

A credit control list is a document in which the account receivables of the company in a specific period of time are mentioned. The period is the entire duration in which the invoices of the company have been outstanding. A template is a useful tool since it helps the company determine its financial health.

The account receivables with the aging show the warning sign for the company if the receivable accounts are not collected with the expected celerity. This all lets the company know which type of risks a company is likely to face and how it can mitigate those risks.

Using the template for credit control list with aging

The template is used by the companies when they want to track the follow-up which they need on all the outstanding invoices. The user is required to enter the required details into the invoice to get the required results.

The rest of the job of determining the length of the time until a user is required to follow up is done by the template. There are a number of columns in the template that a user needs to fill. The formulas that the template needs to use are automatically filled in rows. There is a color scheme used in the template that keeps a clear distinction between the columns and rows. The user can change the color scheme to opt for the colors he likes.

Main features of the template

There are many distinctive features of this template. Some of which are:

- When it comes to managing the credit control list, the template does its job effectively.

- Using this template enables the user to get familiar with the use of an Excel sheet. In other words, once a person learns to use the credit control list template, he will be able to use every other Excel worksheet.

- When a company uses a credit-control sheet, it works more conveniently with the customers without causing them any type of inconvenience. In this way, the relationship between the customers and the company becomes stronger over time.

- The template is useful in decreasing the write-offs.

← Previous Article

Cash Memo Formats and TemplateNext Article →

Order Tracker Template