Mileage Claim Forms

Transportation and fuel expenses occur daily in a business’s operations. Mileage is the distance traveled for different activities, like deliveries, procurement, client meetings, pick-ups, and drop-offs. The vehicle drivers maintain a mileage log that records and tracks various transportation distances. One of the main reasons this log is maintained is reimbursement.

The drivers fill out the mileage claim forms, using the information recorded in the mileage log, and request the organization reimburse them for the traveling costs.

Excel (.xlsx) File: 91 KB

There are many benefits of mileage maintenance and the mileage claim forms, such as:

- The mileage claim form allows the drivers to state all the transportation activities separately and request reimbursement properly.

- The organization will understand its transportation expenses and then strategize accordingly.

- Recording and tracking the mileage, followed by the drivers’ reimbursement claims, enables the organization to indicate the cost as an expense in its financial statements, helping it gain tax deductions.

- The mileage maintenance system is important for HMRC compliance.

- The mileage claims can be kept in the records for any future reference.

For process harmonization and synchronization, organizations provide the drivers with a claim form template, which they can fill in for any reimbursement request. The organization can develop this template from scratch or use an already-developed template by experts, which may be taken from online sources or programs such as Microsoft Excel.

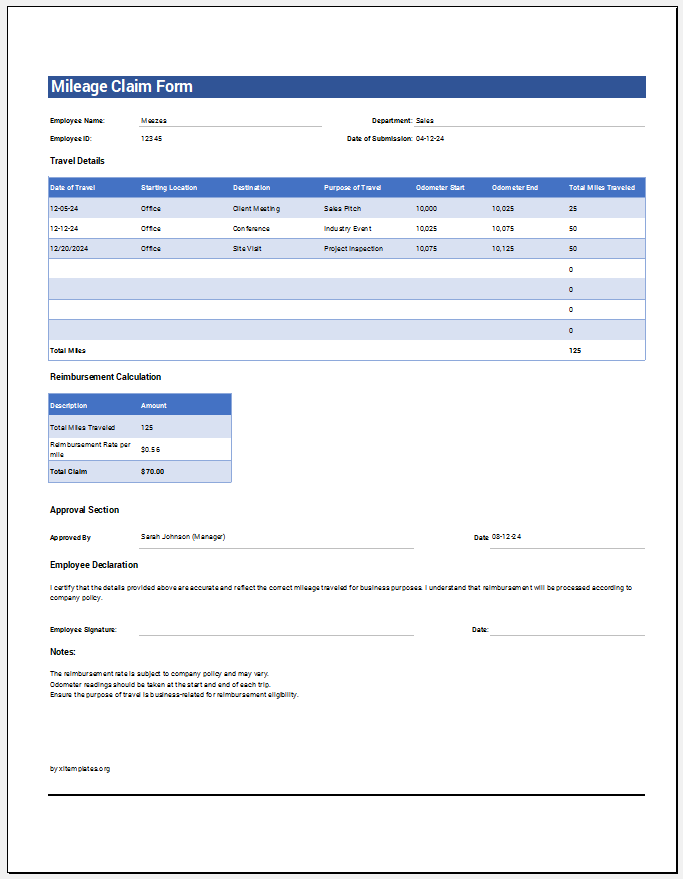

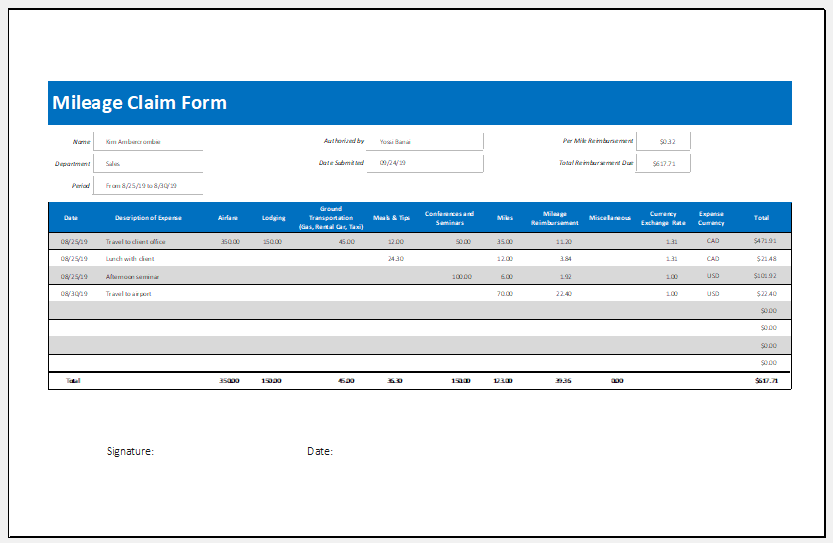

These professional templates are easy to customize as per the organizations’ requirements. The required information or the details in a mileage claim may vary from organization to organization. However, generally, the following information needs to be filled in:

- Date of the claim and date of the acceptance of the reimbursement request.

- Details of the employee, including name, ID, address, account details, etc.

- Total mileage.

- Rate per mile.

- Total reimbursement.

- Details of transportation activities, including their dates, locations, destinations, odometer readings (starting and ending), distance/mileage traveled, and travel costs.

- Signature of the employee and the employer.

When the driver is filling in the mileage claim form, he needs to ensure a few points, for instance:

- The provided information should be correct and should not be misleading. The calculations should be rechecked at least twice.

- The separation of the recording and tracking of the business mileage and personal mileage should be done appropriately.

- The rate per mile used should be the one provided by the IRS, and the modifications should be made, as required from time to time, with any change in the IRS’s rate per mile.

- The HMRC rates for different engine types and vehicle sizes should be appropriately applied.

The driver submits the claim form, which management then reviews. If accepted, the reimbursement is made.

Preview

Format: MS Excel (.xlsx) | Size: 89 KB

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Travel Estimate TemplateNext Article →

Employee Time Cards